USA Travel Insurance Market

Dublin, July 12, 2024 (GLOBE NEWSWIRE) — The “USA Travel Insurance Market, By Type, By Risk Coverage, By Trip Type, By Destination, By Distribution Channel, By End User: By Country – Market Size, Industry Dynamics, Opportunity Analysis and Forecast for 2024-2032” report has been added to ResearchAndMarkets.com’s offering.

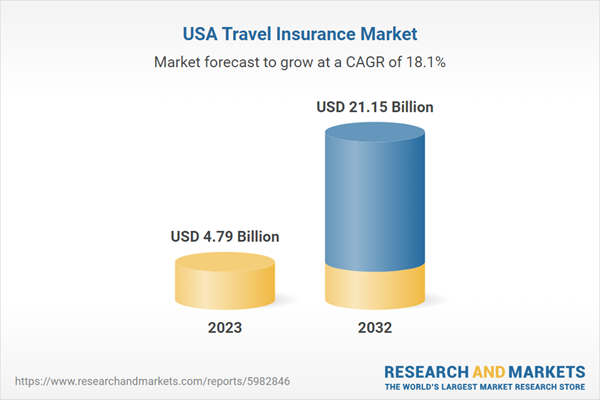

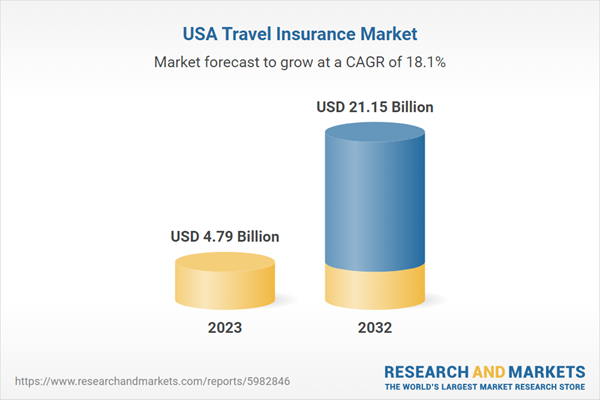

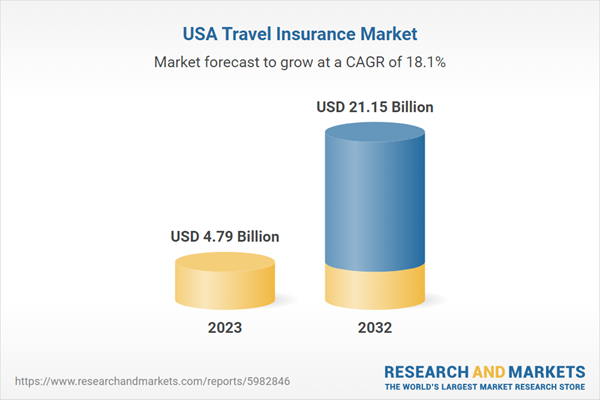

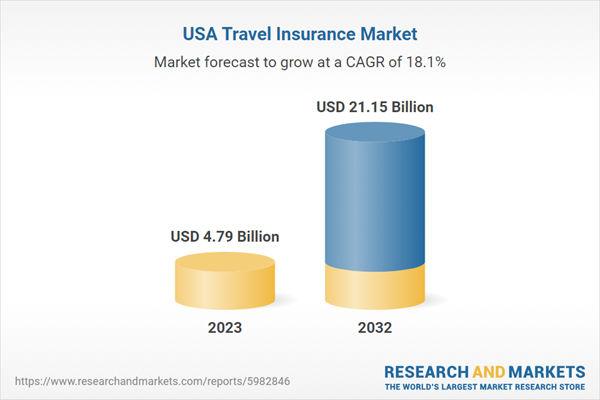

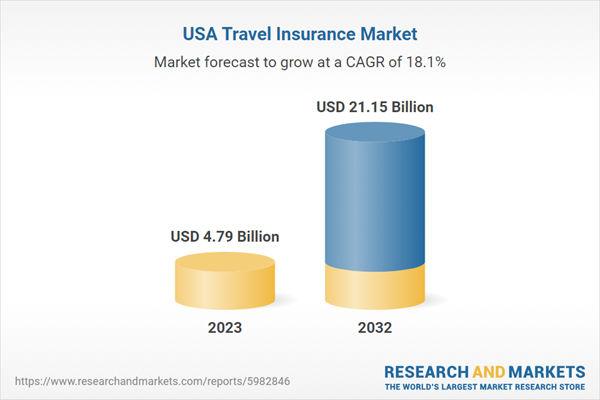

The USA Travel Insurance Market, valued at US$ 4.79 billion in 2023, is projected to expand at a CAGR of 18.14% during the forecast period to reach $21.15 billion by 2032

