Dublin, May 20, 2024 (GLOBE NEWSWIRE) — The “United States Embedded Finance Business and Investment Opportunities Databook – 75+ KPIs on Embedded Lending, Insurance, Payment, and Wealth Segments – Q1 2024 Update” report has been added to ResearchAndMarkets.com’s offering.

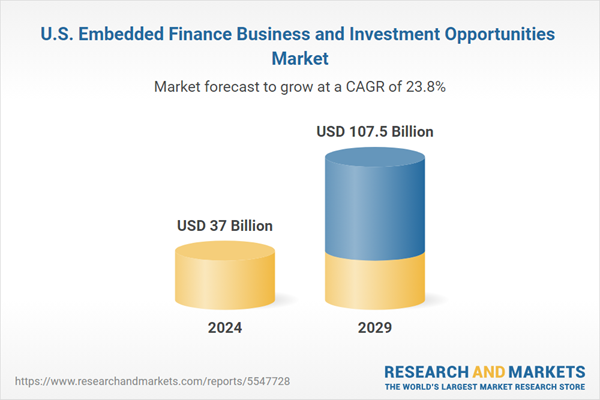

Embedded Finance industry in United States is expected to grow by 33.0% on annual basis to reach US$ 36.99 billion in 2024. The embedded finance industry is expected to grow steadily over the forecast period, recording a CAGR of 23.8% during 2024-2029. The embedded finance revenues in the country will increase from US$ 36.99 billion in 2024 to reach US$ 107.51 billion by 2029.

This report provides a detailed data-centric analysis of the embedded finance industry, covering lending, insurance, payment, wealth and asset based finance sectors market opportunities and risks across a range of different sectors. With over 75+ KPIs at the country level, this report provides a comprehensive understanding of embedded finance market dynamics, market size and forecast.

The embedded finance landscape in the US is rapidly evolving and bringing greater access to financial services to platforms, businesses, and end users. Embedded finance has evolved from being a specialized offering to becoming an essential component in the arsenal of every thriving platform.

Major players in various industries such as e-commerce (e.g., eBay, Shopify), food delivery (e.g., Uber, DoorDash), and digital banking (e.g., Tide) have all adopted integrated financial services to enhance the overall experience for their merchants. Users are now leaning more towards having payment solutions, lending options, insurance services, and other financial functionalities seamlessly integrated into their everyday software, rather than relying solely on traditional financial institutions.

This growth is attributed to increasing demand for digital financial services, the heightened expectation of users and the start of Open Banking in the US. Additionally, Embedded Finance is expanding across industries such as retail, healthcare, education, and mobility.

Benefits from Embedded Finance in US: Businesses can reap significant benefits from embedded finance. With the wide array of services facilitated by SaaS 3.0, embedded finance providers can cater to various American businesses. Here are examples across some of the major industries in the US:

E-commerce: The e-commerce sector in the United States witnessed approximately $768 billion in sales revenue last year, with an increasing number of businesses transitioning online to align with the digital economy. Key players like Amazon and Shopify stand to gain substantially by integrating financial services into their platforms, offering added value to their merchants. By providing financial services within the same ecosystem, platforms can enhance merchant loyalty and drive sales growth through new business financing options.

Commercial Banking: With an annual industry revenue of $838.5 billion, commercial banking primarily generates income through lending to customers and businesses. However, regulatory constraints, complex procedures, and traditional credit assessment methods pose challenges for lending to a wide range of individuals and companies. Embedded finance presents an opportunity for both traditional and challenger banks to overcome these hurdles by seamlessly integrating lending services into their offerings.

Small and Medium Enterprises (SMEs): Despite their significance, SMEs often face difficulties accessing the necessary funding to thrive. Traditional banks struggle to provide financing to emerging digital enterprises lacking established revenue histories or conventional credit metrics. However, alternative embedded finance solutions enable banks to offer straightforward and flexible financing to any business in need, regardless of its stage of development.

Innovation in the US: Over the past year, larger enterprises and technology platforms have offered a broader range of financial products to target customer segments more traditionally served by legacy banks.

Deliver EF-like experiences in-house: Embedded finance has significantly elevated the standard of customer experience in the banking sector. This advancement has prompted larger banks to consider incorporating the insights gained from embedded finance into their own banking services. For instance, Key Bank unveiled Laurel Road, a digital platform tailored for healthcare professionals, with its flagship product being student loan refinancing. Similarly, American Express introduced the Plan It feature, allowing cardholders to convert a standard credit card purchase into an installment loan repayment plan, resembling popular Buy Now, Pay Later (BNPL) offerings from emerging credit card disruptors.

In the United States, digital banking has gained increasing prominence as consumers prefer to bank through mobile applications. This digital push has driven the growth of the embedded finance industry over the last few years. From buy now pay later payment solution to insurance offering, embedded finance solution has become the new normal for most in the United States.

