To print this article, all you need is to be registered or login on Mondaq.com.

2022 was an eventful and tumultuous year that will long be

remembered for aggressive Fed tightening, the Russia and Ukraine

conflict, the cryptocurrency meltdown, and a sharp reduction in IPO

and SPAC activity. 2023 is expected to be no less volatile. So how

are finance executives thinking about next year? We recently

surveyed finance executives for their perspectives on a variety of

topics ranging from the state of the economy to their role as a CFO

and the evolving finance organization. The responses provide a

glimpse into the changing demands on public and private CFOs and

their priorities for this year.

To no surprise, our survey revealed that the role of a CFO is

already one of the hardest jobs in corporate America, and

it’s only getting harder.

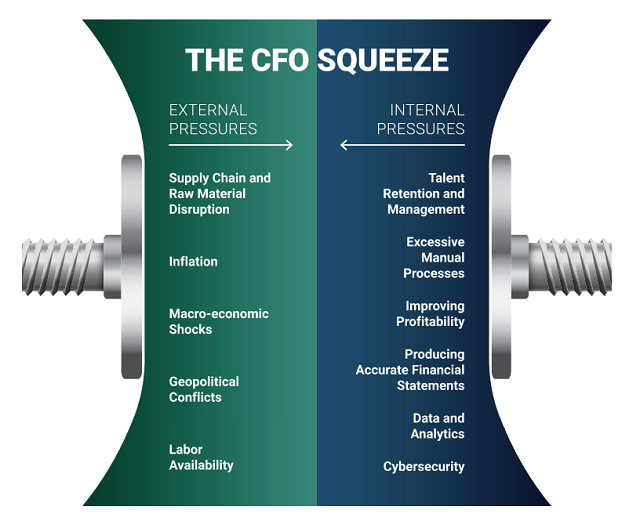

CFOs are getting squeezed from both internal and external

stakeholders as well as macro- and microeconomic forces. Lingering

effects from the COVID pandemic have resulted in supply chain

disruptions, inflationary cost pressures, and rising interest rates

to tame inflation. These factors, combined with increased

geopolitical conflicts and instability, have created an external

environment where the only certainty is that there will be

continued uncertainty. At the same time, the CFO’s role is

continuing to grow and evolve, with demands and responsibilities

both increasing. Aside from the core finance functions, CFOs are

increasingly relied on to provide holistic organizational support,

including strategy & operations, data & analytics to

support decision-making, and corporate development. CFOs need to do

more with limited time, and in some cases, lack of talent. As a

result, CFOs must automate, increase efficiency, and improve the

skills of the organization.

Even Though the Title Is the Same, the Job Is Most Likely

Not

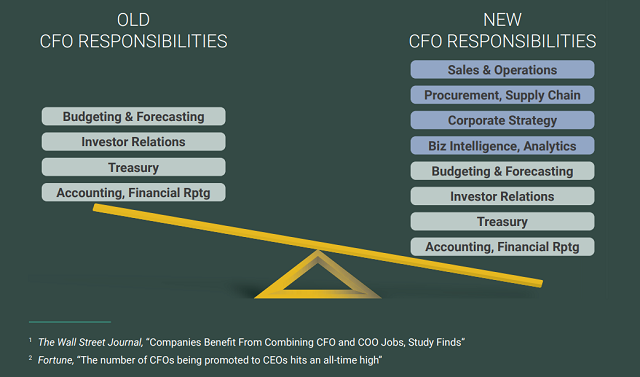

The CFO’s role continues to evolve. Ten to fifteen years

ago, CFOs were mostly focused on core finance functions including

accounting and financial reporting, treasury, and investor

relations. In today’s competitive business environment,

expectations of Finance have shifted from tactical execution to

strategic decision-making. Ongoing advancements in data and

technology continue to be made, and similar advancements are

expected across the Finance organization. Business leaders are

looking for analytics and insights, real-time information, and

scenario planning to make decisions, and are increasingly relying

on Finance to provide that information.

During the past decade, the CFO role has expanded to include

more of a strategic lens; the lines between CFO, COO, and CEO are

becoming less defined, regardless of industry. An increasing trend

is of a combined CFO-COO which, while not unexpected at smaller

organizations, is now also occurring in larger companies such as

PepsiCo Inc., Occidental Petroleum Corp., Afl ac Inc., and WebMD.1

In some cases, CFOs are also in line to succeed the CEO,

traditionally a role taken by a rising COO or division president.

