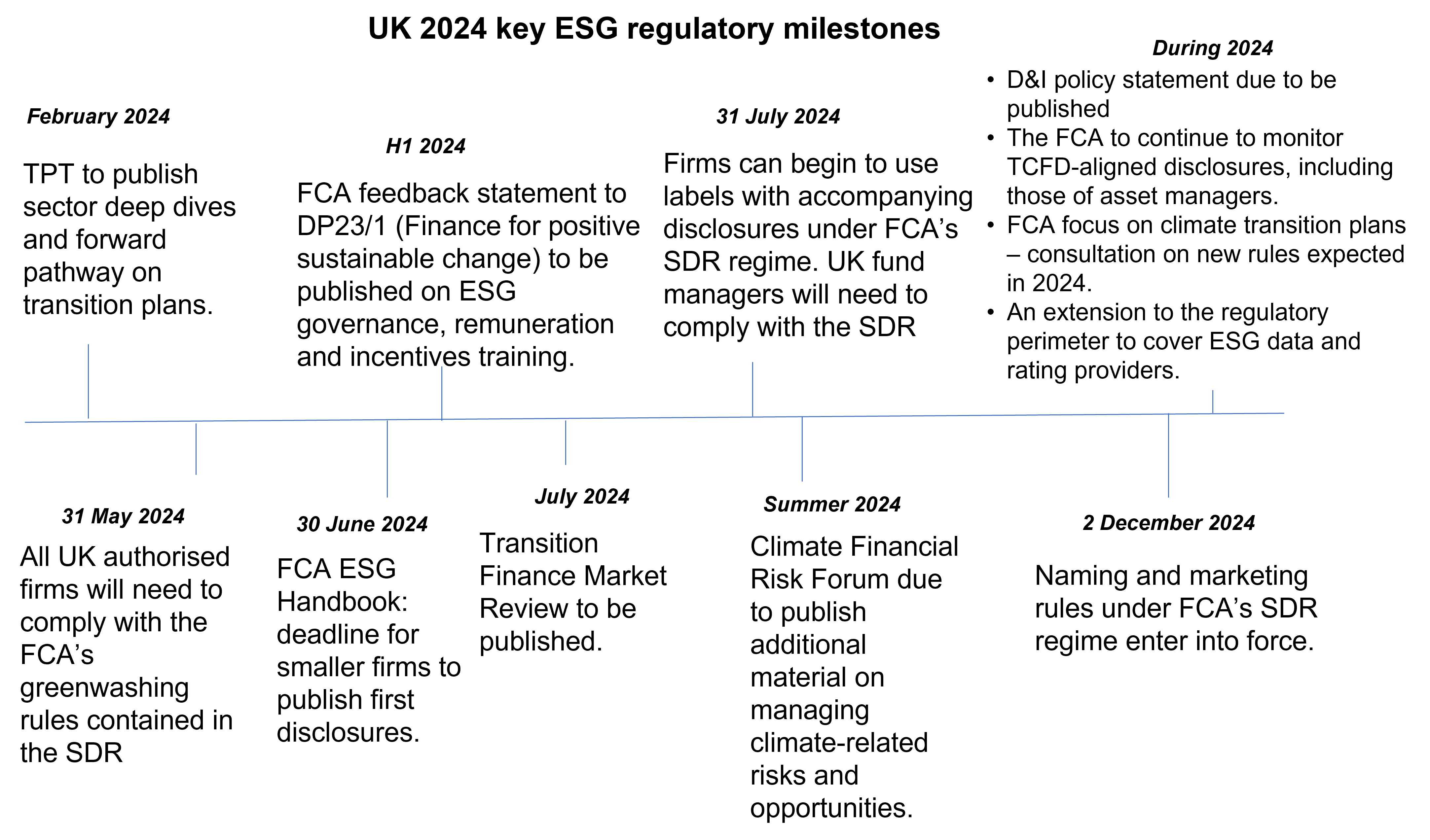

As we enter 2024, we have looked back to Q4 2023 to reflect on the range of momentous ESG regulatory developments and to look at how they will impact ESG regulatory developments throughout this year. Key developments at the end of last year include the FCA finally confirming the SDR and labelling regime, COP28 concluding and the UK government launching a Transition Finance Market Review. We set out below the key Q4 2023 developments in the UK and EU. Ahead of each of the UK and EU sections below, we have set out the key milestones that are on the horizon for ESG regulation for 2024 to help keep track of what is coming down the line. We hope you have had a wonderful start to 2024 and we look forward to another packed year for ESG developments in 2024.

