What Does The Future Hold For Polestar Automotive Holding UK PLC (NASDAQ:PSNY)? These Analysts Have Been Cutting Their Estimates

Market forces rained on the parade of Polestar Automotive Holding UK PLC (NASDAQ:PSNY) shareholders today, when the analysts downgraded their forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

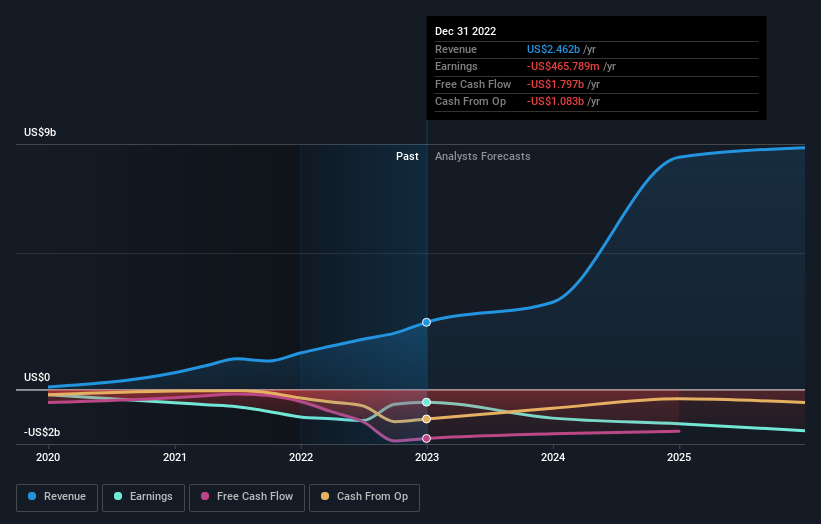

After this downgrade, Polestar Automotive Holding UK’s four analysts are now forecasting revenues of US$3.2b in 2023. This would be a huge 30% improvement in sales compared to the last 12 months. Before the latest update, the analysts were foreseeing US$3.7b of revenue in 2023. The consensus view seems to have become more pessimistic on Polestar Automotive Holding UK, noting the measurable cut to revenue estimates in this update.

Check out our latest analysis for Polestar Automotive Holding UK

Notably, the analysts have cut their price target 12% to US$5.94, suggesting concerns around Polestar Automotive Holding UK’s valuation. There’s another way to think about price targets though, and that’s to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Polestar Automotive Holding UK analyst has a price target of US$12.00 per share, while the most pessimistic values it at US$2.70. So we wouldn’t be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Polestar Automotive Holding UK’s revenue growth is expected to slow, with the forecast 42% annualised growth rate until the end of 2023 being well below the historical 59% p.a. growth over the last three years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 18% annually. Even after the forecast slowdown in growth, it seems obvious that Polestar Automotive Holding UK is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They’re also forecasting more rapid revenue growth than the wider market. The consensus price target fell measurably, with analysts seemingly not reassured by recent business developments, leading to a lower estimate of Polestar Automotive Holding UK’s future valuation. Overall, given the drastic downgrade to this year’s forecasts, we’d be feeling a little more wary of Polestar Automotive Holding UK going forwards.

There might be good reason for analyst bearishness towards Polestar Automotive Holding UK, like a short cash runway. Learn more, and discover the 1 other flag we’ve identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here