The robust expansion of the U.S. travel insurance market is driven by several pivotal factors. Notably, a resurgence in both international and domestic travel post-pandemic has underscored the necessity of travel insurance for protection against cancellations, medical emergencies, and other unforeseen incidents. Heightened awareness of travel-related risks, particularly due to COVID-19, has further solidified the role of travel insurance in trip planning. Technological advancements have simplified policy management and purchase through digital platforms, with AI and machine learning personalizing products and optimizing claims processes.

Additionally, stricter regulatory demands for travel insurance in various nations have compelled American travelers to secure policies, broadening the market. Insurers are developing innovative products for specific activities like adventure sports and eco-tourism. Moreover, strategic partnerships between insurance providers and travel industry stakeholders have made travel insurance more accessible, integrating it seamlessly with travel arrangements, thus fueling market growth.

On the basis of region, Northeast Region of USA holds the dominant position in the market holding 31.69% in the year 2023. This region is further anticipated to hold the highest CAGR of 18.84% during the forecast period. This trend could be attributed to several factors, including the region’s dense population, extensive transportation infrastructure, and robust tourism industry. For instance, the Northeast region encompasses major metropolitan areas such as New York City, Boston, and Philadelphia, which serve as major hubs for both domestic and international travel. Tourists flock to iconic landmarks like the Statue of Liberty, Times Square, and the Freedom Trail, making travel insurance a crucial consideration for visitors navigating the bustling urban landscape.

Moreover, the Northeast boasts picturesque destinations like the White Mountains of New Hampshire, the beaches of Cape Cod, and the scenic vistas of the Hudson Valley, attracting outdoor enthusiasts year-round. Travel insurance becomes essential for adventurers engaging in activities such as hiking, skiing, or water sports, where unforeseen accidents or emergencies may occur. Therefore, the Northeast region’s dominance in the travel insurance market, coupled with its projected growth trajectory, underscores the significance of comprehensive coverage for travelers exploring this dynamic and diverse region.

Market Segment Insights

In 2023, the Individual Insurance category leads the travel insurance market with a commanding 77.49% market share and is forecasted to grow at the highest CAGR of 18.32% during the upcoming period. This growth is primarily fueled by an escalating demand for personalized insurance solutions that cater specifically to the unique requirements of individual travelers. The global increase in travel activities has further amplified the demand for comprehensive insurance coverage, bolstering the importance of the Individual Insurance segment. As travelers engage in a variety of trips, from leisure to business, there is a clear need for insurance plans that are both flexible and adaptable to diverse circumstances.

The Medical Cover segment holds a predominant role in the Risk Coverage category, securing a significant 52.60% market share in 2023, with expectations to achieve the highest CAGR of 18.51% in the forecast period. This segment focuses on providing insurance plans that cover a wide range of medical expenses, such as hospitalization, surgical procedures, medications, and other health-related services. The increasing global healthcare costs and a heightened awareness of the necessity for health insurance are key drivers propelling the demand for medical cover policies. The growth of this segment is stimulated by factors including rising healthcare costs worldwide, enhanced health consciousness among individuals, and government initiatives aimed at promoting universal health coverage.

In terms of trip type, the Comprehensive Travel segment leads with the highest market share in 2023. It offers a broad array of coverage options including trip cancellation, medical emergencies, and lost luggage, appealing to travelers seeking extensive protection. The heightened awareness of travel risks, especially highlighted by the COVID-19 pandemic, has spurred the demand for policies that encompass a wide range of unforeseen events. Additionally, comprehensive travel insurance often proves more cost-effective for those undertaking extensive or frequent travels, as it combines multiple types of coverage under a single policy, offering a cost advantage over multiple specialized policies. The convenience of managing one comprehensive policy rather than several enhances the attractiveness of this option for travelers.

