The FTSE 100 is down about half a percentage point and set to end the week below where it started.

Meanwhile, the London Stock Exchange exodus continues with wealth manager Mattioli Woods being bought out for £432 million.

On Wall Street, traders are digesting yet another blowout jobs report, which renews hopes of a soft, albeit slow, landing from inflation, but could push back rate cuts.

Housebuilders in focus as investors look for signs of recovery

14:44 , Daniel O’Boyle

UK housebuilders are set to shed light on the state of the fragile property market amid a number of key updates from firms next week.

Shareholders are braced to see accounts for Persimmon, Berkeley and Vistry all show a fall in sales numbers after higher interest rates weighed heavily on activity last year.

Interest rates rose to a 15-year high of 5.25% last year and millions of homeowners have been faced with higher mortgage rates as a result.

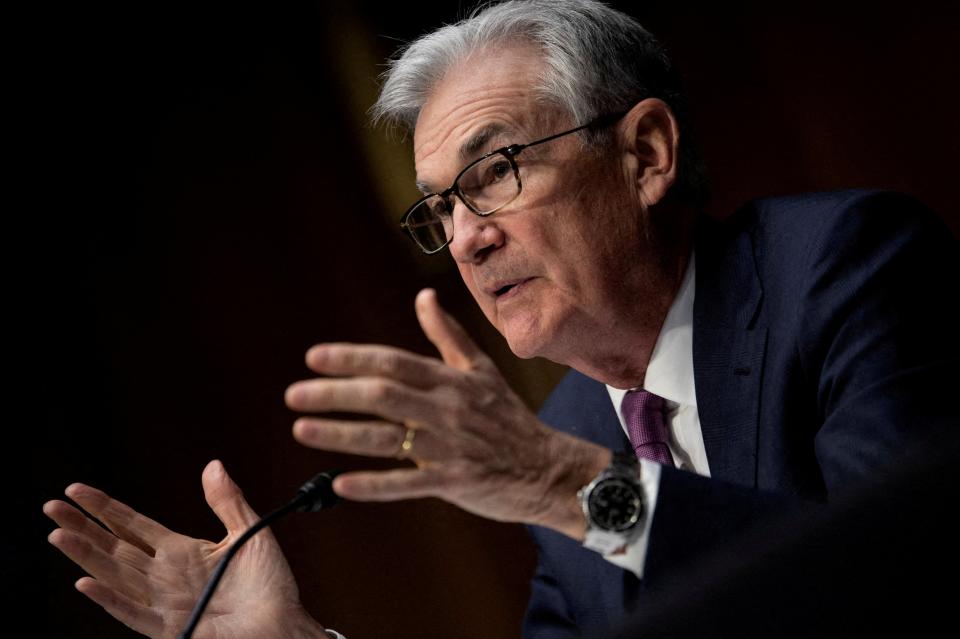

US payrolls support ‘what the Fed has been forecasting all along’

13:36 , Daniel O’Boyle

Commenting on the US non-farm payrolls announcement this afternoon, Richard Flynn, Managing Director at Charles Schwab UK notes: “Today’s jobs report is stronger than expected, indicating that demand in the labour market remains high, following similarly higher than predicted figures in last month’s report. We can expect to see some volatility in the stock market as investors react to these figures in the coming days of trading, but as for the bigger picture, these numbers are unlikely to rock the boat too much. At the start of the year, the market predicted as many as seven rate cuts, but economic data released between then and now has tempered expectations surrounding interest rates. Today’s non-farm payroll report can be seen to support newer, more conservative expectations of three rate cuts in 2024 – which, funnily enough, is what the Fed has been forecasting all along.”

US jobs soar ahead of expectations yet again

13:34 , Daniel O’Boyle

The US economy added another 275,000 jobs in February, smashing expectations once again and vindicating Joe Biden’s record on the economy after yesterday’s State of the Union address.

The figures could renew hope that the US could still be on for a “soft landing”, even if inflation has proved stickier than had been expected. But with no labour slowdown and with inflation showing early signs of ticking back up, it seems that Federal Reserve interest rate cuts might not be coming soon.

The unemployment rate rose to 3.9%, above expectations of 3.7%.

NatWest will offer safe spaces to economic and domestic abuse survivors

11:58 , Daniel O’Boyle

NatWest will offer safe spaces in over 360 bank branches across the UK to people experiencing economic and domestic abuse.

The announcement was made during UK Says No More Week (March 3 to 9 2024), which raises awareness about domestic abuse and sexual violence, and also coincides with International Women’s Day (March 8).

Safe spaces, launched by charity Hestia as part of the campaign, are designated locations which anyone experiencing economic and domestic abuse can use.

