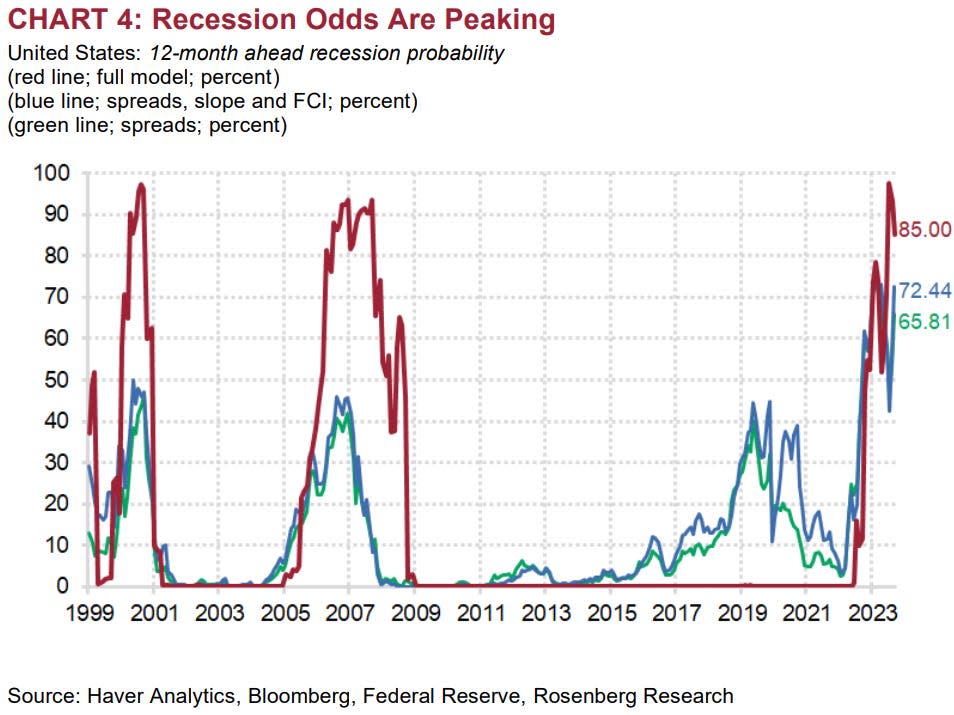

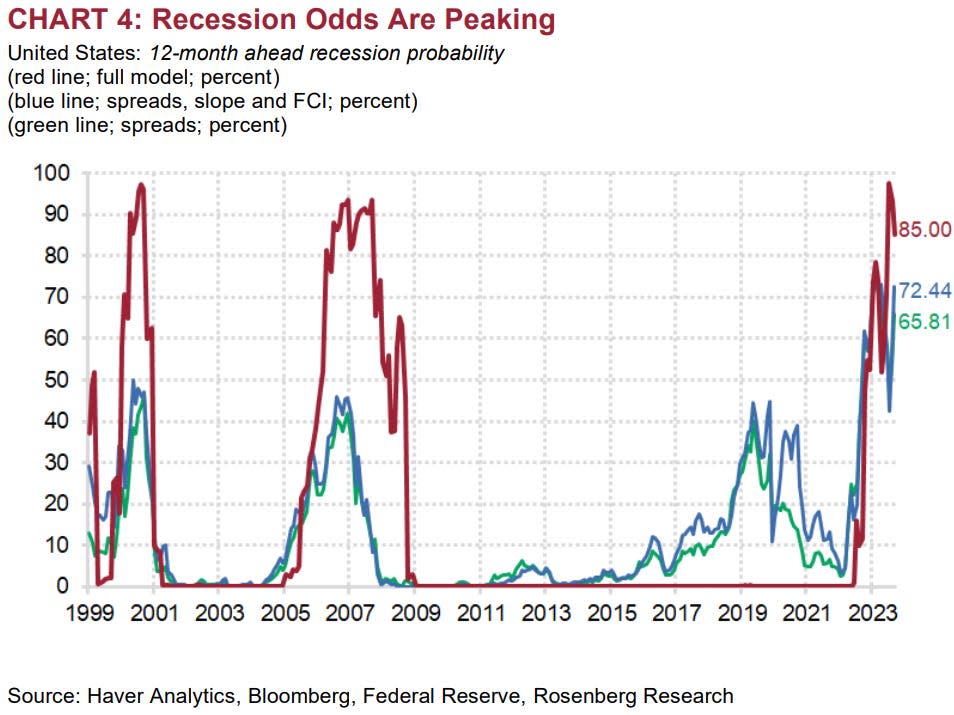

The US now has an 85% chance of recession in 2024, the highest probability since the Great Financial Crisis, economist David Rosenberg says

-

There’s an 85% chance the US economy will enter a recession in 2024, the economist David Rosenberg says.

-

He highlighted a relatively new economic model that has proven to be more timely than the yield-curve indicator.

-

“Our conviction that the recession has been delayed but not derailed is still running at a high level,” Rosenberg said.

A recession is likely to hit the US economy in 2024, a new economic model highlighted by the economist David Rosenberg suggests.

The economic indicator, which Rosenberg calls the “full model,” suggests there’s an 85% chance of a recession striking within the next 12 months.

That’s the model’s highest reading since the Great Financial Crisis in 2008.

The model is based on a working National Bureau of Economic Research paper and consists of financial conditions indexes, the debt-service ratio, foreign term spreads, and the level of the yield curve.

Rosenberg said this economic model had “superiority” over other models due to its history of providing a timely warning of recessions without firing any false signals since 1999.

He noted that in early 2023 this model suggested only a 12% chance of a recession — while the yield-curve indicator said the odds of a recession were 50% at the time.

“The full model predicted the ‘soft landing’ we saw in 2023 — but now is saying that for 2024, recession probabilities are highly elevated,” Rosenberg said.

The model calls into question the growing narrative that the economy is about to pull off a “soft landing” or “no landing” scenario this year.

“Our conviction that the recession has been delayed but not derailed is still running at a high level,” Rosenberg said.

He said if a recession did materialize, it would probably be disastrous for the stock market.

“Few asset classes are priced for that outcome, even though recessions are part and parcel of the business cycle and almost always come on the heels of a Fed rate-hiking cycle that continues past the point of yield curve inversion,” Rosenberg said.

The model utilized by Rosenberg also helps explain why the closely followed yield-curve indicator has so far been inaccurate in predicting a recession.

“It also explains why the yield curve didn’t work as a recession predictor in 2017-19: easy financial conditions, extremely low debt service obligations, and favorable foreign term spreads offset the signal from the inverted U.S. yield curve,” Rosenberg said.

Read the original article on Business Insider