The International segment dominates the Destination category, holding a substantial 67.74% market share in 2023 and is anticipated to exhibit the highest CAGR of 18.50% during the forecast period. This segment specifically caters to travelers crossing domestic borders, offering coverage for various contingencies encountered during international trips. The prevalent international travel, coupled with increasing awareness of potential risks such as geopolitical instability, natural disasters, and medical emergencies, drives the demand for comprehensive travel insurance policies. As globalization continues to enhance global mobility, the necessity to safeguard against unforeseen circumstances during overseas travel becomes increasingly critical.

In the insurance distribution channels, the Insurance Intermediaries segment emerges as the leading segment, capturing the largest share of 29.63% in 2023. This segment includes a range of intermediaries like insurance brokers, agents, and consultants who facilitate the buying and selling of insurance products between insurers and customers. Their extensive networks, deep industry expertise, and personalized service offerings make them the preferred choice for many consumers seeking tailored insurance solutions. On the other hand, the Insurance Aggregators segment, which allows users to compare policies based on coverage, price, and other relevant factors, displays the highest CAGR of 19.13%. Representing online platforms that enable convenient and transparent comparisons and purchases of insurance policies from multiple providers, this segment benefits from the increasing digitalization of the insurance industry and evolving consumer preferences for online shopping and comparisons, driving its rapid growth.

On the basis of end-users category, the traveler segment in the USA, comprising travel bloggers, tourist guides, family travelers, business travelers, and group travelers, observes the highest share and fastest growth due to its complex and frequent travel needs. The globalization of business, along with regulatory and corporate mandates requiring travel insurance for employees traveling abroad, significantly contributes to this growth. Moreover, the surge in adventure and leisure travel among bloggers, families, and groups calls for policies that cover activities beyond standard provisions, such as extreme sports. Insurers have effectively capitalized on these needs with targeted marketing strategies and simplified purchase processes integrated into travel bookings, enhancing the ease with which frequent travelers can secure coverage.

Competitive Landscape

The Travel Insurances market is characterized by a vigorous competitive landscape, with prominent entities like Allianz, AIG, AXA and Generali Global Assistance at the forefront, collectively accounting for approximately 65% of the overall market share. This competitive milieu is fueled by their intensive efforts in research and development as well as strategic partnerships and collaborations, underscoring their commitment to solidifying market presence and diversifying their offerings. The primary competitive factors include pricing, product caliber, and technological innovation. As the Travel Insurances industry continues to expand, the competitive fervor among these key players is anticipated to intensify. The impetus for ongoing innovation and alignment with evolving customer preferences and stringent regulations is high. The industry’s fluidity anticipates an uptick in novel innovations and strategic growth tactics from these leading corporations, which in turn propels the sector’s comprehensive growth and transformation.

Report Insights

-

The U.S. travel insurance market is projected to reach $21.15 billion by 2032, expanding at a CAGR of 18.14% from 2023.

-

The Northeast USA region leads the market due to its dense population, robust tourism industry, and extensive travel insurance uptake.

-

Growth drivers include a surge in international and domestic travel post-pandemic, heightened awareness of travel risks, and technological advancements facilitating easier policy management and purchase.

-

Strategic partnerships between insurance providers and travel industry stakeholders have enhanced the visibility and accessibility of travel insurance, driving market growth.

Key Questions Answered

-

What is the estimated growth rate of the USA Travel Insurance market?

-

What are the key drivers and potential restraints?

-

Which market segments are expected to witness significant growth?

-

Who are the leading players in the market?

Key Attributes

|

Report Attribute |

Details |

|

No. of Pages |

136 |

|

Forecast Period |

2023-2032 |

|

Estimated Market Value (USD) in 2023 |

$4.79 Billion |

|

Forecasted Market Value (USD) by 2032 |

$21.15 Billion |

|

Compound Annual Growth Rate |

18.1% |

|

Regions Covered |

United States |

A selection of companies mentioned in this report includes, but is not limited to:

-

Allianz Global Assistance

-

American Express Company

-

American International Group, Inc.

-

Axa SA

-

Berkshire Hathaway Specialty Insurance Company

-

Generali Global Assistance

-

HTH Travel Insurance

-

Nationwide Mutual Insurance Company

-

Seven Corners Inc.

-

Tin Leg

-

Travelex Insurance Services Inc.

For more information about this report visit https://www.researchandmarkets.com/r/pyx866

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900