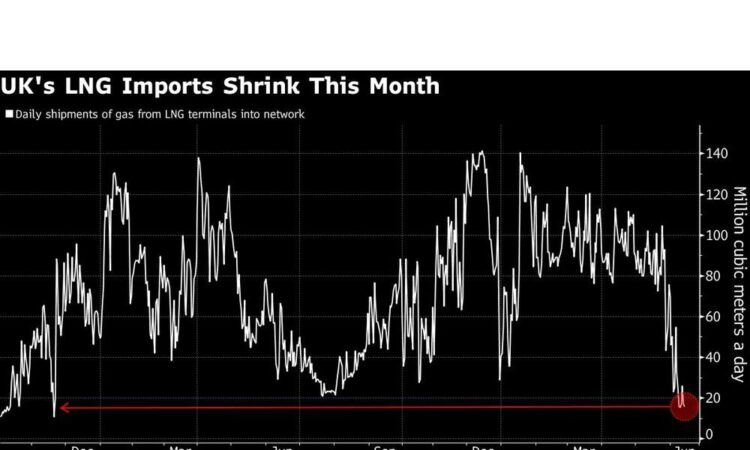

(Bloomberg) — Britain’s liquefied natural gas imports have sunk to the lowest since 2021, a stark turnaround from the height of the energy crisis when the country gobbled up supply — and sent record amounts to mainland Europe.

This advertisement has not loaded yet, but your article continues below.

UK demand for gas purchases has declined following a mild winter. The drop in consumption is mirrored on the continent, where stockpiles are unusually full, narrowing the price gap between the two markets and leaving scant room for traders to profit.

Volumes of LNG sent from British import terminals into the local grid have slumped about 80% so far in June to the lowest in almost 19 months — but have proved sufficient to meet domestic demand.

It was a very different picture last year, when countries across the region scrambled to replace Russian gas amid the war in Ukraine. The UK snapped up vast quantities of LNG, and its energy companies profited from supplying other European nations with the regasified fuel, supplemented by North Sea gas.

This advertisement has not loaded yet, but your article continues below.

Now, exports from the UK to the European Union have shrunk, partly because of swollen inventories there but also because industrial demand remains curtailed by 2022’s price spikes. As a result, Britain’s price discount to the EU’s main hubs — as wide as 50% last summer — vanished for a short period on Tuesday.

The closing of the gap reflects a faster decline in EU gas prices versus UK contracts. While demand in Britain isn’t currently high — with most homes not equipped with energy-hungry air conditioners for summer — the country remains vulnerable in the event of outages in North Sea production.

“Even amid the current heat wave, the UK does not have much residential cooling demand,” and domestic gas use been relatively weak since the start of spring, said Leo Kabouche, an analyst at Energy Aspects Ltd. Yet supply halts are a persistent risk, and Britain’s prices are now “more sensitive” to changes in piped volumes or field-maintenance schedules, Kabouche said.

UK front-month futures jumped as much as 22% on Tuesday as supply halts were extended at three major Norwegian gas facilities. The equivalent Dutch contract — a European benchmark — added as much as 18%. Both have rebounded after losing more than 50% this year.

Read More: European Gas Jumps as Key Norway Sites Extend Outages