- This weekly round-up brings you the latest stories from the world of economics and finance.

- Top economy stories: Bank of England halts interest rate rises; Housing markets slow in US, Germany and UK; France lowers growth expectations for 2023 and 2024.

1. Bank of England halts interest rate rises

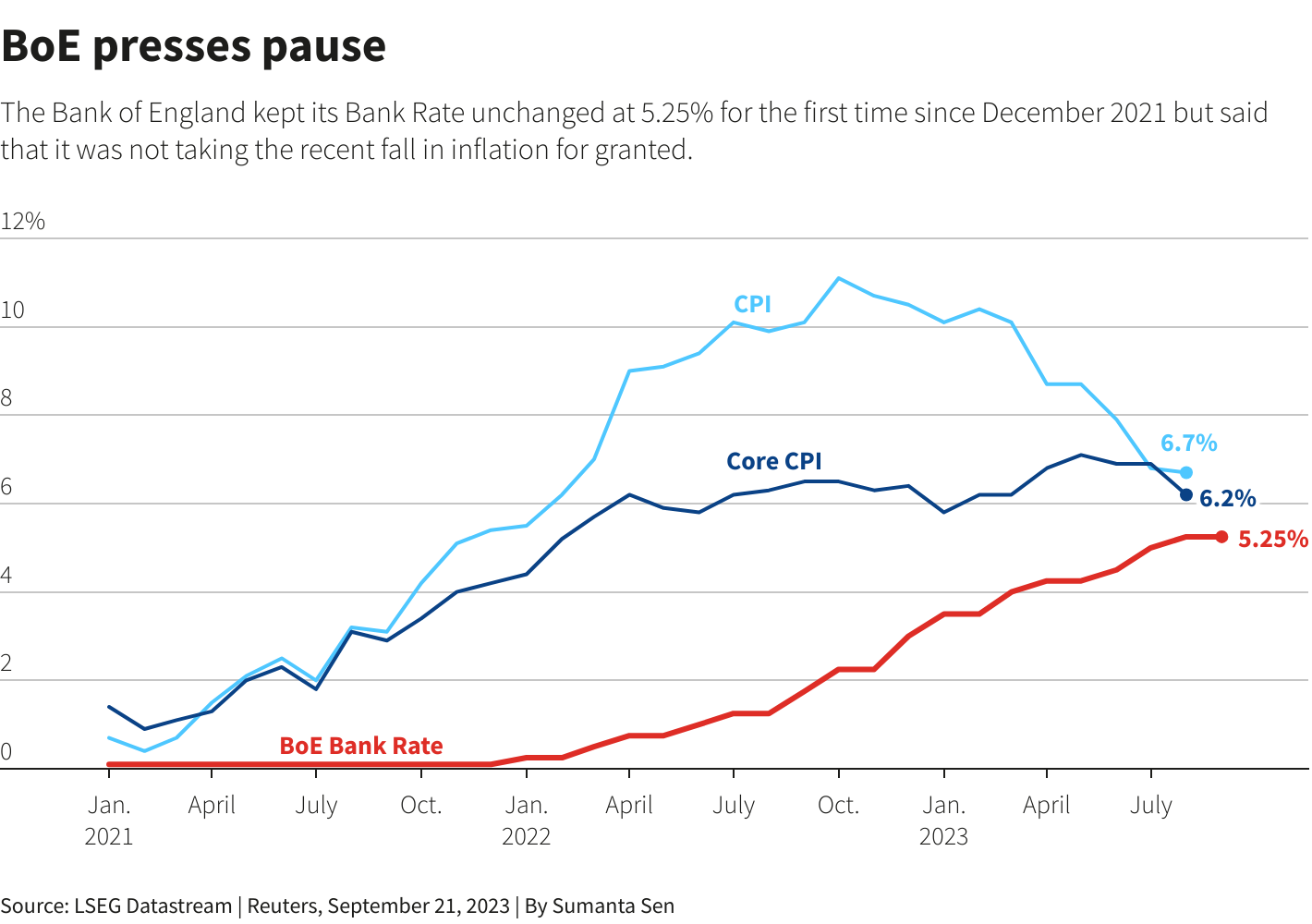

The Bank of England has brought an end to its run of interest rate rises, holding rates steady for the first time since December 2021.

The decision came after inflation slowed unexpectedly, with the bank’s monetary policy committee marginally voting to keep rates at 5.25%.

The Bank’s Governor, Andrew Bailey, would not comment on possible future moves, but said it would be “very, very premature” to lower rates.

The Bank has also cut its growth forecasts for the UK economy, with its outlook for July-September down to just 0.1%. It has also warned that growth for the rest of the year is likely to be slower than previously estimated.

2. Housing markets slow in US, Germany and UK

Housing markets in some major global economies are showing signs of slowing down or contracting, according to data released in recent weeks.

Residential real estate prices in Germany dropped in the second quarter, falling 9.9% year-on-year. This represents the largest decline since data was first gathered in 2000. The number of building permits for apartments also fell sharply in the first half of 2023.

In the UK, house price growth has slowed, with average prices increasing just 0.6% in the year to July – down from 1.9% growth a month earlier. It’s the joint-lowest annual increase since 2012 and the weakest since the pandemic.

And in the US, existing home sales fell in August, with tight supply boosting prices amid rising interest rates. Homebuilder confidence fell to a five-month low in September, but house prices did increase in August compared to a year before.

“Home prices continue to march higher despite lower home sales,” said Lawrence Yun, Chief Economist at the National Association of Realtors. “Supply needs to essentially double to moderate home price gains.”

3. News in brief: Stories on the economy from around the world

Growth outlooks for the French economy have been cut, with its central bank warning that 2024 and 2025 growth will be lower than previously thought – although its outlook for this year has increased slightly.

Eurozone inflation was slightly lower than first estimated in August, according to Eurostat, although at 5.2% year-on-year it remains well above a 2.0% target.

The number of Americans making claims for unemployment benefits has fallen to an eight-month low, dropping by 20,000 to 201,000 for the week ending 16 September.

Turkey has increased its key interest rate by 500 basis points, bringing it to 30%. This is its second severe rate rise in two months. Inflation hit nearly 59% in August, and the central bank has raised interest rates by 2,150 basis points since June.

Russia’s central bank has also increased its key interest rate, raising it by 100 basis points to 13%.

The Bank of Japan, meanwhile, has kept its ultra-low interest rates.

Retail sales in the UK increased in August after a poor July, driven in part by better weather.

Irish consumer sentiment has hit a six-month low, a new survey has shown.

US Treasury 10-year yields have gone above 4.5% for the first time in more than 15 years amid concerns about the impact of US fiscal debt and inflation.

It comes as US mortgage rates rose for the second consecutive week, with the average rate on a 30-year fixed loan increasing to 7.19% from 7.18%.

4. More on finance and the economy on Agenda

What do Chief Economists think about global economic prospects? Our latest Chief Economists Outlook suggests that growth is likely to weaken, inflationary pressure will ease, but the economic outlook could hinder progress towards the SDGs.

Public-private partnerships will have a significant role to play in shaping the future of work. Read more from the Dutch Minister of Social Affairs and Employment on the work that’s needed today to shape the economy of the future.

The World Economic Forum hosted its Sustainable Development Impact Meetings in New York this week. Read what US Secretary of the Treasury, Janet Yellen, said in her keynote.