The state of personal finance in America has unfortunately taken a negative turn in the second quarter of 2023. In the first quarter of the year, survey respondents said their finances were stabilizing, and at the same time, the number of people struggling with money trended downward. But now, halfway through the year, that stability has been almost completely eroded—most likely by persistent inflation, rising prices and the looming restart of student loan payments.

In the second edition of The State of Personal Finance report for 2023, we’ll discuss key metrics for both the financial and mental tolls this turnaround has taken on the American people over the past three months—and how those numbers correspond to overall trends Ramsey Solutions has been tracking over the last two years.

Let’s begin this State of Personal Finance report with the basics. After two back-to-back quarters of promising decline, the foundational data points about Americans’ financial difficulties are creeping back to previous highs.

When asked about the overall state of their personal finances, 34% of Americans said they’re either struggling or in crisis. That’s over 88 million U.S. adults and an increase of 4 percentage points from last quarter. But it’s still shy of the peak in the third quarter of 2022.

Looking at the data generationally, Gen X is struggling the most (43%), with the baby boomers being the least likely to have financial difficulties (23%). In addition, more women than men said they’re having trouble with their finances (40% vs. 27%, respectively).

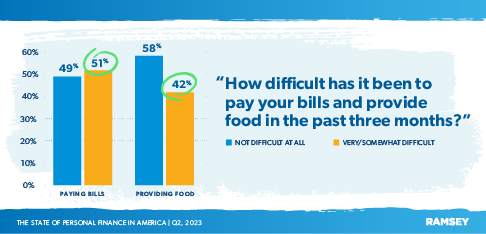

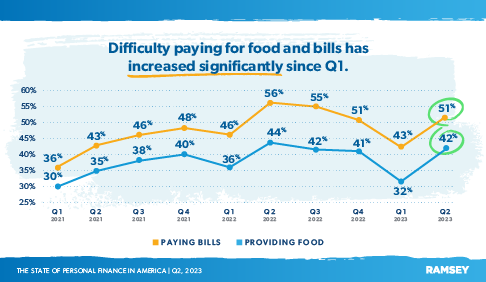

Over Half of Americans Are Having Difficulty Paying Bills

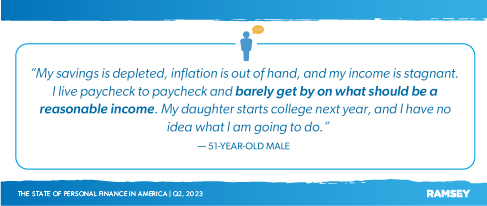

Last quarter, many Americans said they were stable financially but not in a great place overall. Now, after months of steady increases in the costs of everyday items due to inflation, Americans are finding it more difficult to pay basic bills and provide food—making the stability of the previous quarter even more fragile.

Just over half of Americans (51%) said they had difficulty paying their bills in the past three months, while 42% said the same about providing food. This is a return to the numbers from the last two quarters of 2022—effectively eliminating the statistical decline in the number of people struggling to pay for their necessities. Gen Z, the youngest working generation, appears to be the most impacted, with 67% saying it’s hard to pay bills.

However, the data trends from the last two years may be pointing to an annual cycle in Americans’ sentiments around financial difficulties. There’s a sizable dip in the number of people struggling to pay bills and provide food in the first quarter of the past two years, followed by a significant reversal in the second quarters. It’s possible that this decrease is the result of the annual optimistic outlook for the new year, and then by the second quarter, reality sets in again. But more research will be required to reach a definitive conclusion.

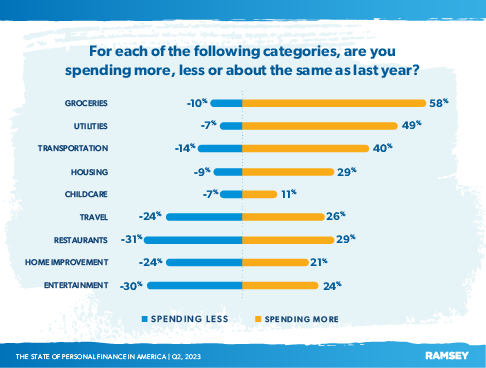

Americans Are Spending More on Groceries and Less on Nonessentials

Groceries are one of the most important expenses in a household budget—one of what Ramsey calls the Four Walls, which also include transportation, housing and utilities. Grocery prices have risen dramatically over the last three years, and a solid majority of Americans (58%) said they’re spending more on groceries than the same time last year. Almost half (49%) said the same thing about utilities.

