Although lenders continue to reduce mortgage rates from recent peaks, UK homeowners are still struggling to cope with monthly repayments.

Interest rates guide mortgage costs which have risen since the Bank of England (BoE) has pushed rates up 14 consecutive times in an attempt to control inflation, bringing the base rate to 5.25%.

However, UK lenders including HSBC (HSBA.L), Nationwide (NBS.L), TSB and Halifax have reduced mortgage rates since the second half of July after it emerged that UK inflation fell further than expected in June.

Despite BoE governor Andrew Bailey telling MPs recently that rates are near the top of the cycle, speculation is growing that the Monetary Policy Committee may vote to raise rates to 5.5%, with think tank Centre for Economics and Business Research (Cebr) urging the BoE to increase rates by 0.25% at its upcoming meeting.

The UK’s Consumer Prices Index (CPI) level of inflation eased to 6.8% in July. This is lower than the peak of 11.1% set last October, but well above the BoE’s target of 2%.

Read more: Bank of England interest rates near ‘the top of the cycle’, says Bailey

To bring down inflation the BoE has raised interest rates to the current level of 5.25%. This means mortgage costs went up but people also saw a higher return on savings.

According to the BoE three significant shocks drove high inflation — the COVID pandemic caused people to buy more goods than services, Russia’s invasion of Ukraine hiked gas and food prices and food prices surged by 17% in June compared to a year ago.

The next interest rate decision is set to take place this Thursday.

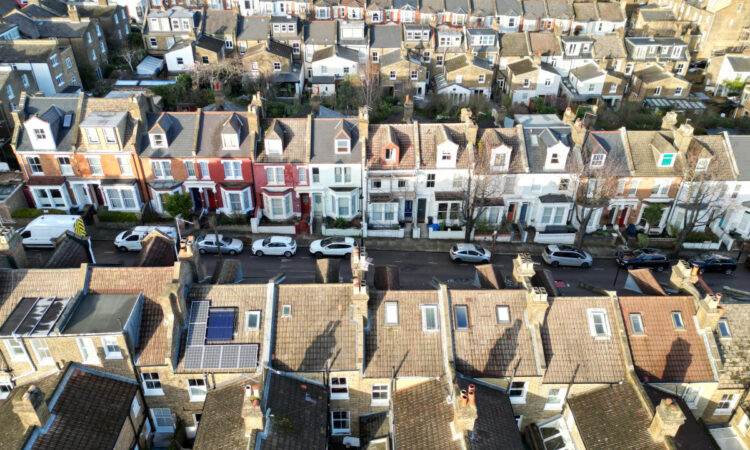

In August, UK house prices saw a slower-than-usual increase due to high interest rates and summer holidays, according to Rightmove. The average asking price for new sellers went up by just 0.4%, adding £1,386 to reach £366,281, lower than the average August increase.

So what does all this mean for mortgage rates?

What is a mortgage?

A mortgage is an agreed loan between a borrower and a lender to facilitate the purchase of a property like a home house or flat. It can also be used to borrow money against the value of a home a person already owns.

The lender has the right to take a property away if a homeowner fails to repay the money borrowed plus interest.

There are two basic types of mortgages — interest-only mortgages and repayment mortgages.

Read more: House prices: Is it better to rent than buy?

An interest-only mortgage means monthly payments only cover the interest, making the cost lower each month but it does not reduce the overall loan. This means at the end of the mortgage term the entire loan must be repaid in full.

Most lenders now require proof of a repayment plan and a significant deposit for interest-only mortgages, except for buy-to-let mortgages.

With a repayment mortgage, each payment reduces the amount you borrowed, but initially most goes towards paying interest. Over time, the interest portion decreases as payment reduces the loan.

The best mortgage rates

When starting a search for the best deal, “never just go to your bank for a cheap deal,” advises Martin Lewis’ website Money Savings Expert, but use mortgage brokers to scour the market for a good mortgage deal.

Consider consulting a financial advisor for personalised guidance. Your ideal mortgage rate depends on your unique financial situation and goals, so staying vigilant in the ever-evolving market is important.

Read more: UK house prices remain subdued amid high interest rates and summer holidays

From working out a budget to preparing paperwork consumer group Which? offers advice on whether now is the right time to apply for a mortgage, and the steps needed get a mortgage loan approved.

Here’s a list of the best mortgage rates on the market according to Which?:

Best Rates on 60% Mortgages

Two-year fix initial rate

-

NatWest (NWG.L) 5.62%

-

TSB 5.64%

-

Virgin Money (VMUK.L) 5.65%

-

Barclays (BARC.L) (cheapest rate with no fee) 5.97%

Five-year fix initial rate

-

Lloyds Bank (LLOY.L) 5.09%

-

HSBC 5.17%

-

Virgin Money 5.13%

-

Lloyds Bank (cheapest rate with no fee) 5.2%

Best rates on 75% mortgages

Two-year fix initial rate

Five-year fix initial fee

Best rates on 85% mortgages

Two-year fix initial rate

Five-year fix initial rate

Best rates on 90% mortgages

Two-year fix initial rate

Five-year fix initial rate

Best rates on 95% mortgages

Two-year fix initial rates

-

Lloyds Bank 6.36%

-

Skipton Building Society 6.39%

-

Leeds Building Society 6.44%

-

Lloyds Bank (cheapest rate with no fee) 6.62%

Five-year fix initial rates

Watch: How much money do I need to buy a house?

Download the Yahoo Finance app, available for Apple and Android.