UK developments

Sustainability Disclosure Requirements (SDR) and labelling regime

FCA confirms final SDR and labelling regime

On 28 November 2023, the Financial Conduct Authority (FCA) confirmed in PS23/16 the long-awaited SDR final rules and guidance for UK asset managers aimed at improving the trust and transparency around sustainable investment products. In a package of measures that represent the most significant piece of UK sustainable finance regulation to date, the FCA also published a guidance consultation in relation to the anti-greenwashing rule. The guidance consultation closed on 26 January 2024. For further information see our Engage article.

FCA ‘Guiding Principles’ for ESG

On 16 November 2023, the FCA set out its findings from a supervisory review that looked at how authorised fund managers are complying with existing regulatory requirements and expectations on the design, delivery and disclosure of Environmental, Social and Governance (ESG) and sustainable investment funds. The FCA’s expectations around the guiding principles for ESG and sustainable investment funds are contained in a ‘Dear Chair’ letter from July 2021. The FCA published the review ahead of its final rules and guidance on the SDR set out above. The FCA expects firms to address the good and poor practices outlined in the review to meet the requirements of the SDR and the Consumer Duty.

UK ESG Ratings developments

On 14 December 2023, the ESG Data and Ratings Code of Conduct Working Group (DRWG), published the final version of its voluntary code of conduct for ESG ratings and data product providers (Code).

The Code consists of six principles, each of which is supplemented by actions providing a practical guide to the application and interpretation of the principle.

The principles relate to the following:

- Good governance – providers should ensure appropriate governance arrangements to enable them to promote and uphold the principles and overall objectives.

- Securing quality – providers should have policies and procedures designed to help ensure the issuance of high quality products.

- Conflicts of interests – the policy and procedures should help to identify, avoid or appropriately manage, mitigate and disclosure conflicts of interest.

- Transparency – providers should make adequate levels of public disclosure and transparency a priority for their products.

- Confidentiality – providers should have procedures designed to protect all non-public information received from or communicated to them by any of its agents related to their products.

- Engagement – providers should review the efficiency of their information gathering processes with entities covered by their products.

An implementation period will apply once a provider has signed up to the code, at the end of which the provider should embed the principles in its organisation. The implementation period is six months for ESG ratings providers and 12 months for ESG data products providers.

The DRWG, which is supported by the International Regulatory Strategy Group (IRSG) and the International Capital Market Association (ICMA), consulted on a draft version of the code in July 2023. It has published a feedback statement setting out details of the changes to the code made in response to feedback. The Code will be owned and maintained and a signatories list will be available here on ICMA’s website. The FCA welcomed the launch of the Code here.

Regulatory Initiatives Grid – ESG related developments

On 30 November 2023, the Financial Services Regulatory Initiatives Forum published the seventh edition of the Regulatory Initiatives Grid setting out the regulatory pipeline for the next 24 months. The developments relating to ESG are set out below. For further detail, please see this Engage article.

- TCFD – the FCA will continue to monitor TCFD -aligned disclosures and publish its findings in 2024.

- Implementing International Sustainability Standards Board (ISSB) disclosures into FCA listing or transparency rules –a consultation paper is due on this in 2024.

- UK Green Taxonomy – a consultation was due to be published autumn 2023 but the timing for its issue has not yet been updated.

- Climate Financial Risk Forum (CFRF) – the CFRF is developing outputs for publication in summer 2024.

- Diversity and inclusion – a Policy Statement is due in H2 2024.

- FRC Stewardship review and Code consultation – a Discussion Paper is expected to be published in H2 2024.

- Remuneration enhancing proportionality for small firms – a Policy Statement and Supervisory Statement was published on 5 December 2023.

Climate transition plans

TPT consults on sector-specific guidance for climate transition plans

On 13 November 2023, the UK Transition Plan Taskforce (TPT) published a consultation on seven sector-specific “deep dives” providing guidance for preparers and users of private sector climate transition plans. The sectors covered are asset managers, asset owners, banks and others outside of financial services. The consultation was open until 29 December 2023. As set out below, the final TPT disclosure framework and implementation guidance was launched in October 2023.