As the costs for these essentials increase, so does the belt-tightening in other nonessential areas of a household’s budget. Nearly a third of people said they’re spending less on eating out at restaurants (31%) and on entertainment (30%).

7 in 10 Renters Under 40 Are Having Trouble Making Rent

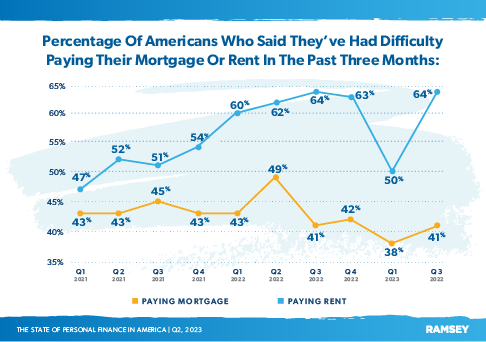

Americans are also spending more on rent (the median rent price is up more than 18.5% over the last three years)1. And 64% of renters are having difficulty keeping up with it. That’s a 28% increase from the low of last quarter—matching the high set in Q3 2022. Millennials and Gen Z (generations under 40) are the hardest hit, with 7 in 10 saying they’re struggling with rent.

Meanwhile, homeowners with a mortgage are faring a little better, with only 41% saying they’re having trouble keeping up with their payments. Overall, the number of people struggling to pay their mortgage has remained relatively steady over the last four quarters.

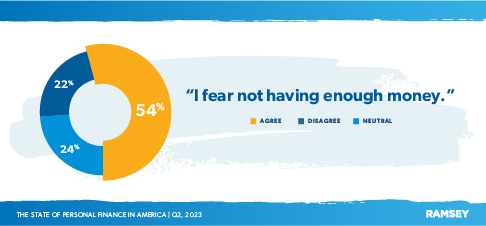

54% of Americans Are Afraid of Not Having Enough Money

With the cost of everything going up, it makes sense that over half of American adults (54%) are afraid they won’t have enough money to cover their personal expenses.

Women were more likely than men to worry they won’t have enough money (57% vs. 51%). And once again, Gen Z is the generation most likely to deal with this anxiety (62%).

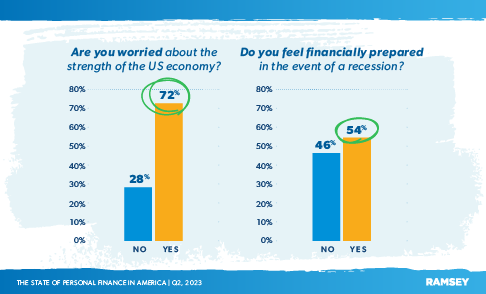

3 in 4 Americans Are Worried About the Strength of the Economy

Americans are not only worried about their own personal finances but also about the financial future of America itself. While politicians continually tout the strength of the American economy, average Americans sense something bad is on the horizon. In fact, most Americans (72%) are worried about the direction the economy is headed. Many economic experts have been warning of a possible recession for some time now. While that hasn’t happened yet, if the economy does teeter into a recession, just over half of Americans (54%) don’t feel financially prepared for one.

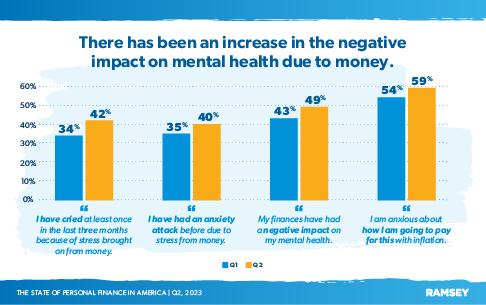

More U.S. Adults Reported Negative Impacts on Mental Health Due to Money

All this worry surrounding both personal and collective finances has had a negative impact on Americans’ mental health. Almost half (49%) said their finances have weighed heavily on their well- being—a 6 percentage point jump from the previous quarter. And 2 out of 5 Americans have even experienced anxiety attacks due to money stress.