In fact, more CFOs are becoming CEOs than ever, with 8.1% of CFOs

at some of the largest companies promoted to CEO in the first half

of 2022, compared to 5.6% in 2012.2

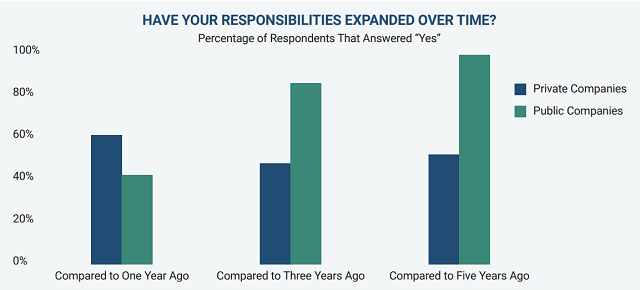

More than 50% of respondents agree that their

responsibilities have increased. The majority of

public company CFOs have seen their role expand steadily during the

past three to five years while their private counterparts have

experienced a more pronounced uptick in the past twelve months. New

responsibilities include areas such as business intelligence and

data analytics, corporate strategy, and procurement. Some also

noted added responsibilities in non-core finance areas such as

sales, operations, and supply chain.

Not Your Day Job but Still Your Headache

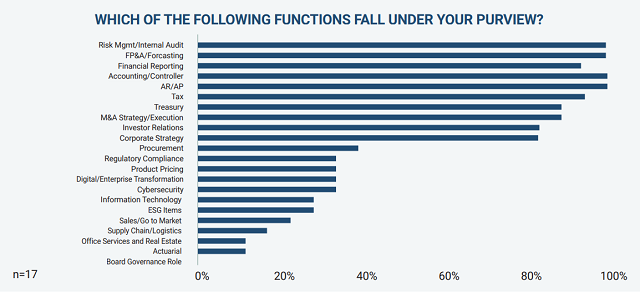

Diving deeper into some of the specific responsibilities

confirmed a few notions; as expected, 100% of CFOs maintained their

purview over bread and butter areas such as controllership,

accounting, FP&A, and treasury. However, outside of the core

finance areas, it became more mixed. In particular, less than 30%

of CFOs surveyed have ownership of IT and cybersecurity, despite

risk management being a key area of responsibility of every

respondent. Most companies have a CIO or CTO who often reports

directly to the CEO, so while it is not unusual for IT and

cybersecurity to fall outside the CFO’s umbrella, it is

important for the CFO to be involved in managing this issue that

impacts enterprise-wide risk.

ESG is no longer a novel concept. Firms are increasingly

challenged over their environmental, social, or governance-related

policies by a multitude of internal and external constituents.

ESG-related disclosure requirements are increasing, whether from

the SEC’s proposals, lenders, municipalities, and

governmental agencies, or even a company’s own employees.

Less than 25% of CFOs in our survey have ESG or ESG-related topics

as a core responsibility, as this subject often falls under other

functions such as the legal organization, the COO, CIO, or a Chief

Sustainability Officer (CSO). However, due to the strategic and

risk-related elements associated with ESG, like IT and

cybersecurity, it is important for the CFO to be intimately

involved in the organization’s ESG strategy.

Another area of inconsistency in CFO roles was related to

corporate strategy and M&A. While more than 3/4 of respondents

have one or both corporate strategy and M&A strategy and

execution responsibilities, they do not always have both. This

variation could be due to a separation of roles, reporting lines,

or that M&A is not part of the broader strategy. As with other

non-core finance areas, the CFO’s role related to corporate

strategy and M&A will vary differently across

organizations.

It’s All About The People

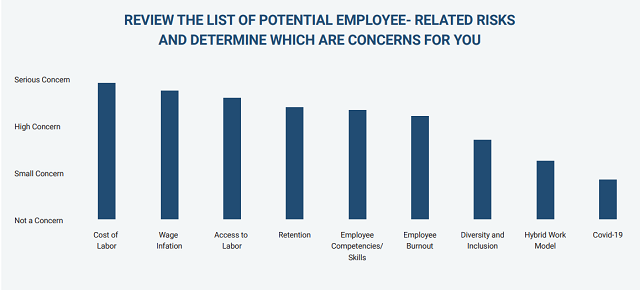

People-related issues are a major concern for most of our

finance leaders. Although COVID and remote work was not an issue

for the respondents, nearly every other area was – regardless

of the size of the company or if it was public vs. private. Cost of

labor, access to labor, retention, wage inflation, employee

burnout, and employee competencies were all high or serious

concerns. To manage these competing forces, companies will need to

engage in a delicate balance between managing talent, cost, and

employee sentiment.