UK launches Transition Plan Taskforce disclosure framework

On 9 October 2023, the TPT issued its final disclosure framework, which aims to provide a ‘gold standard’ for robust, credible and comparable transition plan disclosures. The framework has been designed to align with other guidance and frameworks, including ISSB standards. The FCA’s Primary Market Bulletin 45, published in August 2023, confirmed FCA plans to consult in 2024 on rules and guidance for listed companies to disclose in line with the UK-endorsed ISSB standards and the TPT Framework as a complementary package. Listed companies and regulated firms are encouraged to engage early with the TPT Framework.

Government launches Transition Finance Market Review

On 18 December 2023, HM Treasury and the Department for Energy Security and Net Zero (DESNZ) launched the Transition Finance Market Review. The review is being led by Vanessa Harvard-Williams and will consider what the UK financial and professional services ecosystem needs to do to become a leading hub for and provider of transition financial services. The terms of reference explain that the review will consider what market tools will be most impactful and explore how best to create the conditions for scaling transition-focused capital raising with integrity and maximising the opportunity for UK-based financial services to develop and structure high integrity transition finance services.

The review will run initially for six months and will report back to the government by July 2024, although there is a possibility for the review to be extended to nine months. Both the FCA and the Bank of England (BoE) will act as observers and a panel of advisers will include representatives from across the financial services sector. The review was initially announced in the 2023 Green Finance Strategy.