Inflation is weighing the heaviest on Americans’ minds, with 59% expressing anxiety about their ability to afford inflated prices, an increase of 5 percentage points from just last quarter alone.

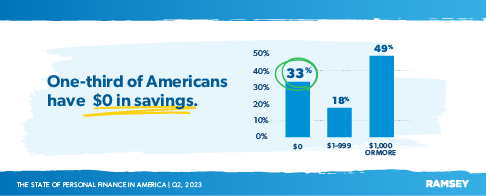

The Reality of Savings in America

During the COVID-19 pandemic, Americans’ savings reached an all-time high thanks to government handouts and a shortage of places to spend money. Over the past three years, Americans have been spending that money with a vengeance (aka revenge spending), making up for lost time. Add in massive inflation and you have a recipe for dwindling savings.

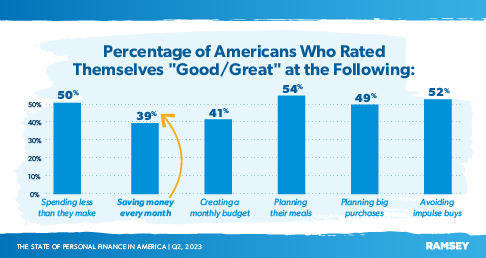

Half of Americans Rated Themselves “Good” at Spending Less Than They Make

Despite the bleak attitude many Americans have about their own financial prospects and the nation’s overall economic situation, half (50%) have a relatively positive view of their own ability to spend less than they make. Over half also consider themselves good at planning their meals and avoiding impulse buys (54% and 52%, respectively). But interestingly, far fewer people (39%) said they’re good at actually saving money every month.

About Half of Americans Have $1,000 on Hand for Emergencies

As stated above, half of Americans think they have a handle on their finances—and the newest savings stats line up with that thought. Nearly half (49%) said they have at least $1,000 in savings for emergencies, holding steady from the findings of the fourth quarter of 2022. But 33% have no savings at all. Of those Americans who have at least $1,000 saved, most have less than $5,000 total.

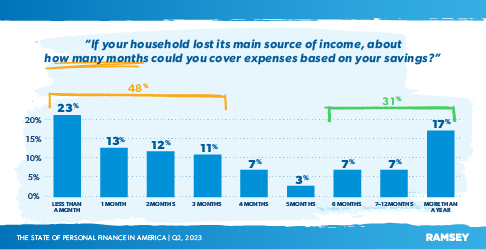

Half of Americans Said They Couldn’t Cover Expenses for 90 Days

It makes sense that so many Americans are fearful of a future recession, as one of the ways to protect yourself and your family from the financial fallout of a recession is saving up a robust emergency fund of 3–6 months of expenses. Just about half of Americans (48%) said they couldn’t cover their expenses for 90 days if they lost their income. And only 31% could cover themselves for six months or more.

America’s Complicated Relationship With Credit Cards Continues

Increased spending and lack of savings have led many Americans to rely more on credit cards just to get by. Credit card debt in the United States reached $1 trillion this year, and credit card APRs (annual percentage rates) continue to climb. This starts a cycle of debt that can be difficult to get out of. And yet, Americans still have a positive perception of the importance of credit.

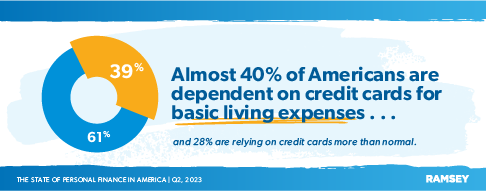

2 in 5 Americans Rely on Credit Cards for Basic Expenses

Of those Americans who have credit cards (which, according to the Federal Reserve, is 77% of the total population over the age of 18), almost 40% rely on them to cover their basic monthly needs.2

Because of increasing costs, 28% of cardholders are relying on their credit cards more than normal. And 1 in 4 have maxed out a credit card in the last 90 days.

