UK Government borrowing overshot forecasts in February in a potential blow to Chancellor Jeremy Hunt, according to official figures.

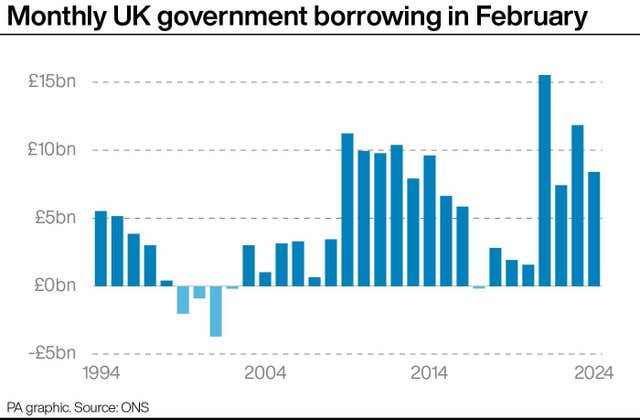

The Office for National Statistics (ONS) said public sector net borrowing hit £8.4 billion last month, amid higher benefits payments such as cost-of-living support.

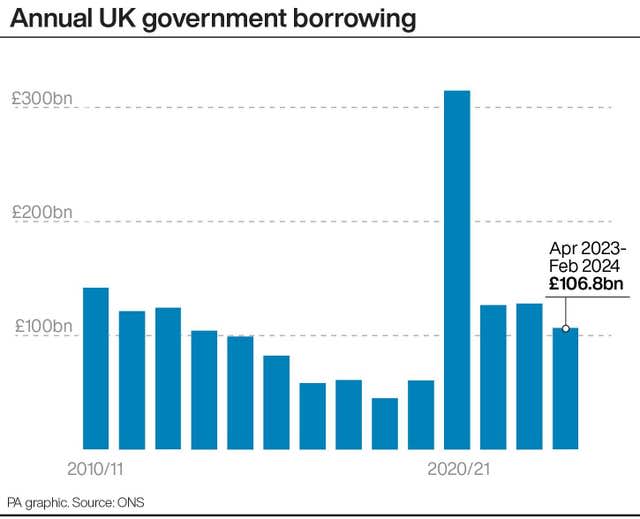

Economists said on Thursday the reading means that the Government could surpass borrowing forecasts for the fiscal year from the Office for Budget Responsibility.

The reading for February was above the forecasts from economists, who had predicted net borrowing of £6 billion for the month.

However, it was still £3.4 billion lower than the same month a year earlier.

It came after central government receipts – the money the state receives through most taxes – were recorded at £86.4 billion for February.

This was up £7.2 billion as Britons and businesses paid out more income tax, VAT and corporation tax.

Meanwhile, central government spending was recorded at £89.6 billion, up £2.9 billion against the same month last year.

This was partly driven by a £5.9 billion increase in social benefits, after an inflation-linked increase in benefit payments and £2 billion in cost-of-living payments.

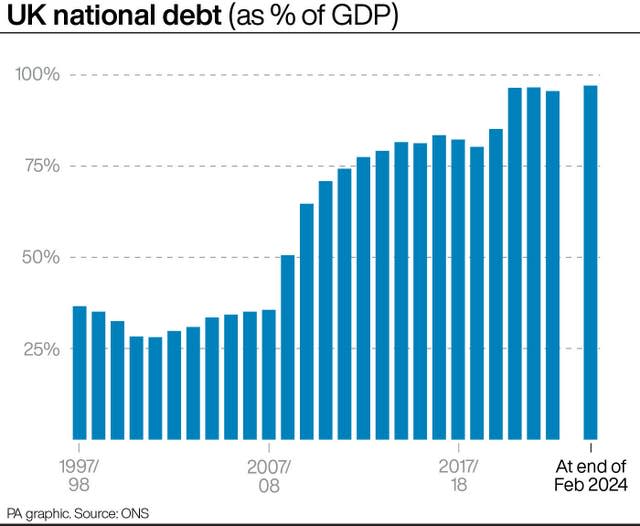

Meanwhile, public sector net debt excluding public sector banks was £2,659.4 billion at the end of February 2024, £157.4 billion more than at the end of February last year.

Debt was provisionally estimated at around 97.1% of the UK’s annual gross domestic product (GDP) at the end of February, the ONS said.

Senior ONS statistician Jessica Barnaby said: “This was the fourth consecutive month in which borrowing was lower than in the same month a year ago, with growth in tax receipts exceeding growth in spending.

“Across the financial year to date, borrowing was the lowest it has been for four years.

“Relative to the size of our economy, debt remains at levels last seen in the early 1960s.”

Ruth Gregory, deputy chief UK economist at Capital Economics, said the higher-than-predicted monthly borrowing data means the Government could overshoot forecasts for the year to March.

“This means that borrowing in March will have to come in at just £7.2 billion for the OBR’s full-year forecast of £114 billion to be met,” she said.

“Given that borrowing last March was £16.9 billion, that seems very unlikely.

“That said, we still expect borrowing to fall more quickly beyond 2025/26 than the OBR expects.

“This may mean the Government squeezes in another pre-election giveaway in a fiscal event later this year.”

Chief Secretary to the Treasury Laura Trott said: “It was right that this Government provided billions of pounds to support individuals and businesses during Covid, and pay half of people’s energy bills after Putin’s invasion of Ukraine.

“But we can’t leave future generations to pick up the tab.

“The plan is working.”