Large-blend assets are among the most important building blocks for a diversified portfolio. Over the last 12 months, large-blend funds are up an average of 25.03%, compared to a 27.85% gain in the US stock market as measured by the Morningstar US Market Index.

Among the top performers in this category are funds from Fidelity, T. Rowe Price, Vanguard, and JPMorgan. Two sustainable investing offerings made the list.

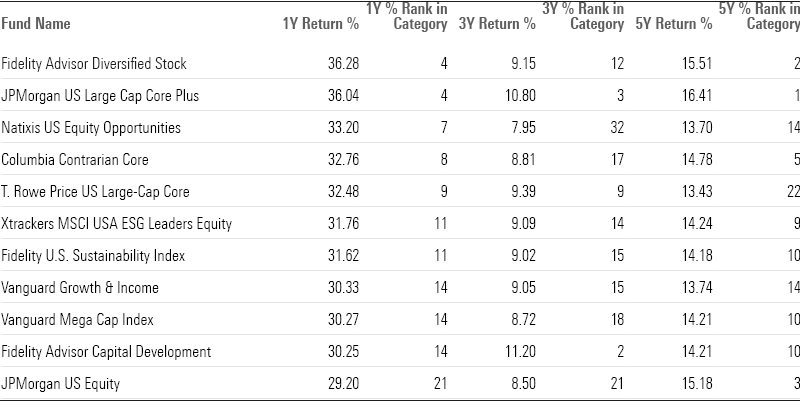

- Fidelity Advisor Diversified Stock FDESX

- JPMorgan US Large Cap Core Plus JLPYX

- Natixis US Equity Opportunities NESNX

- Columbia Contrarian Core COFYX

- T. Rowe Price US Large-Cap Core RCLIX

- Xtrackers MSCI USA ESG Leaders USSG

- Fidelity US Sustainability Index FITLX

- Vanguard Growth & Income VGIAX

- Vanguard Mega Cap Index VMCTX

- Fidelity Advisor Capital Development FDETX

- JPMorgan US Equity JUEMX

What Are Large-Blend Funds?

Large-blend funds are considered fair representations of the US stock market. Such portfolios focus on neither growth nor value and invest across US industries. Due to their broad exposure, large-blend funds often perform similarly to the S&P 500 Index and total-stock market indexes.

Large-Blend Fund Performance

In the year to date, the average large blend fund has gained 6.72%, compared with the overall stock market’s gain of 6.87%. Over a three-year period, the average fund in the category largely matched that of the overall market. Over five years, the category lagged the market, with a 12.11% average annual return while the US Market Index gained 12.90%.

Screening for the Best-Performing Large-Blend Funds

To find the best-performing funds in this category, we looked for those that have posted the top returns across multiple periods. We first screened for the funds that ranked in the top 33% of the category over the past one-, three-, and five-year time frames. Then we filtered for the ones with Morningstar Medalist Ratings of Gold, Silver, or Bronze. We excluded funds with less than $100 million in assets and those with minimal or no Morningstar analyst input on their Medalist Ratings.

Because the screen was created with the lowest-cost share class for each fund, some may be listed with share classes that are not accessible to individual investors outside of retirement plans, or they may be aimed at institutional investors and require large minimum investments. The individual investor versions of those funds may carry higher fees, reducing returns. In addition, Medalist Ratings may differ among share classes of a fund.

Fidelity Advisor Diversified Stock Fund FDESX tops the list, posting returns of 36.28% over the past year and outperforming the average category gain. The $3.3 billion fund has gained 11.85% in the year to date, while the average fund in its category is up 6.72%. The Fidelity fund is up 9.15% over the past three years and up 15.51% over the past five years. The $2 billion JPMorgan US Large Cap Core Plus JLPYX gained 36.04%, beating the average large-blend fund’s gain of 25.03%. The fund has gained 10.80% over the past three years and 16.41% over the past five years.

Three index funds made it through the screen: Xtrackers MSCI USA ESG Leaders Equity ETF USSG, Fidelity US Sustainability Index FITLX, and Vanguard Mega Cap Index Institutional VMCTX. These funds have beaten the year-to-date category returns with posted returns of 8.40%, 8.19%, and 7.95%, respectively.