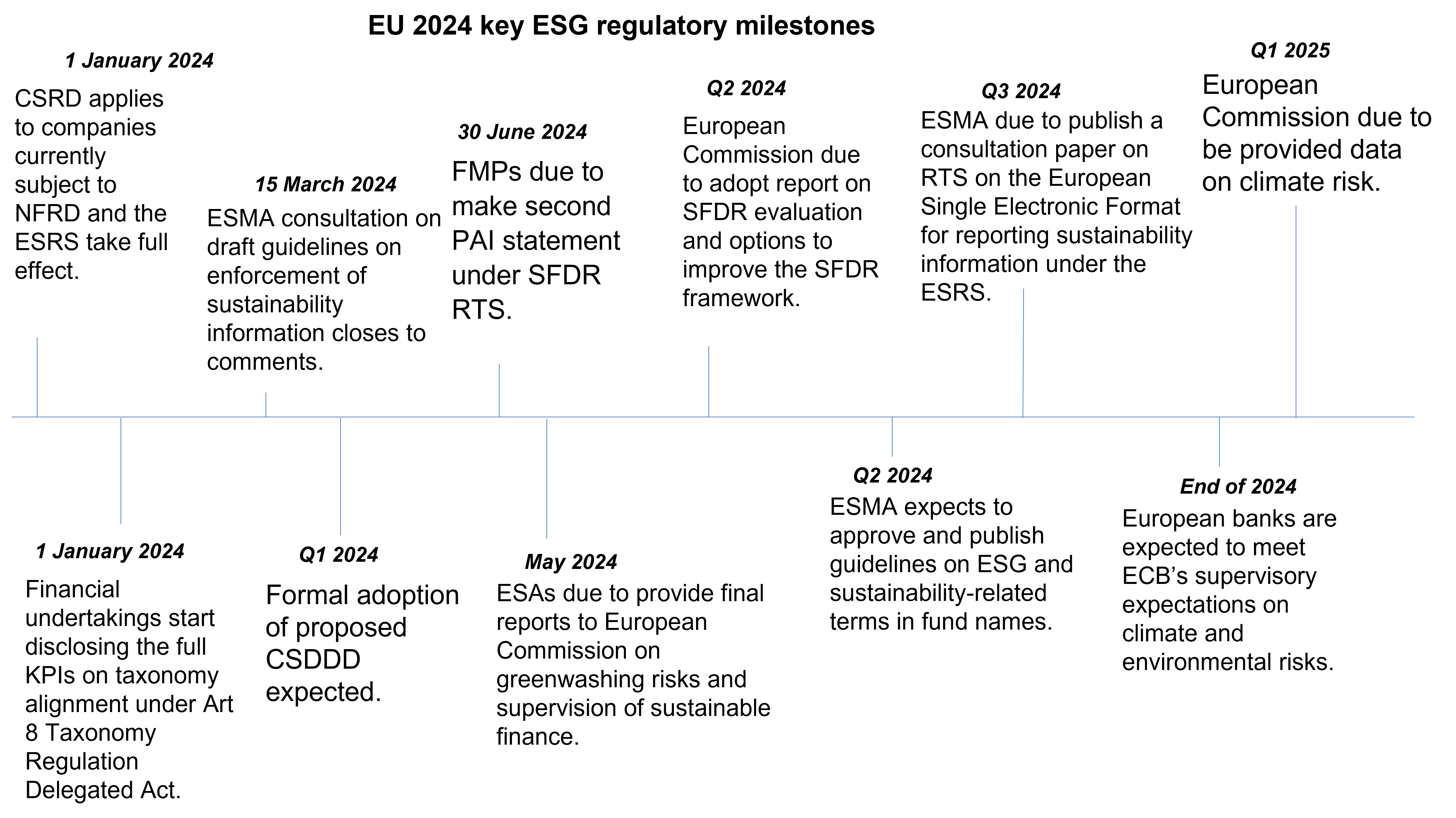

EU and International Developments

Greenwashing and sustainability fund names

On 14 December 2023, the European Securities and Markets Authority (ESMA) published a statement stating that it intends to postpone its adoption of guidelines on funds’ names using ESG or sustainability-related terms. This follows ESMA’s November 2023 consultation on draft guidelines specifying criteria to assess whether the name of a fund containing ESG or sustainability features, are fair, clear and not misleading. ESMA intends to postpone the adoption of the guidelines to allow for full consideration of the outcome of the reviews of the Alternative Investment Fund Managers Directive and UCITS Directive which are due to be complete by Q2 2024. The Guidelines will then apply 3 months after their publication on ESMA’s website in all EU languages.

IOSCO reports on supervisory practices to address greenwashing

On 4 December 2023, the International Organisation of Securities Commissions (IOSCO) published a final report on supervisory practices to address greenwashing (FR12/23). The report provides an overview of the initiatives undertaken to address greenwashing following IOSCO publishing recommendations in November 2021 and a call for action in November 2022. The report presents the challenges hindering the implementation of these recommendations, including data gaps, transparency, quality, and reliability of ESG ratings, consistency in labelling and classification of sustainability-related products, evolving regulatory approaches and capacity building needs. IOSCO specifically highlights:

- There is no global definition of greenwashing, but many regulators have provided guidance on the identification of greenwashing and risks associated with it.

- The market for ESG ratings and data products is in a phase of rapid growth. A few jurisdictions are developing mandatory or voluntary policy frameworks for ESG ratings and products providers as detailed in the ESG ratings sections of this newsletter.

- Enforcement measures have been applied to greenwashing cases including for example actions for civil or criminal liability and public reprimands.

IOSCO concludes that greenwashing will remain a high risk to the reputation of global sustainable finance markets until the quality and reliability of information available to investors improves.

EU ESG disclosures under the Benchmarks Regulation

ESMA to launch CSA on ESG disclosures under the BMR

On 13 December 2023, the ESMA announced that it will launch and carry out a common supervisory action (CSA) with national competent authorities (NCAs) on ESG disclosures under the Benchmarks Regulation ((EU) 2016/1011) (BMR). The CSA will be carried out during 2024 and until Q1 2025. As part of the CSA, ESMA and the NCAs will share knowledge and experiences to foster convergence in how they supervise ESG disclosure requirements for benchmark administrators. This will be ESMA’s first CSA in its role as a direct supervisor of benchmarks administrators. ESMA is aiming to ensure the consistent and effective supervision of the ESG disclosures of supervised administrators across the EU and enhance the comparability of the information provided to users of benchmarks.

EU ESG Ratings developments

Council of the EU adopts negotiating mandate on Proposed Regulation on ESG rating activities

On 20 December 2023, the Council of the EU published a press release announcing that it has agreed its negotiating mandate on the proposed Regulation on the transparency and integrity of ESG rating activities (2023/0177(COD)). The text of the mandate for negotiating with the European Parliament is set out in a Council “I” item note (16711/23) dated 15 December 2023 sent from its General Secretariat to its Permanent Representatives Committee (COREPER). In the negotiating mandate, the Council of the EU:

- Clarify when ESG ratings will fall within the scope of the proposed Regulation and applicable exemptions.

- ESG rating providers will need to comply with specific requirements if they wish to operate in the EU, including being authorised by ESMA or for third country ESG rating providers there will need to be an equivalence decision or an endorsement of their ESG ratings or a recognition.

- Introduces a temporary optional registration regime of three years for existing smaller ESG rating providers and new small markets entrants.

- Clarifies the territorial scope, outlining what constitutes operating in the EU.

The Council’s mandate paves the way to interinstitutional negotiations that were expected to start in January 2024.

