(Bloomberg) — Cutting or pausing dividends is a step that corporate executives usually do everything possible to avoid as it can scare off investors and prompt them to move their capital elsewhere.

Most Read from Bloomberg

But with their companies being squeezed by higher interest rates, tighter profit margins and an uncertain economic outlook that can put their credit ratings at risk, executives are being pushed to tighten their belts at the expense of their shareholders.

So far this year, as many as 17 companies in the Dow Jones US Total Stock Market Index cut their dividends, Bloomberg’s Jill R. Shah and Ian King reported on Friday. Pressure may build for more to follow suit as revenue and profits decline — and as debt, as a proportion of earnings, grows. A wall of upcoming debt maturities is also increasing the need to retain cash on balance sheets.

For credit investors, it’s a welcome change from the days when corporate executives opened the taps on dividend payouts and even loaded up on cheap credit to fund them. Data from S&P Dow Jones Indices shows that companies in the S&P 500 spent $564.6 billion on dividends in 2022, the most in data going back to 2000 and up from $511.2 billion in 2021.

By keeping that cash on their balance sheets, companies can stave off ratings downgrades that could make raising capital even costlier.

Intel Corp., the world’s largest maker of computer processors, slashed its dividend payment this past week to the lowest level in 16 years. The company saw its credit ratings slashed by all three major ratings firms this month.

The belt-tightening isn’t limited to cutting dividends. Companies are also taking steps that will be painful for employees, such as streamlining operations and reducing headcount.

An Outlier in Europe

As many companies tighten the spigot on shareholder payouts in order to keep creditors happy, at least one company in Europe is finding plenty of debt investors willing to keep the party going, Lisa Lee writes.

Investors in recent days rushed to snap up a leveraged loan from French packaging firm Eviosys that would add to the company’s debt pile in order to pay a dividend to its shareholders. Demand for the the €350 million ($370 million) loan has been so strong that Barclays, the arranger of the deal, brought forward the deadline to participate to Feb. 27.

Such a deal, which creditors would often treat with caution, is a sign of how few opportunities investors are finding in the leveraged loan market. Deal volume has yet to fully recover from a tumultuous 2022 that saw issuance largely come to a halt.

Elsewhere:

-

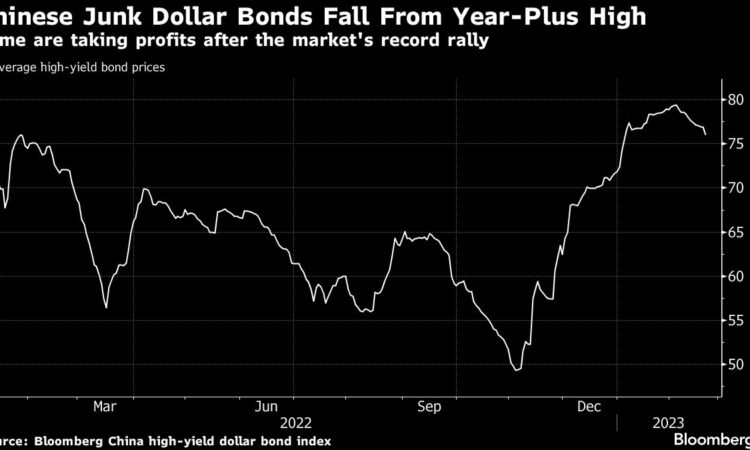

One of Asia’s best-performing bond funds is looking for opportunities to pull back from Chinese developers’ offshore notes — and Asia’s junk-debt market more broadly — after raising its holdings during a record rally, Bloomberg’s Dorothy Ma reports. Jane Cai, manager of the ChinaAMC Select Asia Bond Fund, will instead be looking at high-grade securities in developed markets around the world as well as yuan-denominated notes of mainland Chinese firms offshore.

-

Porsche Automobil Holding SE smashed records in the so-called Schuldschein market on its debut, borrowing €2.7 billion in the largest-ever deal in the niche German debt market, which is becoming an increasingly popular funding option for big European companies. For an explainer on the the Schuldschein market, read this QuickTake from Jacqueline Poh.

-

Ares Management Corp. is lining up as much as £1 billion in private credit to finance a potential buyout of the UK-based veterinary services firm VetPartners amid interest from multiple possible bidders. The involvement of direct lenders would further underline the influence of the industry in bigger deals in Europe as investment banks dial back on risk.

-

Silver Point Capital, the US-based credit fund founded by former Goldman Sachs bankers, is looking to hire in London as it expands its presence in Europe. Even without a physical presence in the region, the firm has made a number of investments in Europe, including in troubled real estate firm Adler Group and German discount retailer Takko.

-

Petroleos Mexicanos is negotiating with Goldman Sachs and JPMorgan Chase for at least $1 billion in financing as the debt-laden and loss-making oil major scrambles for cash amid sinking production, Bloomberg News reported this week.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.