Market snapshot: FTSE 100 slips further

11:16 , Daniel O’Boyle

The FTSE 100 has lost a little bit more ground today, while the pound has continued to rise against the dollar.

Take a look at today’s market snapshot.

BP hands new CEO Murray Auchincloss £8 million after predecessor Looney’s shock exit

11:08 , Daniel O’Boyle

The shock exit of former CEO Bernard Looney last year and accusations of “profiteering” have done little to bring about a change in the oil supermajor’s executive pay policy, as it handed new boss Murray Auchincloss £8 million last year.

The firm said Auchincloss’ pay was “broadly in line” with his predecessor Bernard Looney, who shocked the City in September when he announced his sudden departure from BP after admitting he was not “fully transparent” in his disclosures about past relationships with colleagues. In December, the firm revealed it would strip Looney of £32 million worth of bonuses due to his “serious misconduct”.

Watchdog could block sugar deal between Tate & Lyle and Whitworths makers

10:27 , Daniel O’Boyle

The competition watchdog has said that it might block the tie-up between two major sugar companies if they cannot allay its concerns that the deal could lead to higher prices for customers.

The Competition and Markets Authority (CMA) said that it believed competition could be harmed by the plan by the maker of the Tate & Lyle brand to buy the maker of the Whitworths brand.

T&L Sugars (TLS) – the company behind Tate & Lyle – announced its plan to purchase Tereos UK and Ireland’s business-to-consumer packed sugar unit in November.

Royal London to share £163 million with members as profits rise to £249 million

10:24 , Michael Hunter

Royal London, the UK’s biggest insurance firm owned by its customers, announced details of its payout to members today.

The firm, which has over $150 billion in funds under management, will share $163 million of its profits with around 2 million eligible life insurance and pensions customers.

Its operating profit before tax rose to £249 million for 2023, up from £210 million.

Barry O’Dwyer, CEO, said:

“In 2023, we welcomed 930 new workplace pension schemes, allowing us to support a further 240,000 new pension savers.

“The breadth and depth of our investment range attracted over £4bn in net inflows, as we grew our membership base, and delivered strong active investment performance while expanding our fund range and international reach.”

More than £10 billion departs London Stock Exchange in a week

10:10 , Simon Hunt

Several major listed companies unveiled plans to depart the London Stock Exchange in the past week in deals worth a combined £10.2 billion as the crisis facing the exchange shows signs of deepening.

Wealth management firm Mattioli Woods today became the latest firm to quit the public markets after it recommended an £432 million offer to be acquired by private equity firm Pollen Street Capital.

Pollen Street’s offer of 804p per share represents a 34% premium on yesterday’s closing stock price and 42% above the average price the stock has traded over the last six months.

Mattioli Woods dealt a parting shot on the problems of the public markets as it prepared it leave the London Stock Exchange, saying it “recognises the opportunities that can be delivered under private ownership…with the support of a growth-focused shareholder” adding that going private provides “the flexibility to take longer-term decisions to maximise the growth potential of the business.”

On top of Mattioli Woods’ decision today, the past week alone has seen the proposed departures of Spirent Communications, which had been listed for decades, British bank Virgin Money, packaging firm DS Smith and logistics firm Wincanton. Other firms such as office business IWG have begun exploring options to move their primary listing to New York, while some blue-chips including Direct Line and Currys have rejected private equity takeovers in recent weeks.

Informa shares rise after upping 2024 forecasts

08:58 , Daniel O’Boyle

Shares in FTSE 100 exhibitions group Informa are higher after the business upped its 2024 forecasts.

The business known for events like the Miami International Boat Show expects revenue of around £3.5 billion and profits of between £950 million and £970 million this year.

The shares are up 2% to 821p.

Stephen A. Carter, Group Chief Executive, Informa PLC, said: “Informa’s final results confirm further outperformance in 2023 and continuing momentum and growth in 2024.”

He added: “Strong growth in IMEA, (India, Middle East & Africa), which is emerging as a material geographic growth engine alongside the Americas, China, ASEAN, and Europe, leads to updated 2024 guidance. We are expanding our platform in B2B Digital Services through the proposed combination with TechTarget. And we are delivering further strong shareholder returns in 2024, including continuing dividend growth and a minimum of £340m of in-year share buybacks.”

Market snapshot: FTSE 100 slips back, pound rises further

08:41 , Daniel O’Boyle

Take a look at today’s market snapshot as the FTSE 100 slips back and the poound tops $1.28

FTSE 100 slips back in opening trade as Mondi shares fall on £5 billion bid for DS Smith

08:22 , Michael Hunter

London’s main stock market index edged lower in opening trade, with a multi-billion pound deal announce after yesterday’s close at the centre of attention.