Adopted text ECON report on Proposed Regulation on ESG rating activities

On 8 December 2023, the European Parliament published the report of its Economic and Monetary Affairs Committee (ECON) on the European Commission’s legislative proposal for a Regulation on the transparency and integrity of ESG rating activities. The report, contains a draft European Parliament legislative resolution, the text of which sets out suggested significant amendments to the proposed Regulation. Changes include further promoting double materiality, greater transparency and measures to boost competition.

Sustainable Finance Framework

ESMA publishes three explanatory notes covering key features of the EU sustainable finance

On 22 November 2023, ESMA published three explanatory notes covering key features of the EU sustainable finance framework as follows:

-

The first explanatory note relates to sustainable investments and environmentally sustainable activities in the EU sustainable finance framework (ESMA30-379-2279

-

The second explanatory note concerns “Do no significant harm” (DNSH) definitions and criteria across the EU sustainable finance framework (ESMA30-379-2281). It explains the DNSH principle embedded in several pieces of EU sustainable finance legislation such as the SFDR, the Taxonomy Regulation, and the EU BMR.

-

The third explanatory note explains how key EU sustainable finance legislation deals with the use of “estimates” and “equivalent information” (ESMA30-1668416927-2548). It also explains the requirements under which estimates are permissible as sources of data for the preparation of mandatory ESG metrics for regulated entities when fulfilling compliance obligations.

The explanatory notes are intended to aid stakeholders better navigate and understand the EU sustainable finance legislative framework.

AFME report on sustainable finance in the EU

On 16 November 2023, AFME published a report highlighting its members perspectives on how the EU regulatory framework for sustainable finance is functioning. The report concludes that over the last five years, the EU has established a comprehensive regulatory framework for sustainable finance but challenges remain for financial institutions in providing financing in support of ESG goals. Alongside recommendations on improving the functioning of the EU regulatory framework, the report also sets out AFME’s recommendations in three further important areas which it sees as priorities for EU policymakers including facilitating transition finance, developing carbon markets and scaling finance for nature.

SFDR and Taxonomy Regulation

ESAs propose new SFDR RTS to the European Commission

On 4 December 2023, the ESAs published a Final Report with proposals to amend the draft regulatory technical standards (RTS) to the Delegated Regulation supplementing the Sustainable Finance Disclosure Regulation (SFDR). The proposed amendments presented to the European Commission include the following:

-

New social Principle Adverse Impacts (PAIs);

-

New disclosures in relation to GHG reduction targets;

-

Upgrades to the DNSH concept to the environment and society; and

-

Simplification of the pre-contractual and periodic disclosure templates for financial products.

The European Commission will study the draft SFDR RTS and decide whether to endorse them within 3 months.

AFM publishes position paper on improvements to the SFDR

On 2 November 2023, the Dutch Authority for the Financial Markets (AFM) published a position paper on improvements to the SFDR, in light of the European Commission targeted consultation on the implementation of the SFDR (which closed for comments on 15 December 2023, our earlier Engage article provides further information on the consultation).

Key proposals include:

- introducing sustainable product labels aligned with investor expectations with a focus on where sustainable impact can be made.

- Removing the current Article 8 and Article 9 to tackle their current misuse as proxy labels.

- Allowing other products that do not meet the quality requirements for any of the sustainability labels to disclose their ESG credentials with reduced disclosure requirements.

- Ensure a level playing field: require minimum adverse impact disclosures for all financial products regardless of their sustainable characteristics.

Discussion is welcomed by the AFM on the paper and the proposals.

ESMA publishes results of fact-finding exercise on corporate reporting practices

On 25 October 2023, ESMA published the results of a fact-finding exercise on corporate reporting practices under the EU Taxonomy Regulation.

ESMA gathered information from national enforcers regarding the non-financial statements published by European non-financial undertakings listed on regulated markets for the Fiscal Year 2022 and concluded that; “almost all issuers, selected by the national enforcers among those being active in four main sectors covered by the Taxonomy Climate Delegated Act, disclosed the required Taxonomy alignment KPIs (96% of the sample).”

CSDDD

Provisional agreement on CSDDD reached

On 14 December 2023, the Council and the European Parliament reached provisional agreement on the Corporate Sustainability Due Diligence Directive (CSDDD), requiring certain institutions operating in the EU to comply with upstream supply chain obligations and develop climate transition plans aligned with the Paris Agreement. Despite initial claims of the financial sector’s temporary exclusion, we understand that it will now be partially included, necessitating climate plans and adjustments to remuneration schemes. The decision is subject to review, two years after the entry into force of the CSDDD, and faces criticisms for its partiality, with France and Germany influencing certain exemptions and civil liability provisions.

