Dissecting the Underrepresentation of China and India in the MSCI ACWI ex USA Index

As the world’s economic landscape continues to evolve, the MSCI ACWI ex USA Index, renowned for its broad international equity exposure, has come under scrutiny for its disproportionate representation of China and India. Despite both nations boasting robust GDP and market capitalization, they remain vastly underrepresented in the index, prompting a deeper analysis of the underlying factors.

(Read Also: Groundbreaking Study to Evaluate Mental Health Intervention for Children in China)

Unveiling the Discrepancy

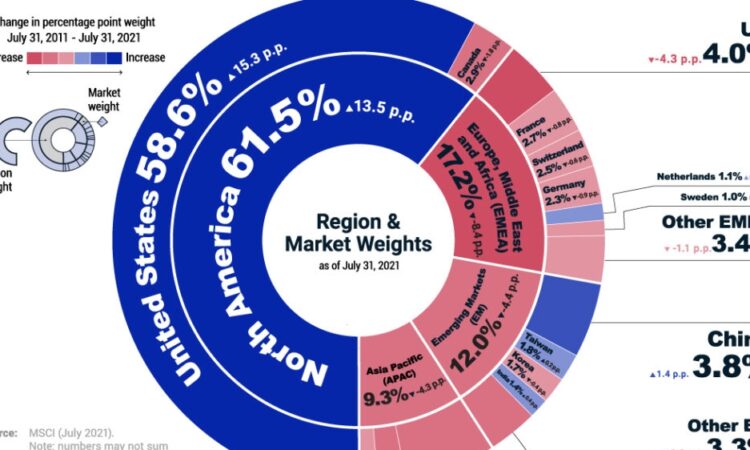

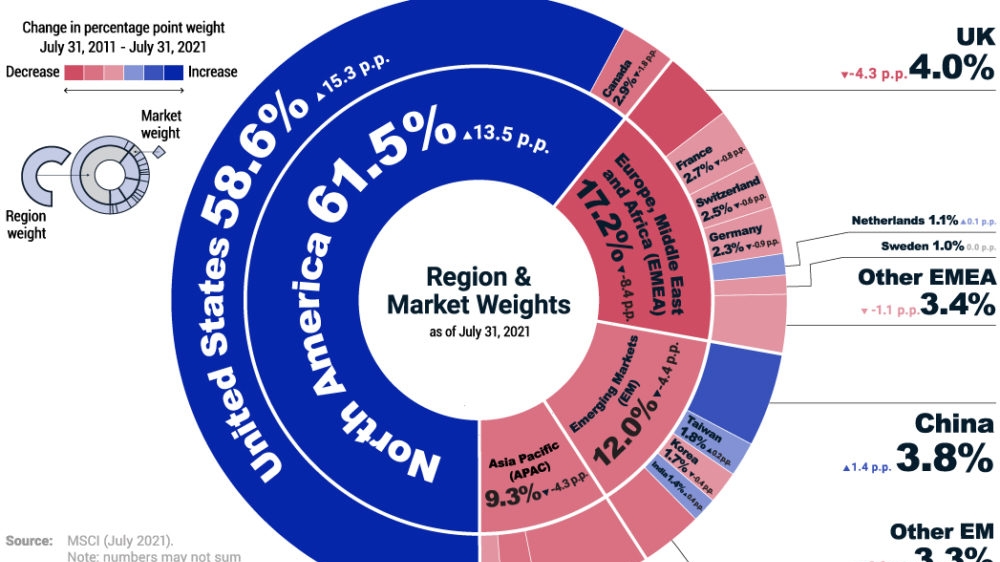

The MSCI ACWI ex USA Index, designed to capture large and mid-cap representation across developed and emerging markets – excluding the United States, aims to encapsulate approximately 85% of the global equity opportunity set outside the U.S. However, a comparison of the index’s country weights relative to the GDP and market capitalization of the top 10 economies outside the U.S., reveals a glaring disparity. China, with an impressive GDP of $17.7 trillion and market capitalization of $10.6 trillion, is allocated a mere 8% in the index. Similarly, India, boasting a GDP of $3.7 trillion and market capitalization of $4.2 trillion, is allocated only 4.68%. In stark contrast, nations such as the UK and Canada appear overrepresented relative to their GDP and market capitalization.

Decoding the Underrepresentation

This glaring discrepancy raises pertinent questions about the root cause of this underrepresentation. One plausible explanation could be a ‘governance discount’, a phenomenon where risks related to governance and investment friendliness in China and India are taken into account. Conversely, it could also be attributed to a ‘home bias’, a tendency among investors to lean towards markets closer to home.

(Read Also: China’s Gray Zone Warfare in the West Philippine Sea: Implications and Countermeasures)

The MSCI’s Response

While the MSCI does offer a GDP-adjusted version of the ACWI index, it is not the default choice for ETFs. The MSCI India portfolio selection process, driven by market capitalization and subject to constraints like liquidity and foreign investor access, does not seem to factor in governance considerations. This implies a potential need for Indian policymakers to address the perception of an ‘India discount’ by improving governance and facilitating easier shorting of stocks. Moreover, MSCI offers a ‘China A Inclusion Top 200 Select Governance Quality ex Controversies Score Index’, factoring in corporate governance. However, the specifics on governance measurement remain undisclosed and the product is not the default version of the index.