The 11 Best-Performing Large-Blend Stock Funds

Fidelity Advisor Diversified Stock

“Dan Kelley diversifies the portfolio across three kinds of companies he distinguishes by their quality, growth profile, and valuation. To him, a high-quality company boasts a strong balance sheet, stable earnings growth, juicy margins, and a capable management team. He embraces secular-growth firms whose unique value proposition can sustain above-average growth over multiple years. He also buys firms he thinks are inexpensive and likely to see expanding price multiples as the market catches on to their opportunity.

“Over the longer term, the fund has tended to protect more capital than its peers in either the large-blend or -growth categories during market pullbacks.”

—Robby Greengold, strategist

JPMorgan US Large Cap Core Plus

“The managers hold long positions in most stocks making up the “Magnificent Seven,” but Tesla has never been part of the portfolio, while Apple is a strong underweighting. Instead, the managers prefer other players within these companies’ value chains, such as diversified energy management company Eaton or smartphone supplier Qorvo.

“The investment seeks to provide a high total return from a portfolio of selected equity securities. Under normal circumstances, at least 80% of the value of the fund’s assets, which are expected to include both long and short positions, will consist of different U.S. securities, selected from a universe of publicly traded large capitalization securities with characteristics similar to those comprising the Russell 1000 and the S&P 500 Indices.”

—Jeffrey Schumacher CFA, director

Natixis US Equity Opportunities

“It seeks undervalued stocks with an open mind. Analysts scrutinize firms’ management teams and paths to value creation. They sensibly tailor their valuation models, using (among other tools) sum-of-the-parts analyses, merger-and-acquisition activity, and prospective cash flows to assess companies’ worth. A small stock selection committee builds an approved list from which Harris’ sleeve must draw its holdings.”

—Tony Thomas, associate director

Columbia Contrarian Core

“Columbia Contrarian Core’s effective team and disciplined process have consistently delivered for investors, making it a solid choice in the large-blend Morningstar Category.

“Guy Pope and his team of three comanagers narrow the investment universe with a simple contrarian screen. They target U.S. stocks with market caps of at least $2 billion trading in the bottom third of their 52-week price range. The team then ensures the market’s pessimism is based on fleeting issues, discarding those with secular headwinds or structural industry decline. The team conducts fundamental research on the narrowed universe, tapping Columbia’s central research bench of about two dozen fundamental industry analysts, as well as quantitative and responsible investing teams. Pope invests in both value and growth stocks, yet avoiding companies with more entrenched problems has historically given the portfolio a growth tilt.”

—Drew Carter, analyst

T. Rowe Price US Large-Cap Core

“Shawn Driscoll’s runs a risk-aware approach focusing on quality compounders. The core focus—about 70% to 80% of the portfolio—remains on high-quality businesses with recurring revenues, strong fundamentals, and sound business models that yield pricing power. Driscoll splits the remaining 20% to 30% of the strategy between what he calls growth cyclicals and early cyclicals. For the growth cyclicals basket, he thinks of industries such as semiconductors, railroads, and containers, where there has been consolidation and other changes, resulting in rising returns and demand growth. While Driscoll aims for decent downside protection, he wants to increase the strategy’s ability to outperform in market rallies by opportunistically investing in what he calls early cyclicals, typically companies early in their lifecycle which should benefit the portfolio when the economy is growing.”

—Stephen Welch, senior analyst

Xtrackers MSCI USA ESG Leaders

“The fund fully replicates the MSCI USA ESG Leaders Index. The index screens for companies with the best ESG scores and weights them by their market capitalization. Its starting universe, the MSCI USA Index, captures the large- and mid-cap portion of the investable US market. The index requires a minimum MSCI ESG rating and controversy score, and it excludes companies involved in controversial businesses. Companies with ties to controversial and nuclear weapons face stricter screens. The remainder of its exclusions are based on the amount of revenue that firms derive from these businesses.”

“The fund’s technology overweighting and energy underweighting worked well in the growth-favored market that characterized much of its life. The fund also piled into major winners such as Nvidia NVDA and Alphabet GOOGL, who led major market rallies in 2020 and 2023.”