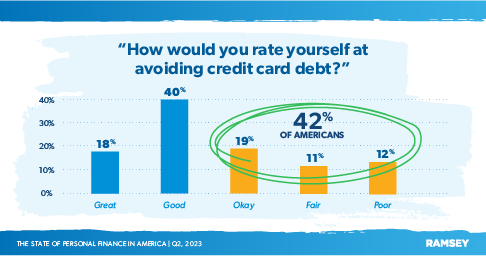

42% of Americans Rated Themselves as “Okay,” “Fair” or “Poor” at Avoiding Credit Card Debt

Credit cards are a large part of the lives of most Americans today, but a significant number of people are finding it hard to pay off their balances each month. Almost half of Americans (42%) rated themselves as “okay,” “fair” or “poor” when it came to avoiding credit card debt.

This stat is consistent with the above findings that half of Americans think of themselves as “good” at living on less than they make.

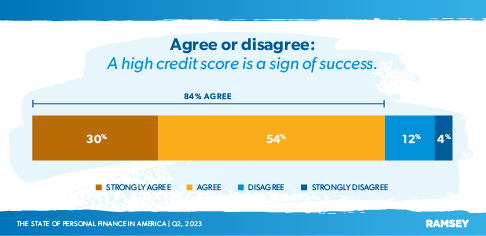

Most Americans Believe That a High Credit Score Is a Sign of Financial Success

America’s infatuation with debt goes beyond using credit cards. For most, credit is a way of life. People gauge their financial status based on their credit score, with a supermajority of Americans (84%) saying a high credit score is a sign of financial success.

Conventional wisdom continues to put credit scores on a pedestal, even though credit scores like the FICO score are, in reality, just a measure of how good someone is at handling debt. They’re not a measure of a person’s ability to build wealth or handle money.

39% of Americans Think About Their Credit Score Frequently

The pressure to build and maintain a “good” credit score means many Americans think about their score “often” (24%) or “all the time” (15%).

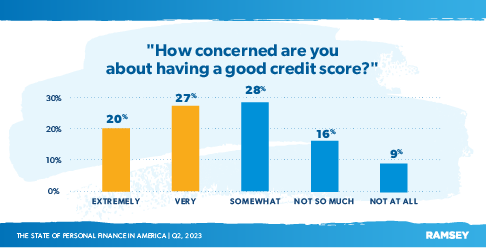

Diving in further, almost half of Americans (47%) are either extremely or very concerned about maintaining a good credit score.

Half of Adults Don’t Know the Interest Rates on Their Credit Cards

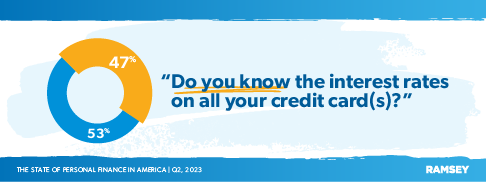

With the average credit card APR hitting an all-time high of 20.68% this year, it’s more expensive than ever to carry a credit card balance over month after month.3 And as interest adds to those balances, it’s more and more difficult to pay them off.

Credit card holders have blinders on when it comes to the danger of building balances. Almost half (47%) don’t even know the APRs on their own credit cards.

Rewards and Cash Back Are the Top Reasons Americans Keep Their Credit Cards

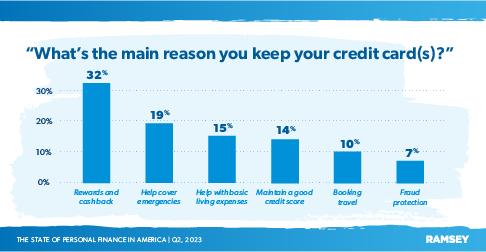

So, what keeps all these credit card users swiping? According to the numbers, most Americans keep their credit cards for the rewards and cash back (32%).

The next-most common reason cardholders keep their cards handy is to cover emergencies (19%). This finding is in line with the current state of savings in America highlighted earlier in this report (half of Americans not having much savings).

The Return of Student Loan Payments Looms Large

The pause on student loan payments brought on by the COVID-19 shutdowns officially ends in October. This will likely shake up the financial lives of many Americans who have gotten used to one less monthly payment. Fear surrounding resuming payments took up a lot of space in the minds of many Americans.

8 in 10 Americans Worried About Student Loan Payments Restarting

Most Americans with student loan debt (79%) are worried about the impact the payments will have on their budgets when they resume in October.

It will take some adjustment for a lot of people. Only 27% said they’re very prepared to start making payments again.