Shares in Mondi made the biggest loss after the packing maker unwrapped plans last night for the acquisition after the market closed

On Friday, Monday’s shares made the biggest single fall, down 45p at 1317p, a drop of over 3%. DS Smith rose by over 18p to 344p, a gain of almost 6%.

Overall, the FTSE 100 fell by 13 points to 7,679.62, a drop of 0.2%.

Direction on global markets is likely to be defined by closely watched US jobs data due at 1.30 p.m. London time. There was another record close for Wall Street’s S&P 500 overnight, led by demand for chipmakers.

Record profits for Just Group

08:06 , Daniel O’Boyle

Pensions business Just Group reported record profits as higher interest rates had a “positive effect” on its main business arms.

The business made a £172 million profit, after a £494 million loss the year before.

CEO David Richardson said: “We are delighted with our financial performance in 2023, a record year for the Group, and are confident of exceeding our medium term profit growth pledge. As such, we now expect to achieve our target of doubling profits in three years instead of the originally intended five.

“Given the multiple opportunities available and strong structural growth drivers in our chosen markets, we have never been more confident in our ability to deliver sustainable and compounding growth.”

Matches falls into administration

07:31 , Simon English

Mike Ashley’s Frasers Group has put luxury e-tailer Matches into administration, just weeks after buying the business for £52 million.

Frasers, the owner of Sports Direct, said in a statement: “Whilst Matches’ management team has tried to find a way to stabilise the business, it has become clear that too much change would be required to restructure it, and the continued funding requirements would be far in excess of amounts that the Group considers to be viable,” Frasers Group said in a statement. “In light of this, Frasers has been informed that the directors of Matches have taken the decision to put the Matches group into administration. Frasers remains committed to the luxury market and its brand partners.”

Matches was founded in the 1980s, originally as a store in London. It went online in 2007, once selling more than 500 luxury brands including Gucci and Balenciaga.

The business was valued at $1 billion as recently as 2017 when it was bought by Apax Partners.

Mattioli Woods latest London firm to be bought off stock exchange in £432m deal

07:21 , Daniel O’Boyle

Another London-listed company is to be bought out as wealth manager Mattioli Woods agreed to a £432 million offer from private equity firm Pollen Street Capital.

The 804p-per-share offer is a 34% premium on Mattioli Woods’ share price.

Pollen Street said it felt Mattioli Woods “ will benefit from transitioning to private ownership”

Ian Mattioli MBE, the CEO of Mattioli Woods, said: “Since our admission to AIM in 2005, we have seen significant expansion in both the size and nature of our business, integrating asset management, financial planning and employee benefit services to serve personal and corporate clients throughout the UK.”

He is set to make £26 million from the deal.

Lindsey McMurray, Managing Partner of Pollen Street said: “We are pleased to have reached agreement with the board of Mattioli Woods on the terms of Bidco’s offer to Mattioli Woods Shareholders. We believe Mattioli Woods would benefit from a transition to private ownership, which would enable Mattioli Woods to accelerate its growth strategy and to capitalise on the market opportunity in UK wealth management. Pollen Street has strong heritage in supporting companies in the financial and business services sectors and we are excited by the opportunity to work with Mattioli Woods in achieving our ambitious goals for the business.”

FTSE 100 expected to gain at the open after record US close

07:08 , Michael Hunter

London’s main stock market index is expected to rise in opening trade, with the mood getting a boost from a fresh closing record on Wall Street overnight.

The FTSE 100 will add around 20 points according to futures trade, with similar rises on the cards for its European equivalents in Paris and Frankfurt.

Overnight in New York, there was new all-time high for the S&P 500. The run higher was led by chipmaking stocks. The bullish mood faces a test from influential employment data due out this afternoon in UK time.

Recap: Yesterday’s top stories

06:49 , Simon Hunt

Good morning from the Standard City desk.

Nationwide Building Society, a prince of the financial world since 1884, yesterday said it would spend £2.9 billion (billion!) of members cash on Virgin Money.

We can assume Nationwide boss Debbie Crosbie is not a customer of Virgin Money, or she’d know it is worth nothing like that.

Nationwide is selling this deal as if it were a continuation of its mutual principles.

Advisers include three bankers from UBS, four from JP Morgan, four from Goldman Sachs and a bunch of highly paid PR folk.

Which doesn’t exactly scream of mutuality.

This is not Nationwide coming to the rescue of a small building society – it’s a massive bet on an expansion plan absolutely no one was asking for accept presumably Debbie Crosbie.

Nationwide’s write-down on the value of this deal in next year’s results is a matter of inevitability. The guys at Goldman Sachs shall rub their hands in glee. Anything else we can do for you nice folks?

Raise you a bit of equity perhaps?

The point about mutuality, indeed the very definition of the word, is that everyone is in it together.

Here’s a summary of our other top stories from Yesterday: