United States Online Trading Platform Market Projected to Reach USD 4.35 Billion by 2028, Fuelled by AI Integration and Mobile Accessibility

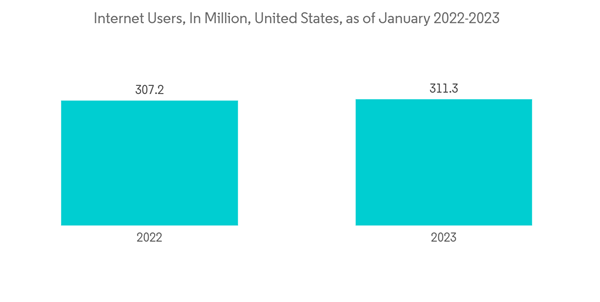

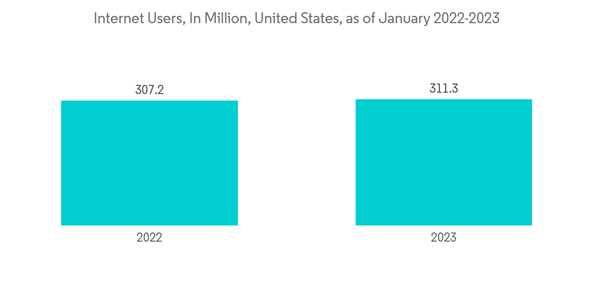

United States Online Trading Platform Market Internet Users In Million United States As Of January 2022 2023

Dublin, Jan. 26, 2024 (GLOBE NEWSWIRE) — The “United States Online Trading Platform Market Size & Share Analysis – Growth Trends & Forecasts (2023 – 2028)” report has been added to ResearchAndMarkets.com’s offering.

The latest industry analysis confirms the continued growth of the United States Online Trading Platform market, with forecasts indicating an expansion from USD 3.03 billion to a remarkable USD 4.35 billion over the next five years. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 6.11% from 2023 to 2028.

The surging accessibility of online trading through smartphones, combined with the progression of Artificial Intelligence (AI) and robo-advisor integration, stand as key drivers propelling the upward trajectory of the market. With these advancements, trading and investment platforms are enhancing their capabilities, offering consolidated functions for trade orders and investment management on unified platforms.

Key Trends Influencing Market Expansion

Foremost among the trends is the increasing ease of mobile access that is reshaping user engagement in the financial markets. Smartphones have unlocked the potential for user-friendly trading across the United States, allowing investors to effortlessly manage their portfolios and execute trades on the go. This unprecedented level of convenience is spurring greater participation in stock trading among a more diverse populace.

Innovation in AI within banking and financial services is spearheading a transformative approach to real-time data analytics and decision-making support systems. Such ground-breaking steps were evidenced in BNY Mellon’s recent announcement to utilize an AI-powered tool for enhancing its customer data management.

However, the market’s progress faces challenges such as the risks of fraudulent activities in online trading platforms, which could undermine investor confidence. Despite these concerns, the adaptive strategies of market leaders are expected to mitigate potential slowdowns in market growth.

Segmental Insights: Platforms Offerings Lead the Growth

-

Platforms Offerings Segment – The segment that includes a variety of platforms such as brokerage, direct market access, forex, options, cryptocurrency trading, and social trading platforms, is anticipated to hold a notable market share. Advanced features, heightened security measures, and user-oriented designs are fueling popularity and consequently driving market growth.

-

Mobile Trading Dominance – With heightened smartphone sales and a paradigm shift towards mobile media for trading, the segment is poised for significant expansion within the forecast period, marked by advanced trading features.

Competitive Landscape: Technological Integrations Accentuate Market Dynamics

The competitive sphere of the United States Online Trading Platform market remains highly fragmented. Notable players continue to differentiate their offerings through the integration of forward-thinking technology such as AI and cloud computing. Recent developments include Merrill’s launch of Merrill Video Pro and E*TRADE from Morgan Stanley’s platform enhancements, both of which are designed to improve the customer experience and bolster market positions.

Outlook and Analyst Support

The market outlook remains bullish with significant support from advancements in platform offerings and heightened mobile trading activity. As investors and traders increasingly seek flexibility, speed, and efficiency in managing investments, online trading platforms are strategically positioned to capture this growing demand.

With the convergence of advanced technologies and strategic investment in user experience, the United States Online Trading Platform market stands at the cusp of an evolving era of digital trading solutions, catering to the modern investor’s needs.

For More Insightful Industry Analyses

Focused reports on specific sectors and cutting-edge trends in the United States Online Trading Platform market provide key industry insights, strategic recommendations, and growth forecasts crucial for staying ahead in this dynamic market landscape.

The industry overview delves into the intricate dynamics shaping the market, with particular attention to platform offerings and technological advancements that command significant market share and support robust growth trajectories.

A selection of companies mentioned in this report includes

-

Fidelity Investments Institutional Operations Company Inc.

-

The Charles Schwab Corporation

-

Merrill Lynch, Pierce, Fenner & Smith Incorporated (Bank of America Corporation)

-

E*Trade (Morgan Stanley)

-

Interactive Brokers LLC

-

Webull Financial LLC

-

Trading Technologies International, Inc. (7RIDGE)

-

eToro

-

Robinhood Markets Inc.

-

Tradestation Group Inc.

-

Coinbase Global Inc.

-

BAM Trading Services Inc. (Binance.US)

-

The Vanguard Group Inc.

For more information about this report visit https://www.researchandmarkets.com/r/2hg3kz

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900