Every year, the Government raises around £1 trillion in revenue from taxes. The lion’s share, according to the Institute for Fiscal Studies (IFS), comes from income tax and National Insurance.

It’s a colossal amount of money flying straight from your pay packet into the Government’s coffers. But do you really understand how income tax bands work and how they apply to your earnings?

Read Telegraph Money’s guide to UK income tax bands and rates to find out more.

What is the annual personal tax-free allowance?

Income tax is paid by individuals on the money they earn. This includes employed or self-employed work, rental income, investment dividends or gains and pension earnings. Everyone is entitled to earn a certain amount of income tax free known as your annual personal allowance.

The personal allowance has changed over the years. Before the 2013/2014 tax year it was based on age, then this shifted to date of birth. But from 2016/17 onwards it has been set at one standard rate for all.

Although the personal allowance can change from one year to the next, since the 2022/23 tax year it has remained at £12,570. That means almost all workers can earn up to £12,570 before paying a penny in income tax.

The Government has previously announced that the personal allowance threshold and higher rate tax threshold would be frozen until April 2028.

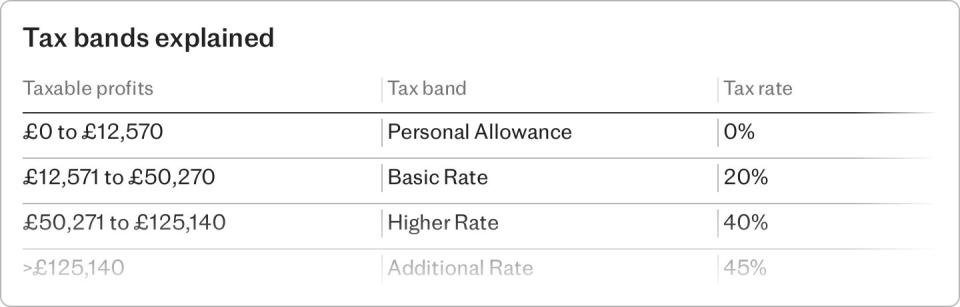

In England, Wales and Northern Ireland, the income tax bands are the same. Scottish income tax bands are different. We’ll look at the differences later.

The only people for whom the personal allowance is reduced are very high earners. If you earn between £100,000 and £125,140, your personal allowance begins to erode by £1 for every £2 earned within this range. If you earn more than £125,140, you don’t get any personal allowance at all.

If you’re blind, you receive an additional £3,070 on top of your personal allowance which increased from £2,870 to £3,070 for the 2024/25 tax year which takes your personal allowance up to £15,640.

What is basic rate vs higher rate tax?

Your taxable income is the amount you earn above the tax-free threshold.

The basic rate of tax, applied to earnings above the tax-free threshold up to £50,270, is charged at 20pc. Earnings above £50,270 up to £125,140 fall into the higher rate tax band which is charged at 40pc.

Where does National Insurance come in?

Your National Insurance Contributions (NICs) pay for benefits such as the state pension while also contributing to the NHS.

NICs are collected directly from your pay by your employer along with income tax from the age of 16 up to your state pension age, at which time you’ll stop paying even if you continue to work.

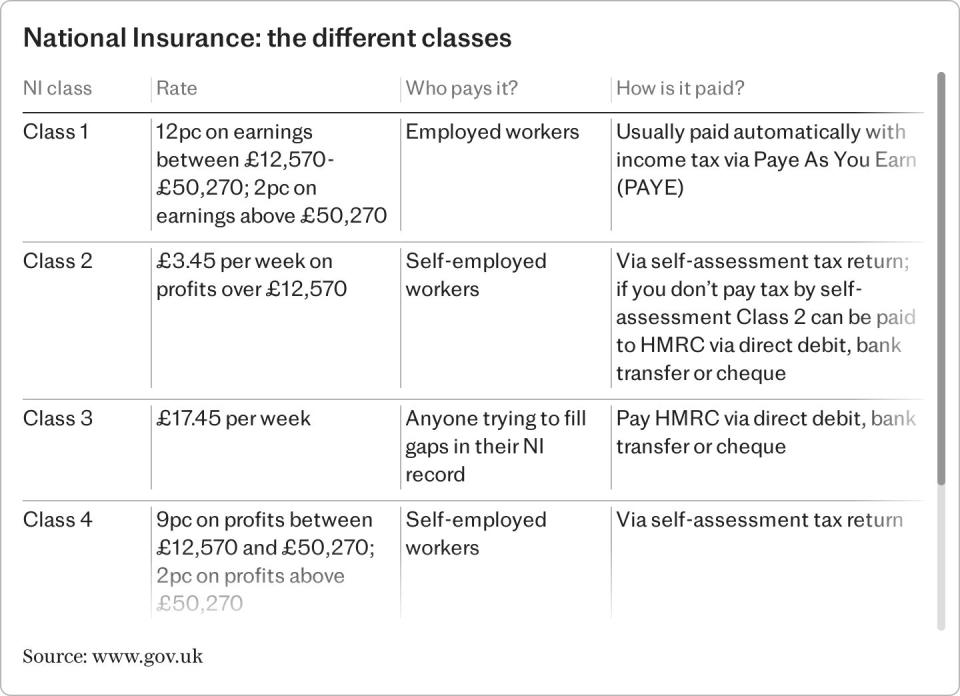

How much you pay depends on how much you earn and which class of NICs applies to your circumstances.