Main Barriers to Embedded Finance in the US: One of the primary challenges facing Embedded Finance is regulatory compliance. Due to heavy regulation in the financial services sector, integrating financial products into non-financial platforms can pose regulatory hurdles. Embedded Finance providers must adhere to various regulations, encompassing data privacy, consumer protection, and anti-money laundering measures.

In the United States, Embedded Finance providers are employing several strategies to tackle regulatory compliance. Firstly, the companies are partnering with established financial institutions already compliant with the requisite regulations. Secondly, seeking the necessary licenses and regulatory approvals to function as financial institutions themselves. Although this process can be time-consuming and expensive, it affords Embedded Finance providers greater control over their products and services.

Key Players: Key players in the US embedded finance landscape, include Amount, Cross River, Plaid, and YouLend. The financial services in the US as embedded finance solutions are becoming more mainstream. There are enormous opportunities for banks and platforms to serve the more than 30 million SMEs in North America.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 130 |

| Forecast Period | 2024 – 2029 |

| Estimated Market Value (USD) in 2024 | $37 Billion |

| Forecasted Market Value (USD) by 2029 | $107.5 Billion |

| Compound Annual Growth Rate | 23.8% |

| Regions Covered | United States |

Scope

United States Embedded Finance Market Size and Forecast

Embedded Finance by Key Sectors

- Retail

- Logistics

- Telecommunications

- Manufacturing

- Consumer Health

- Others

Embedded Finance by Business Model

- Platforms

- Enabler

- Regulatory Entity

Embedded Finance by Distribution Model

- Own Platforms

- Third Party Platforms

United States Embedded Insurance Market Size and Forecast

Embedded Insurance by Industry

- Embedded Insurance in Consumer Products

- Embedded Insurance in Travel & Hospitality

- Embedded Insurance in Automotive

- Embedded Insurance in Healthcare

- Embedded Insurance in Real Estate

- Embedded Insurance in Transport & Logistics

- Embedded Insurance in Others

Embedded Insurance by Consumer Segments

Embedded Insurance by Type of Offering

- Embedded Insurance in Product Segment

- Embedded Insurance in Service Segment

Embedded Insurance by Business Model

- Platforms

- Enabler

- Regulatory Entity

Embedded Insurance by Distribution Model

- Own Platforms

- Third Party Platforms

Embedded Insurance by Distribution Channel

- Embedded Sales

- Bancassurance

- Broker’s/IFA’s

- Tied Agents

Embedded Insurance by Insurance Type

- Embedded Insurance in Life Segment

- Embedded Insurance in Non-Life Segment

Embedded Insurance in Non-Life Segment

- Motor Vehicle

- Fire and Property

- Accident and Health

- General Liability

- Marine, Aviation and other Transport

- Other

United States Embedded Lending Market Size and Forecast

Embedded Lending by Consumer Segments

- Business Lending

- Retail Lending

Embedded Lending by B2B Sectors

- Embedded Lending in Retail & Consumer Goods

- Embedded Lending in IT & Software Services

- Embedded Lending in Media, Entertainment & Leisure

- Embedded Lending in Manufacturing & Distribution

- Embedded Lending in Real Estate

- Embedded Lending in Other

Embedded Lending by B2C Sectors

- Embedded Lending in Retail Shopping

- Embedded Lending in Home Improvement

- Embedded Lending in Leisure & Entertainment

- Embedded Lending in Healthcare and Wellness

- Embedded Lending in Other

Embedded Lending by Type

- BNPL Lending

- POS Lending

- Personal Loans

Embedded Lending by Business Model

- Platforms

- Enabler

- Regulatory Entity

Embedded Lending by Distribution Model

- Own Platforms

- Third Party Platforms

United States Embedded Payment Market Size and Forecast

Embedded Payment by Consumer Segments

Embedded Payment by End-Use Sector

- Embedded Payment in Retail & Consumer Goods

- Embedded Payment in Digital Products & Services

- Embedded Payment in Utility Bill Payment

- Embedded Payment in Travel & Hospitality

- Embedded Payment in Leisure & Entertainment

- Embedded Payment in Health & Wellness

- Embedded Payment in Office Supplies & Equipment

- Embedded Payment in Other

Embedded Payment by Business Model

- Platforms

- Enabler

- Regulatory Entity

Embedded Payment by Distribution Model

- Own Platforms

- Third Party Platforms

United States Embedded Wealth Management Market Size and Forecast

United States Asset Based Finance Management Industry Market Size and Forecast

Asset Based Finance by Type of Asset

Asset Based Finance by End Users

For more information about this report visit https://www.researchandmarkets.com/r/qea1rg

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.