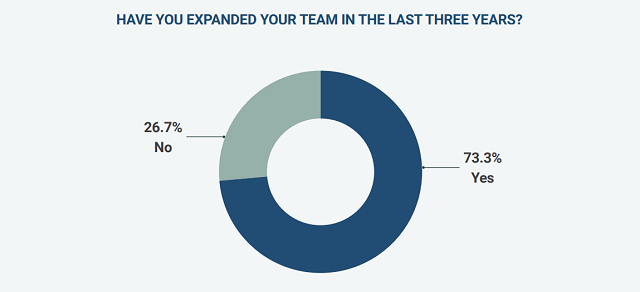

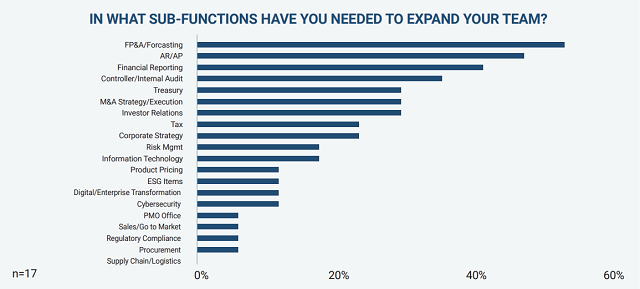

As a result of the increasing demands and changing role of

finance organizations, about 75% of our respondents have also added

resources across their teams. More than half increased talent in

FP&A and forecasting. Core finance areas such as AP/AR and

financial reporting were also major areas where teams were

expanded. In addition, almost 1/3 of respondents that increased

teams also did so in controllership/ internal audit, investor

relations, M&A, and project management. Despite some CFOs

adding supply chain as a responsibility and some showing concern

about this capability, none of our respondents indicated that they

had added personnel to this function.

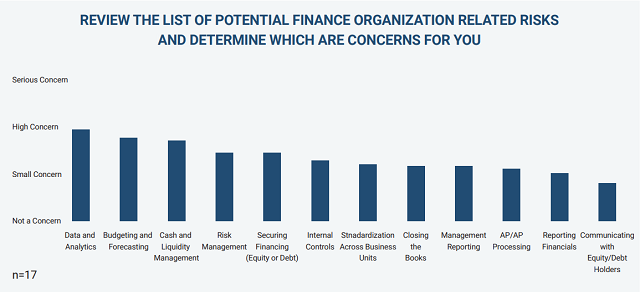

Nearly 86% of our executives had concerns about data &

analytics capabilities in their organization. Technology is also

developing at breakneck speed, but teams are not necessarily able

to keep up, often due to a lack in resources, skills, or time. To

properly support their organizations, finance teams will need to

become more efficient at core responsibilities and upskill their

talent.

Scotty, We Need More Power!

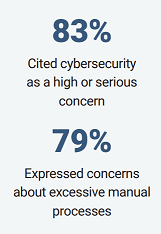

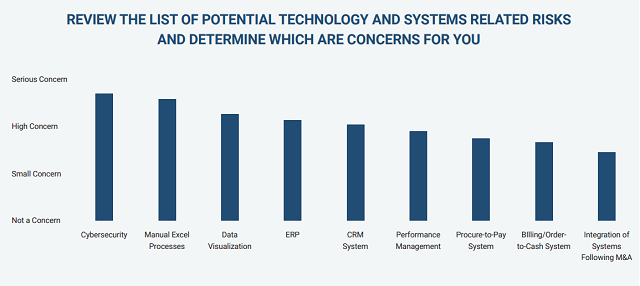

A day rarely goes by without a major cyber-related hack or

incident. Cybersecurity is a universal source of unease across the

respondents, with ~ 83% citing it as a high or serious concern.

This issue continues to increase and is not going away. Like ESG,

as a risk officer, the CFO has the responsibility to be involved in

the company’s cyber strategy whether it officially falls

under their oversight or not.

Approximately 79% of executives also expressed concerns about

excessive manual processes and the use of Excel. Considering the

continuously increasing demands on the finance organization,

improving efficiency with streamlined processes, automated

workflows, and enabling tools and

technology will be essential to supporting the business.

Reducing manual operations will minimize errors while increasing

speed and efficiency, allowing the team time to engage in more

strategic or analytical activities.

Additionally, there is angst, especially with smaller

organizations, with the selection of ERP and data visualization

tools. This can be a daunting process. Technology is rapidly

changing and it is difficult to know where to start or what is

right for the company. It is important to fully evaluate and define

both current and future needs and usage to identify the right tools

and systems for the company and its situation.

