-

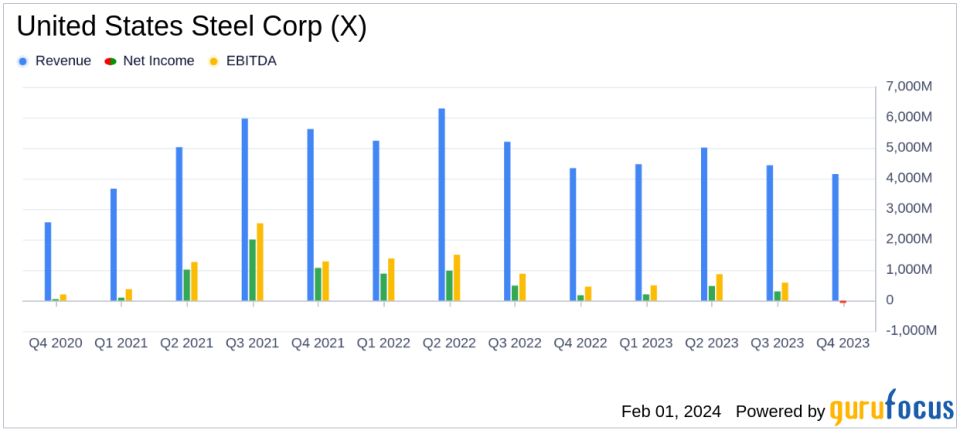

Net Loss in Q4: United States Steel Corp (NYSE:X) reported a net loss of $80 million in Q4 2023, contrasting with a net earnings of $174 million in Q4 2022.

-

Adjusted Net Earnings: Adjusted net earnings for Q4 2023 were $167 million, down from $235 million in the same quarter the previous year.

-

Annual Performance: Full-year net earnings for 2023 stood at $895 million, a decrease from $2,524 million in 2022.

-

EBITDA: Adjusted EBITDA for the year was $2,139 million, compared to $4,290 million in the prior year.

-

Capital Expenditures: Capital expenditures increased significantly to $2,576 million in 2023 from $1,769 million in 2022.

-

Strategic Investments: The company highlighted strategic investments in sustainable steelmaking and the upcoming merger with Nippon Steel Corporation.

On February 1, 2024, United States Steel Corp (NYSE:X) released its 8-K filing, detailing its financial performance for the fourth quarter and full-year 2023. The company, which operates primarily in the United States with additional steelmaking capacity in Slovakia, faced a challenging year with a net loss in the fourth quarter but managed to achieve adjusted net earnings growth. United States Steel Corp’s operating segments include North American Flat-Rolled, Mini Mill, U. S. Steel Europe, and Tubular Products, serving a diverse range of markets from construction to automotive.

Financial Performance and Challenges

United States Steel Corp’s fourth quarter saw a net loss of $80 million, or $0.36 per diluted share, compared to net earnings of $174 million, or $0.68 per diluted share, in the same period of the previous year. Adjusted net earnings for the quarter were $167 million, or $0.67 per diluted share, a decrease from $235 million, or $0.89 per diluted share, in Q4 2022. The full-year net earnings for 2023 were $895 million, or $3.56 per diluted share, a significant drop from $2,524 million, or $9.16 per diluted share, in 2022. Adjusted net earnings for the full year were $1,195 million, or $4.73 per diluted share, compared to $2,785 million, or $10.06 per diluted share, in the previous year.

The company’s performance is critical as it reflects the health of the steel industry, which is a bellwether for the broader economy due to its ties to construction, manufacturing, and infrastructure. The challenges faced by United States Steel Corp, such as market volatility and operational hurdles, could lead to problems that affect profitability and strategic initiatives.

Strategic Investments and Merger Plans

Despite the mixed financial results, United States Steel Corp highlighted its strategic investments and the definitive merger agreement with Nippon Steel Corporation. President and CEO David B. Burritt commented on the company’s strong financial and operational performance and the strategic review process that led to the merger agreement. He emphasized the opportunities the merger would create, reinforcing the company’s commitment to employees, customers, and local communities.

“We are excited by the opportunities afforded by the Nippon Steel and U. S. Steel combination. It is the right transaction not only for U. S. Steel stockholders, but also for our employees and customers,” said Burritt.

Burritt also noted the company’s investments in sustainable steelmaking, such as the production of direct reduced-grade pellets and the construction of the state-of-the-art mini mill, Big River 2, which is expected to start operations in the second half of 2024.

Key Financial Metrics

United States Steel Corp’s financial achievements include managing extended lead times due to broad customer demand and operating at high levels of utilization. The company’s net sales for the fourth quarter were $4,144 million, a slight decrease from $4,338 million in the same quarter of the previous year. For the full year, net sales were $18,053 million, down from $21,065 million in 2022. The adjusted EBITDA for the fourth quarter was $330 million, and for the full year, it was $2,139 million, indicating the company’s ability to generate earnings before interest, taxes, depreciation, and amortization.

Capital expenditures rose to $2,576 million in 2023, reflecting the company’s investment in strategic projects and sustainable operations. The increase in capital expenditures is significant as it represents the company’s commitment to innovation and long-term growth within the steel industry.

In conclusion, United States Steel Corp’s 2023 performance presents a complex picture of strategic growth amid financial headwinds. The company’s focus on sustainable practices and strategic mergers sets the stage for potential future gains, even as it navigates the challenges of the current economic environment. Investors and stakeholders will be watching closely as the company moves towards the completion of its merger with Nippon Steel Corporation and the launch of new projects in 2024.

Explore the complete 8-K earnings release (here) from United States Steel Corp for further details.

This article first appeared on GuruFocus.