The United States stock market has shown robust growth, rising 1.2% over the last week and achieving a 28% increase over the past year, with earnings expected to grow by 15% annually. In such a thriving market environment, stocks like Victory Capital Holdings that combine high insider ownership with significant growth potential are particularly compelling.

Top 10 Growth Companies With High Insider Ownership In The United States

|

Name |

Insider Ownership |

Earnings Growth |

|

GigaCloud Technology (NasdaqGM:GCT) |

26% |

21% |

|

PDD Holdings (NasdaqGS:PDD) |

32.1% |

22.4% |

|

Atour Lifestyle Holdings (NasdaqGS:ATAT) |

26% |

28.2% |

|

Li Auto (NasdaqGS:LI) |

29.3% |

23% |

|

Super Micro Computer (NasdaqGS:SMCI) |

14.3% |

40.2% |

|

Bridge Investment Group Holdings (NYSE:BRDG) |

11.6% |

98.2% |

|

EHang Holdings (NasdaqGM:EH) |

33% |

104.9% |

|

Carlyle Group (NasdaqGS:CG) |

29.2% |

23.6% |

|

ZKH Group (NYSE:ZKH) |

17.7% |

98.2% |

|

BBB Foods (NYSE:TBBB) |

23.6% |

77.5% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★★☆

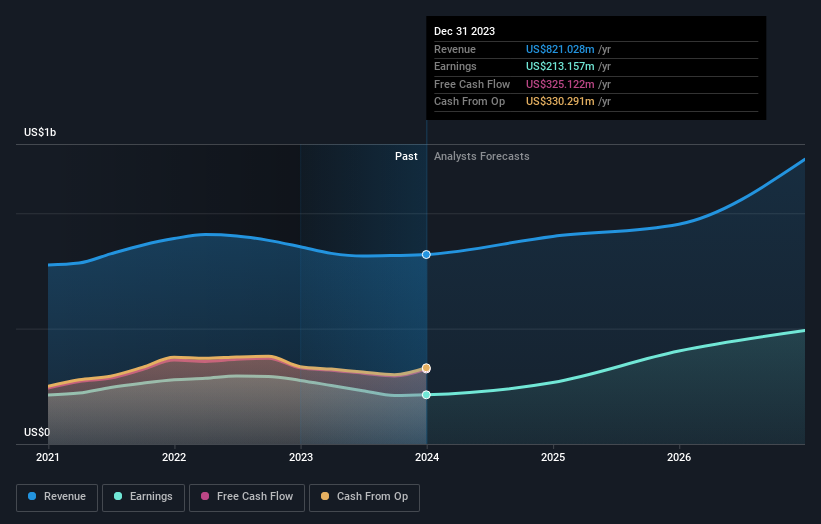

Overview: Victory Capital Holdings, Inc. operates globally as an asset management firm, with a market capitalization of approximately $3.38 billion.

Operations: The firm generates revenue primarily through providing investment management services and products, totaling approximately $835.57 million.

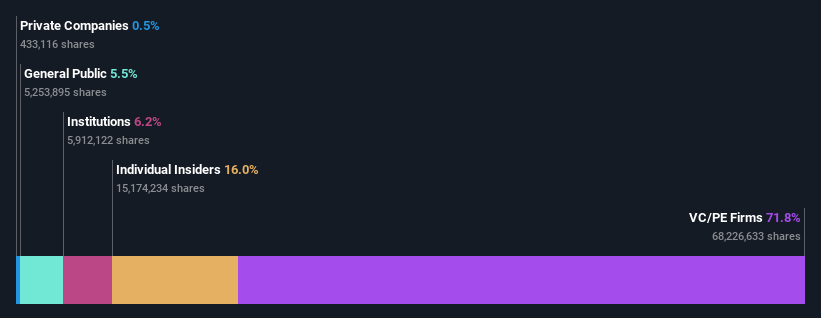

Insider Ownership: 12.1%

Return On Equity Forecast: 33% (2027 estimate)

Victory Capital Holdings, demonstrating robust financial growth, reported a significant increase in Q1 2024 earnings with revenue reaching US$215.86 million and net income at US$55.69 million. The firm is enhancing its strategic position through a major alliance with Amundi, aiming to merge Amundi US into its operations. This move is set to expand Victory Capital’s asset management capabilities globally and diversify its investment offerings, potentially increasing shareholder value through enhanced scale and distribution reach.

Simply Wall St Growth Rating: ★★★★☆☆

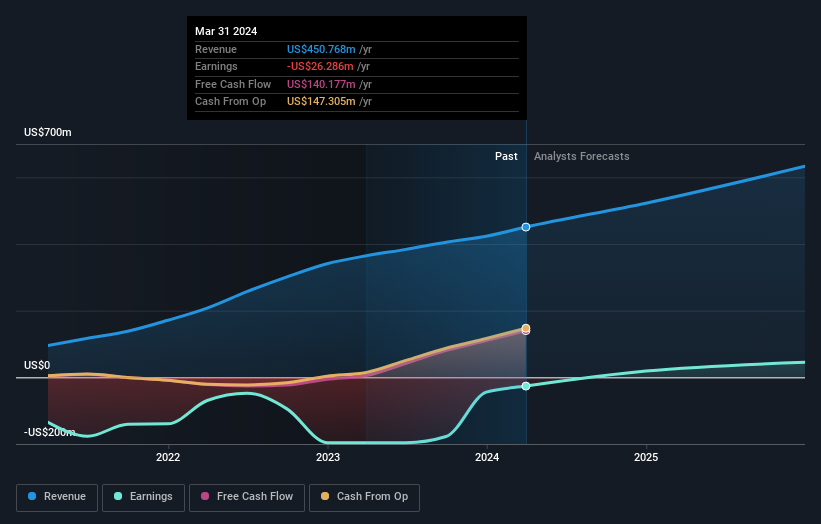

Overview: MoneyLion Inc. is a financial technology company offering customized products and financial content to American consumers, with a market capitalization of approximately $899.39 million.

Operations: The company generates its revenue primarily through data processing services, amounting to $450.77 million.

Insider Ownership: 20.4%

Return On Equity Forecast: N/A (2027 estimate)

MoneyLion Inc. has shown promising financial performance, transitioning from a net loss to a profitable first quarter in 2024 with revenues increasing to US$121.01 million from US$93.67 million the previous year. Despite this growth and substantial insider buying over the past three months, the company faces challenges including significant insider selling and high share price volatility. Future revenue is expected to grow between 17% and 22% in Q2 2024, reflecting an optimistic outlook for continued expansion.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mach Natural Resources LP is an independent upstream oil and gas company engaged in acquiring, developing, and producing oil, natural gas, and natural gas liquids in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the Texas panhandle with a market cap of approximately $1.96 billion.

Operations: The company generates revenue primarily through its exploration and production segment, totaling $673.16 million in oil, natural gas, and natural gas liquids.

Insider Ownership: 16%

Return On Equity Forecast: N/A (2026 estimate)

Mach Natural Resources, despite its recent dividend cut and high debt levels, is trading at 51.3% below its estimated fair value, suggesting potential undervaluation. The company’s revenue growth of 14.1% per year outpaces the US market average, with earnings expected to surge by 38.6% annually over the next three years. However, its profit margins have declined significantly from the previous year and its hefty dividend yield is poorly supported by earnings and cash flows.

Seize The Opportunity

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:VCTR NYSE:ML and NYSE:MNR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com