UK Consumers Grapple with Worst Inflation Rates in a Generation

Consumers in the UK faced the highest rates of inflation in a generation in 2023, which caused them great financial hardship. The year was marked by a sharp increase in food inflation, which reached a frightening 19.6% peak in March. Prices are still fixed at an average 9% higher than the previous year, even if the rate of increase has now slowed.

Impact on Everyday Essentials

Certain categories, such as butters and spreads, have witnessed price reductions since the previous year. However, the cost of everyday essentials may not revert to pre-crisis levels. Budget products continue to serve as the most affordable options in supermarkets, but access to these items is not universal, especially for those who rely on higher-priced convenience stores.

The Energy Sector and Financial Burden

The energy sector has also played a crucial role in exacerbating the financial burden on consumers. The Ofgem energy price cap soared to over £4,000 annually for the typical household at the start of 2023. Despite a £400 government subsidy and a cap on average energy prices at £2,500, the price cap is projected to rise again to just over £1,900 from January 1, 2024.

Headline Inflation and Interest Rates

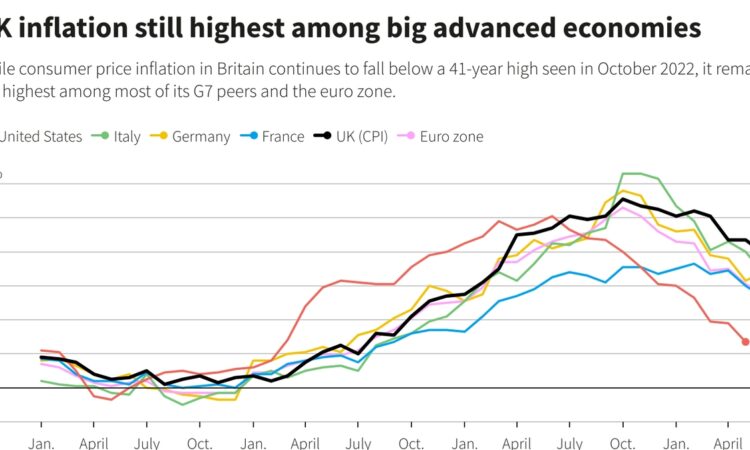

Amidst these challenges, headline inflation registered a decrease, hitting its lowest point in over two years at 3.9% in November. This decline has been driven by falling fuel prices and decreased food inflation. This downturn has sparked speculation that the Bank of England may initiate a reduction in interest rates early in 2024. The Bank, however, has cautioned that the objective of achieving the 2% inflation target is yet to be accomplished and downplayed the probability of immediate interest rate cuts.

Outlook for 2024

Despite the challenges of 2023, there is a glimmer of hope that economic conditions will improve in 2024. Factors such as potential fuel price spikes or wage growth could still prompt a rate increase, while a weakening economy could lead to earlier rate cuts. Experts anticipate that 2024 will be a challenging year, but they also see potential for improvement as inflation stabilizes and interest rates potentially ease.