(Bloomberg) — UK equity-index futures climbed and the pound held recent gains after the Labour Party won a majority of seats in Parliament, giving it a clear mandate to deliver on its pledge for greater economic stability.

Most Read from Bloomberg

Contracts on the FTSE 100 Index advanced 0.2%, while the pound was little changed around $1.277. Labour passed 326 of the 650 seats in the House of Commons, securing its long-predicted landslide election victory. Rishi Sunak conceded defeat and Keir Starmer is now set to become prime minister.

Heading into the vote, investors were betting that a win for Starmer’s center-left platform would mean an end to policy-induced market meltdowns. While Labour’s historic support for higher taxes and trade unions has traditionally put it at odds with markets, this time traders are confident that the specter of the UK’s gilt crisis two years ago will keep the next government in check.

“For the first time in years, the UK will be a relative island of political stability and this will favor moderating risk premia and asset market discounts,” Evercore ISI’s Krishna Guha and Marco Casiraghi wrote in a note.

UK government bonds start trading at 8 a.m. in London.

Read: Watch UK Banks, Homebuilders as Labour Heads for Election Win

According to the official exit poll, Labour is on course to win 410 of the 650 seats, the most since Tony Blair’s 1997 landslide victory. Sunak’s Tories are projected to be reduced to 131 seats, compared with 365 in 2019, a result that would likely see some of the party’s biggest names voted out. The Liberal Democrats are on course for 61, with Nigel Farage’s Reform UK on 13.

The exit poll is based on a mass survey of tens of thousands of people after they cast their ballots. That has generally made it more accurate in predicting the outcome of UK elections than snapshot surveys of voters’ intentions conducted during the campaign.

A large victory for the Labour party “should imply an underlying bid tone for sterling,” said Neil Jones, a foreign-exchange salesperson to financial institutions at TJM Europe.

Before the vote, Labour placed economic stability at the top of its manifesto and pledged to stick to tough spending rules. Rachel Reeves, an ex-Bank of England staffer who’s set to become the UK’s finance minister, said that the administration would not raise three of the UK’s key taxes on wages and goods.

Other promises included building more houses, creating a publicly-owned energy company and moving to “reset the relationship” with the EU — though Labour’s manifesto also ruled out a return to the single market or customs union.

Fiscal stability and any improvement in the UK’s relationship with the EU would be supportive of gilts in the near term and have positive implications for the pound, strategists at TD Securities led by James Rossiter wrote in a note on July 4.

What Bloomberg’s Strategists Say…

“If the ultimate results are in line with the exit poll prediction the pound is likely to be well-supported in the days to come.”

— Ven Ram, cross-asset strategist.

Click here for more

Still, the incoming government is inheriting a sluggish and fragile economy. While inflation has fallen back to the Bank of England’s 2% target, prices for services remain sticky. And a rebound from last year’s technical recession appears to be losing momentum, according to the most recent growth data. But expected interest-rate cuts by the BOE in the next few months give bond investors another reason to favor gilts.

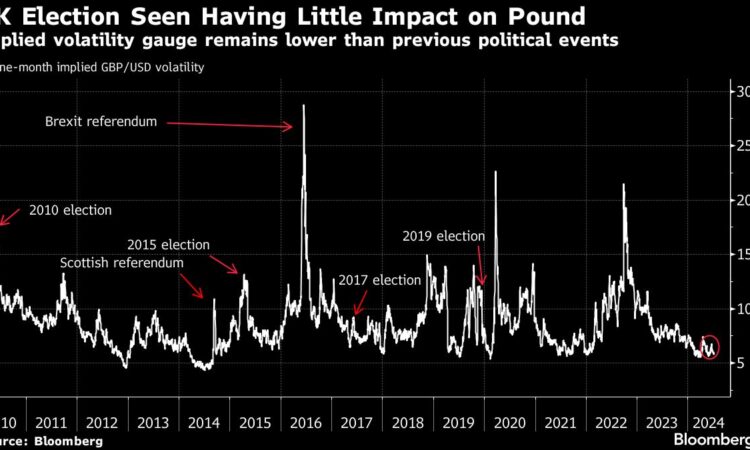

A Labour win has been widely priced in by markets, as the party held a commanding lead in polls for well over a year before Sunak called a snap election on May 22. That didn’t change after the election date was set, leaving the pound steady, bond volatility low and stocks hovering just off a peak. The FTSE 100 even rallied 1.5% in the past two days, the most in nearly two months, while global equities extended a record high.

“Markets like certainty and so Labour winning decisively will be welcomed,” Nigel Green, founder of wealth management firm deVere Group wrote in a note. “This boost is likely to be limited, however, as the markets have already largely priced in the expectation.”

The calm in financial markets puts the UK in contrast with neighboring France, where President Emmanuel Macron’s decision to call a snap vote in early June ignited a selloff. The yield premium on French bonds over safer German debt at one point rose to levels last seen in the depths of the euro-area debt crisis. The move pared this week as polls show the far-right National Rally is unlikely to achieve an absolute majority in a vote Sunday.

“With political turmoil hitting other developed economies at the same time, this huge majority may present the UK to investors as somewhat of a political safe haven,” said Lindsay James, a strategist at Quilter Investors.

It’s also a far cry from years where UK markets danced to the tune of political drama. Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that followed caused gyrations in the pound and stocks. At the last general election in 2019, meanwhile, investors fretted over former Labour leader Jeremy Corbyn’s left-wing policies including nationalization and worker stakes in companies.

More recently, former Prime Minister Liz Truss’s package of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered forced selling from leveraged pension fund strategies. Gilts plunged, forcing an extraordinary Bank of England intervention.

That event has loomed large over politicians since, and both Labour and the Conservatives preached economic caution during the election campaign. Former Labour shadow chancellor Ed Balls said the party had put itself into a fiscal “straitjacket” by ruling out both austerity and tax rises. And Starmer’s target for annual growth of at least 2.5%, which might help fund additional spending, has been criticized by economists as unrealistic.

Markets, meanwhile, are watching closely for any signs of additional bond issuance to generate funds. The UK national debt is at the highest levels since the 1960s as a percentage of gross domestic product, and Britain is already committed to one of its biggest annual borrowing sprees on record. Further increases could hurt appetite for gilts among investors.

“For now, the markets will just be happy to get an election over and done with, and that should benefit market sentiment,” said Kyle Rodda, senior market analyst at Capital.Com.

–With assistance from John Cheng and Abhishek Vishnoi.

(Updates with Labour win from first paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.