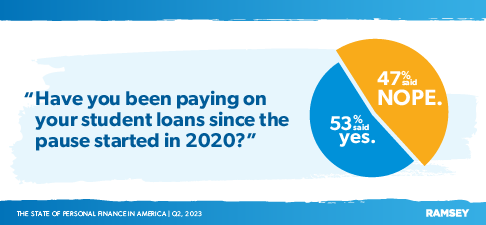

Half of Student Loan Holders Have Paid on Their Loans since 2020

During the three-year pause on student loan payments, loan holders had the opportunity to pay down their debt with zero interest. But because of financial hardships brought on by the pandemic or simply by choice, only half of Americans (53%) chose to take advantage of the situation by making consistent or sporadic payments.

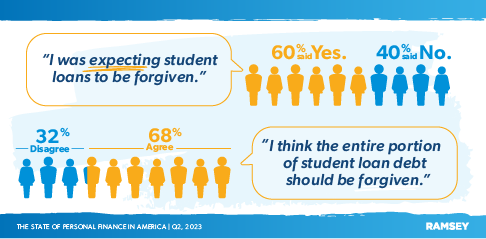

60% Thought Student Loans Were Going Away

When President Biden’s administration announced a student loan forgiveness plan last April, many loan holders expected that debt to be wiped clean. In fact, 60% of Americans with student loans expected some kind of forgiveness.

Even now that the Supreme Court has struck down Biden’s attempt at loan forgiveness as unconstitutional, 68% of student loan holders still think the government should forgive loans.

Student Loan Debt Is Taking Longer to Pay Off Than Planned

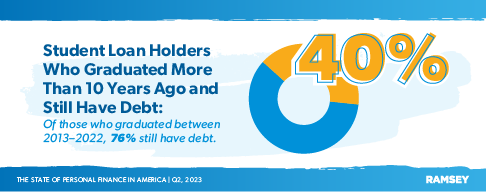

Given that most borrowers usually start out with a 10-year plan to pay off their student loans, the fact that 76% of borrowers who graduated in the past 10 years (2013–2022) still have student loan debt isn’t very surprising.

What is surprising, though, is that 40% of borrowers who graduated before 2013 are still paying off their student loan debt—carrying the burden of their debt longer than they had planned.

Half of Americans Estimate at Least 10 More Years to Pay Off Student Loans

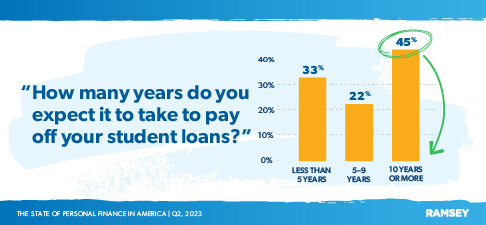

There’s a morbid trope in the popular culture that many people will die with student loan debt— because not even bankruptcy can wipe out federal student loans. Many Americans have blown past their 10-year payoff plans because deferments and forbearance have extended the life and cost of student loan debt. But the debt still looms large, as we just saw in the data.

Whatever the reasons for the delays, 45% of Americans with student loans estimate it’ll take 10 additional years to pay off their loans—maybe even more. That’s 10-plus years’ worth of investing and buying power gone because of debt (along with 10-plus years’ worth of interest adding to the debt). This is why it’s so important to pay off your debts as soon as possible and not take on any more.

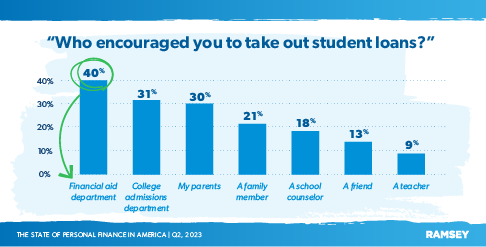

Colleges Are the Number One Advocates for Student Loans

Most young Americans looking forward to college see student loans as the only way to afford a four-year degree. The institutions themselves stand to benefit the most from student loans, so it comes as no surprise that most prospective students (71%) hear about loan programs from the colleges and universities they hope to attend. High school teachers were the least likely to push the idea of loans on their students (9%).