CSRD reporting

ESMA consultation on draft guidelines on enforcement of sustainability information

On 15 December 2023, ESMA published a consultation on draft guidelines on the enforcement of sustainability information, as required by the Corporate Sustainability Reporting Directive (CSRD). The CSRD expands the scope of undertakings who must report sustainability information and requires the European Commission to adopt mandatory European Sustainability Reporting Standards (ESRS). CSRD introduces a new Article 28d to the Transparency Directive which requires ESMA to issue guidelines on the supervision of sustainability reporting by national competent authorities.

ESMA states that the main goals of the draft guidelines are to:

-

Ensure that national competent authorities (NCAs) carry out their supervision of listed companies’ sustainability information under the CSRD, the ESRS and Article 8 of the Taxonomy Regulation in a converged manner.

-

Establish consistency in, and robust approaches to the supervision of the sustainability and financial information of listed companies. This aims to facilitate increased connectivity between the two types of reporting.

ESMA is seeking views on the guidelines by 15 March 2024, including on the following:

-

The proposed scope of the guidelines which is currently all NCAs undertaking supervision of sustainability information under the Transparency Directive. The enforcement is proposed to apply to sustainability information provided by EU issuers, with securities.

-

The types of examination enforcers can use when they examine sustainability information.

-

The process for the enforcer’s examination.

-

The conditions enforcers should apply when they offer issuers pre-clearance of sustainability information.

-

The considerations enforcers should apply when they identify an infringement in the sustainability information and have to determine the enforcement action to use.

ESMA expects to publish the final guidelines in Q3 of 2024.

EFRAG launches ESRS Q&A platform to support the implementation of ESRS

On 24 October 2023, EFRAG announced the launch of its ESRS Q&A platform to collect and answer technical implementation questions regarding the implementation of the ESRS to support stakeholders. The regularly updated log of questions can be accessed here.

The platform confirms that all responses provided by EFRAG are non-authoritative and answered by EFRAG only and do not necessarily reflect the views of the European Commission.

European Commission amends the Accounting Directive reducing the scope of CSRD application

On 17 October 2023, the European Commission adopted amendments to Article 3(13) of the Accounting Directive to account for inflation. This will result in fewer companies being in scope for reporting under the CSRD. The changes increase the size thresholds for micro, small and medium/large companies by approximately 25% which came into effect on 1 January 2024. For further information see our Engage article.

European Commission Work Programme 2024 – CSRD proposals

Following the publication of the European Commission’s 2024 work programme on 17 October 2023 and announcements from the UK Government, this Engage article explores how both the UK and the EU are focusing on closing out the remaining legislative files before the elections next year, with the aim of reducing the regulatory burden for market participants. The article discusses key proposals including the changes to CSRD and the EU BMR.

Climate risk scenarios

ESMA presents methodology for climate risk stress testing and analysis of the financial impact of greenwashing controversies

On 19 December 2023, ESMA published two articles, one outlining an approach to modelling the impact of asset price shocks from adverse scenarios involving climate-related risks, the other exploring the use of ESG controversies for the purpose of monitoring greenwashing risk. ESMA is organising a public webinar on the articles’ findings. The webinar will be held online via on 7 February 2024. Interested persons are welcome to register by 2 February 2024.

Green bonds

EU approves “European Green Bond” label standards

On 5 October 2023, the European Parliament voted to adopt a new voluntary standard for the use of a “European Green Bond” label. This creates uniform standards for issuers who wish to use the designation “European green bond” or “EuGB” for the marketing of their bond. The standards are aligned with the EU’s taxonomy framework that defines which economic activities the EU considers environmentally sustainable.

Biodiversity

Biodiversity: incorporating nature and TNFD into your strategy

Just as the financial community is getting to grips with TCFD, TNFD arrived. TNFD provides a framework for disclosure of nature-related financial information – the ways in which nature risks might impact a business, its assets, suppliers and customers and the dependencies that business has on nature capital and services to survive. In this recent Engage article we consider the meaning of “nature” and “biodiversity”, the similarities and differences between the TCFD and the TNFD and the steps businesses need to take to incorporate nature into their risk assessments and reporting.