Nobody Has A Crystal Ball

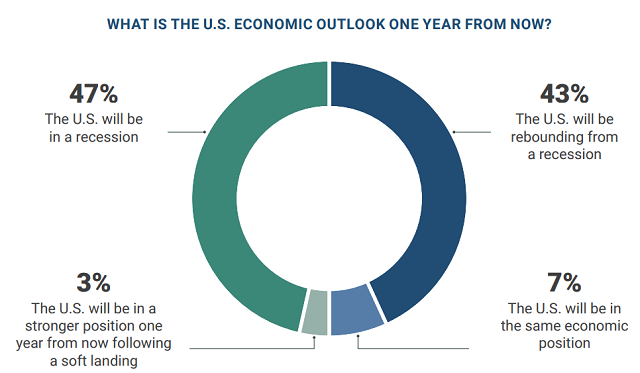

After the turbulent events in 2022, we are all wondering: what

could the future bring? We asked our group of executives to opine

on the state of the U.S. economy. The responses were split nearly

perfectly, with half of respondents believing that the U.S. will be

in a recession in 12 months and the other half thinking the economy

will already have rebounded.

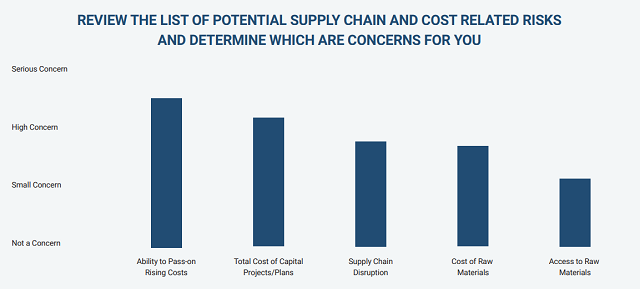

In terms of external forces on executive’s minds, the

ability to pass on rising costs was listed as a high or serious

concern by 97% of our respondents. Other areas such as supply chain

disruptions and access to raw materials were also concerns but were

much less critical to our executives.

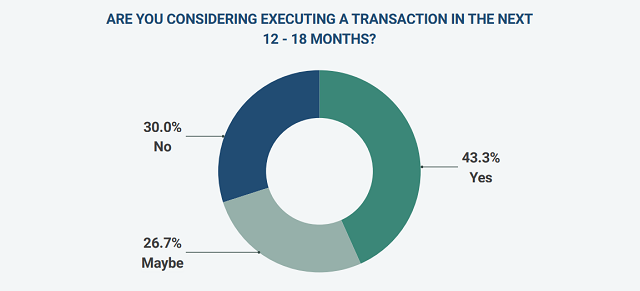

Following a year with below average M&A activity, 70% of our

respondents expect to engage in some form of M&A during the

next 12-18 months with 40% suggesting that it is extremely likely

they will execute some form of M&A.

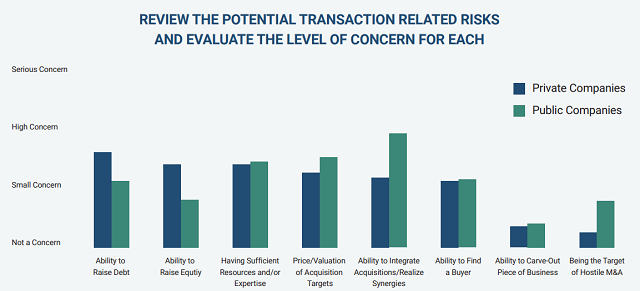

As respondents contemplate M&A, the main concerns,

particularly with smaller and medium sized private companies, are

the ability to raise debt and having sufficient resources and

expertise available. Public companies are less concerned with

access to funds but, like their private counterparts, are also

worried about skills and resources needed to execute a successful

transaction.

What To Put In Your Lunchbox

The role of a CFO continues to be squeezed from both internal

and external forces. Increased responsibilities and demands within

the organization, heightened economic volatility and uncertainty,

and workforce challenges have provided immense headwinds. To manage

this difficult environment, CFOs, and finance leaders should focus

on some areas with high impact:

Taking actions to ensure the finance organization is more nimble

and flexible will enable the CFO for success and position the

company to navigate and even thrive in the coming year.

Appendix

The Ankura CFO Survey had a total of 30 respondents including

CFOs, senior financial executives, and board members. Our analysis

and conclusions include instances where respondents that identify

as CFOs by title have been isolated as a group. In these instances,

we have footnoted this change to the new set of respondents, by

noting (n) is a number less than 30.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.