Breaking the stat down further, the top spot belongs (again, not surprisingly) to college financial aid departments, followed right behind by the admissions departments. These colleges and universities are seeing an opportunity to fill their coffers and endowments with an endless supply of money. That money comes courtesy of the American taxpayer. And the students are then saddled with loans that take years to pay off.

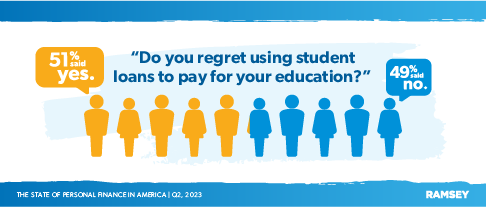

Half Regret Taking Out Student Loans

Despite the crushing, stifling debt from student loans that lasts for years (and even decades), only 51% of those who took out student loans regret that choice. More men regretted getting student loans than women (59% vs. 42%, respectively). And Gen Z loan holders regretted their student loans the most at 66%—but not by much. Sixty-five percent of millennials said the same thing.

It seems that many young Americans still want a college education “at all costs,” despite the fact that they have many other debt-free options that will give them the knowledge they need to earn a good living.

The Way Out: Knowledge

Though it may seem like the state of personal finance is dire (and it is looking that way), there’s always hope—a way to get out of the financial mess and into a more stable situation. And that turn begins when Americans have the right information to make better decisions about our financial futures.

But as we like to say at Ramsey Solutions, financial change is 80% behavior and 20% head knowledge. Americans also have to want to change their habits and behaviors.

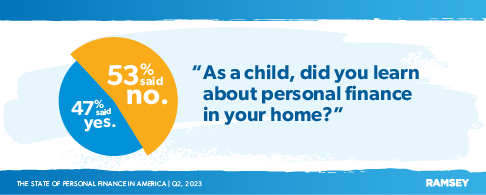

130 Million Americans Weren’t Taught About Money

Good habits start in the home—especially when it comes to personal finance. Unfortunately, a little over half of Americans (53%) were never taught those important lessons growing up. That’s 130 million adults who had to figure out how to handle their own money as adults—often the hard way.

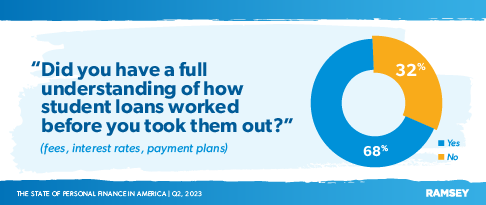

1 in 3 Americans Didn’t Understand Student Loans Before Taking Them Out

Almost one-third of Americans (32%) didn’t understand the consequences of taking out student loans before they signed on the dotted line. This should come as no surprise when a system is incentivized to push student loans on college-age Americans and a huge chunk of the population is not educated or prepared to handle money.

It seems that basic knowledge about how loans work could have saved a lot of time, money and headaches. Of those who didn’t understand student loans, 61% said that they regretted taking them out in the first place.

7 in 10 Said They Would Consider Using a Financial Coach

In many of the greatest stories ever told, a wise guide comes alongside the hero to teach them what they need to know to be successful on their journey. Much in the same way, a financial coach can give people solid advice and tools to help them get out of serious financial situations. Again, knowledge is the key to understanding and growing.

Almost three-quarters of student loan holders (69%) said they would consider using a financial coach to help them create a plan to pay off their loans. There’s a definite desire on the part of Americans to clean up their financial messes. And partnering with a coach can give them the knowledge, encouragement and accountability they need to change their financial picture.

Conclusion

The state of personal finance in America is one of fear and anxiety. While the data started out by heading in a positive direction at the beginning of the year, more people are now struggling to keep their heads above water—especially as student loan payments begin again. And the younger generations are having a much harder time overall.

Many factors have created this perfect storm of financial stress and uncertainty, including inflation and bad government monetary policy. It may seem like there’s no way out, but there is.

Building back hope starts with building a knowledge base about personal finance and a plan to get out of the mess. But it also requires a genuine desire to change. It takes time and discipline—but it is possible.

About the Study

The State of Personal Finance is a quarterly research study conducted by Ramsey Solutions with 1,006 U.S. adults to gain an understanding of the personal finance behaviors and attitudes of Americans. The nationally representative sample was fielded from August 24 to 29, 2023, using a third-party research panel.