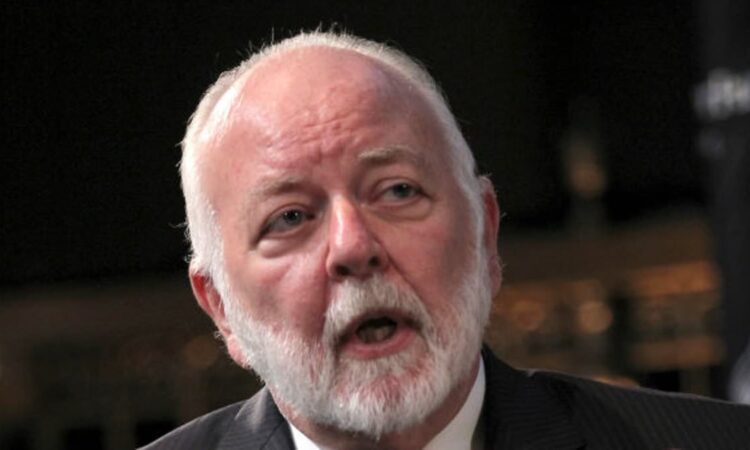

- The recently-retired banking oracle – who forecast the 2008 housing crisis – made the dramatic prediction this week

- Bove, 83, claimed other analysts won’t make the same admission because they’re ‘monks praying to money’ who rely on the mainstream financial system

- It comes despite the collapse of its property sector, which accounts for roughly a quarter of the country’s economy, and US growth

China will soon overtake the American economy and the US dollar will catastrophically collapse, according to famed financial analyst Richard X Bove.

In a characteristically histrionic forecast, the recently-retired 83-year-old banking oracle has announced that ‘the dollar is finished as the world’s reserve currency’.

His dire prophesy comes despite the collapse of China’s Evergrande – impacting its property sector which accounts for roughly a quarter of the country’s economy – and despite the US economy doing better than expected in the last quarter.

But it’s in line with the longer-term outlook, with many analysts forecasting China taking America’s leading spot in the world rankings in just over a decade.

Speaking with the New York Times, Bove said you won’t hear his latest prediction from any other analysts because they are ‘monks praying to money’ who won’t speak out about the mainstream financial system their livelihoods depend upon.

Florida-based Bove worked at 17 brokerage firms during his decades-long career before retiring from boutique brokerage Odeon Capital – and he’s no stranger to the spotlight or making bets which go against the grain.

Not all of his financial forecasts have borne out, but he’s known for predicting the 2008 housing crisis three years before it happened in his 2005 report This Powder Keg Is Going To Blow.

Bove is a controversial figure in banking – from his sometimes far-fetched predictions provoking ire in the industry, to even being fired from two big firms – Dean Witter Reynolds and Raymond James.

The former let him go for allegedly being too bullish on bank stocks. And BankAtlantic, now defunct, unsuccessfully sued him over a critical 2008 research report they said was defamatory.

Many finance heavyweights on Wall Street view Bove as a grifter or an attention seeker – but plenty of people listen to him.

Among his supporters are Jamie Dimon, the chief executive of JPMorgan Chase, whom Bove generally praises.

Meanwhile, Bank of America head Brian Moynihan is among his naysayers – and the pair haven’t spoken in a decade after Bove apparently visited the bank’s Manhattan headquarters and blasted executives over their expansion plans, according to the Times.

He’s also been dubbed ‘the loneliest analyst’ thanks to his proclivity for expressing extreme opinions, some of which have influenced the stock market.

However, Bove’s latest prediction is in line with projections based on current growth rates, which show that Chinese GDP will more than double that of the US in just over 10 years, according to World Economics.

However, in the short term, America’s economy grew much faster than expected in the final three months of last year while China suffered a major blow to its property sector.

The US easily missed going into recession – which many analysts had forecast was inevitable.

Gross domestic product (GDP), a measure of all the goods and services produced, jumped 3.3 percent annually in October through December, the Commerce Department reported this month.

Analysts’ consensus had been for a fourth quarter growth rate of just 2 percent.

It was a slightly slower pace than the 4.9 percent rate in the third quarter from July through September – which was thanks to a surge in consumer spending over the summer months.

But the latest figures reflect the surprising durability of the US economy – and the willingness of the American consumer to spend despite high interest rates and price levels.

It marks the sixth straight quarter in which GDP has grown at an annual pace of 2 percent or more.

As well as better than expected GDP figures, there was also good news on inflation.

A measure preferred by the Federal Reserve – core prices for personal consumption expenditure – rose by 3.2 percent annually, down from 5.1 percent a year ago.

Meanwhile, China’s economy has suffered a knock after property giant Evergrande, the world´s most heavily indebted real estate developer, was ordered to go into liquidation by a Hong Kong court.

Evergrande Group is among dozens of Chinese developers that have collapsed since 2020 under official pressure to rein in surging debt the ruling Communist Party views as a threat to China´s slowing economic growth.

But the crackdown on excess borrowing tipped the property industry into crisis, dragging on the economy and rattling financial systems in and outside China.

Chinese regulators have said the risks of global shockwaves from Evergrande’s failure can be contained.

The court documents seen Monday showed Evergrande owes about $25.4 billion to foreign creditors. Its total assets of about $240 billion are dwarfed by its total liabilities.