Class one NICs of 8pc apply to employees who earn between £242 a week and £967 a week (£12,570 to £50,270 a year). After that, a 2pc rate applies. Self-employed workers pay class four NICs charged at 6pc on profits between £12,570 and £50,270, and 2pc on profits over £50,270

If you earn less than £242 a week (£12,570), known as the primary threshold, you don’t pay National Insurance. However, providing your earnings are above £123 a week, you’ll still earn the qualifying years for state pension entitlement, even though you don’t make NICs.

What are the UK income tax bands?

Wales, England and Northern Ireland all adhere to the same tax band structure. The power to change income tax rates has been devolved to the Welsh government but they are currently the same as England’s income tax bands.

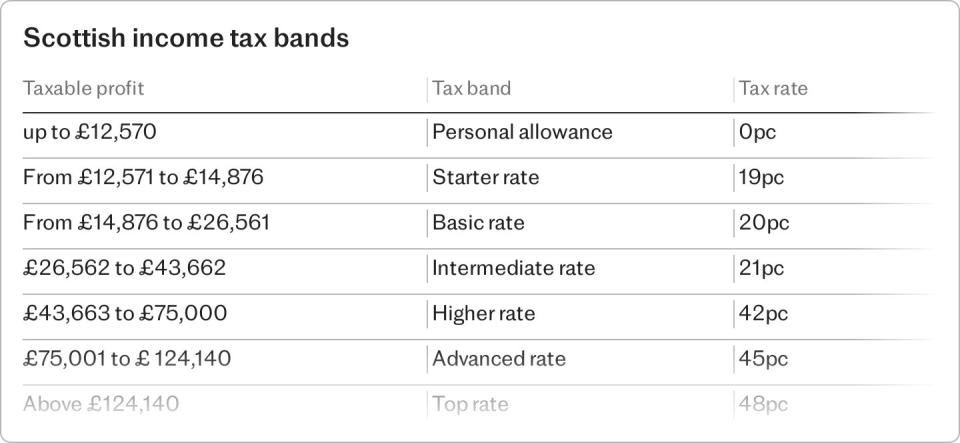

Scottish income tax bands

The personal allowance is the same across the whole country. But, unlike the rest of the UK, Scotland has six income tax bands above the personal allowance.

A new threshold, the top rate, was added in the 2024/25 tax year.

What is my take-home pay if I earn £50,000?

If you earned £50,000 you’d pay £7,486 in income tax and £2,993 in National Insurance Contributions.

Here’s a breakdown of how it’s calculated: £12,570 of your £50,000 is tax free, the remaining £37,430 falls within the basic rate tax band and is charged at 20pc giving you a tax bill of £7,486.

Because you’re employed, class one NICs charged at 8pc apply to your earnings above £12,570 which gives you an annual National Insurance bill of £2994.40.

£50,000 less £7,486 income tax and £2994.40 National Insurance gives you take-home pay of £39,519.60.

Will the tax bands change – and if so, when?

There are currently no plans to change the income tax bands. In the March Budget 2021, the then-chancellor Rishi Sunak, announced that the personal allowance threshold and the higher rate tax threshold would remain the same until 2025/26.

This was extended by Jeremey Hunt up to and including 2027/2028.

The additional rate tax threshold was reduced from £150,000 to £124,140 from April 2023.

As the income tax thresholds are not rising in line with inflation, the freezes will raise the government over £40bn a year by 2027/2028 as wage inflation pushes workers into higher tax brackets, according to the IFS.

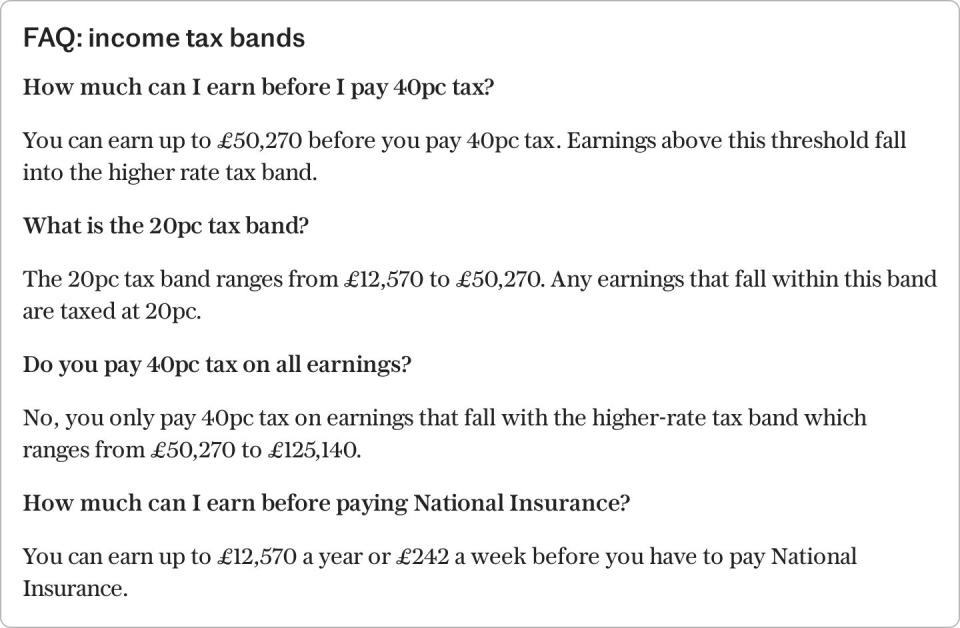

Frequently asked questions