—Lan Anh Tran, analyst

Fidelity US Sustainability Index

“The fund tracks the MSCI USA ESG Leaders Index, which targets large- and mid-cap US firms with strong ESG characteristics. After screening out companies involved in controversies and controversial businesses, the index ranks companies relative to their sector peers on ESG metrics. It adds top-ranking names until it covers 50% of each sector’s total market capitalization. Some sectors are more rife with ESG risks than others, which can lead to sector biases. However, its sector-neutral approach doesn’t make the type of sector bets some of its ESG-oriented peers do.”

“It inherited some of this outperformance from the MSCI USA Index’s broad portfolio. Still, ESG-driven tilts accounted for a 71 basis point lead against its parent index over this period. The fund’s technology overweighting and energy underweighting worked well in the growth-favored market that characterized much of its life. The fund also piled into major winners such as Nvidia NVDA and Alphabet GOOGL, which led major market rallies in 2020 and 2023.”

—Lan Anh Tran

Vanguard Growth & Income

“The strategy will continue relying on stock selection to differentiate itself from its S&P 500 benchmark. Each subadvisor typically keeps sector exposures within 2 percentage points of the index’s and reigns in any style bets or factor exposures. Historically, this has made for a sprawling portfolio.”

—Andrew Redden, analyst

Vanguard Mega Cap Index

“The fund tracks the CRSP US Mega Cap index, which constitutes the top 70% of the US equity market by market cap. The index implements buffers along its lower market-cap boundary and spreads rebalancing trades over a few days to mitigate turnover and trading costs.

“The bedrock of this strategy is its market-cap weighting approach, which harnesses the market’s collective wisdom of each holding’s relative value with the added benefit of low turnover and trading costs. It’s a sensible approach because the market tends to do a good job pricing mega-cap stocks. The companies in this portfolio attract liquidity and widespread investor attention such that prices reflect new information quickly.

“Focusing on the largest and most established names has been a boon to performance. The fund managed a 7.5-percentage-point advantage over its average peer in 2023 as mega-cap stocks like the Magnificent Seven posted stellar results and higher-quality stocks paced the market.”

—Mo’ath Almahasneh, associate analyst

Fidelity Advisor Capital Development

“With its seasoned portfolio manager and ample resources, Fidelity Large Cap Stock FLCSX and funds run in a similar fashion—including Fidelity Advisor Capital Development—have an edge.

“Armed with deep industry knowledge and insights from Fidelity’s sprawling team of equity analysts, manager Matt Fruhan has a fighting chance of beating the market over the long term. Since 2005, he has consistently plied a gritty approach that often embraces unloved or fundamentally challenged companies, avoids firms whose shares he thinks have been bid up by market mania, and looks for secular-growth companies whose magnitude or duration of growth is underappreciated. At the core of his bottom-up approach is the belief that the market routinely misprices companies’ earnings power over a multiyear horizon.

“The strategy’s above-index risk tolerance has produced clear performance patterns in a variety of market environments. Since Fruhan’s start, it has routinely delivered big gains when high-beta stocks—those most sensitive to stock market changes—have outperformed stocks with low volatility. It also performs well when the market’s expectations for economic growth increase.”

—Robby Greengold

JPMorgan US Equity R6

“Despite generally investing in 50-60 stocks, this portfolio hasn’t behaved all that differently from its S&P 500 benchmark, and that is due to manager Scott Davis’ work alongside J.P. Morgan’s central team of sector analysts. Analysts rank stocks in their coverage universe, but Davis doesn’t simply pick the ones on top. He challenges analysts on their picks, pinning their ideas against others that possess similar business characteristics, all with the goal of building a portfolio that will substantially assume the same factor risks as the benchmark. The portfolio’s sector weightings tend to differ from those of the benchmark as Davis considers the correlations between stocks more than their official labels.

“The result is a concentrated portfolio that behaves like a more diversified one, with the variance explained by idiosyncratic factors rather than sector or style bets. Davis utilizes a quantitative model to backtest hypothetical portfolios, but much of his work is focused on forward-looking risks that cannot be captured by historical data.”

—Adam Sabban, senior analyst