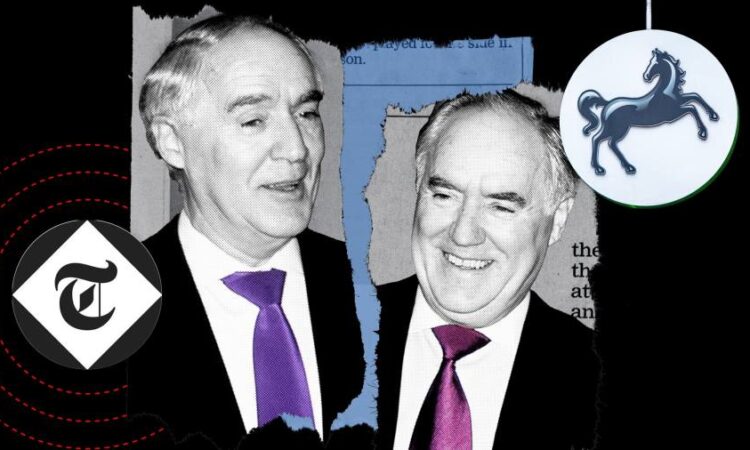

While on holiday in the Maldives a decade ago, António Horta-Osório happened to run into one of his biggest and more problematic customers: Aidan Barclay.

It was a chance encounter, according to people close to Horta-Osório. But the pair knew each other well. The Barclay family was the debtor behind one of the single largest problem loans on the balance sheet of Lloyds Banking Group, where Horta-Osório had been chief executive since 2011.

Loans secured against key assets in their business empire, including the Telegraph newspaper group, had originally been extended to the Barclay family by HBOS, which collapsed in 2008.

Horta-Osório left Lloyds in 2021, but the work of reducing its exposure to the Barclays continued under his replacement, Charlie Nunn. Almost 15 years after Lloyds’ government-brokered rescue of HBOS, the resolution of those loans is inching closer to completion after Lloyds decided to recoup part of its debt by seizing effective control of the Telegraph Media Group and putting it up for sale.

The FT has spoken to multiple people involved in the debt renegotiations over the years, as well as those familiar with the Barclay family’s position and others involved in the sale process of the Telegraph.

The sudden repossession of one of Britain’s most influential newspapers by a high street bank shows the extent to which two working-class brothers from west London had built a business empire using, in the words of one person familiar with their operations, “other people’s money”.

The Telegraph

Bought: 2004, for £665mn

The brothers had previously owned the European, but the Telegraph group, which included the daily and Sunday newspapers and the Spectator magazine, was much bigger and more influential

Estimated worth: Bankers are touting a price of over £500mn

Another former business acquaintance agrees: “The business is all loaded with debt. It owes more than it’s worth.” Though once widely touted as multibillionaires in rich lists and feted as successful yet eccentric tycoons, many people involved in the negotiations say that the public view of the family’s fortune belied the huge borrowings that sat behind it.

Such debts raise fresh questions over the Barclays’ remaining businesses, including the former Littlewoods retail and consumer credit group, held through a complex web of onshore and offshore financial structures. But those close to the family say that they have not given up — they are now fighting again to regain ownership of their beloved newspaper with backing from the Middle East.

Representatives for the family declined to comment on any specific matters, but said in a statement: “As we have made clear throughout, discussions with Lloyds Banking Group remain ongoing. We hope to come to an agreement that will satisfy all parties.”

The family and the banker

The Barclay empire was built by the late Sir David and Sir Frederick Barclay, London-born identical twin sons of a travelling sweets salesman. Early forays into local real estate soon led to larger investments in hotels, culminating in the 1995 acquisition of the Ritz, one of London’s top hotels. There were also investments in shipping and retailing. Over the years two of David’s sons, Aidan and Howard, became increasingly active in the family businesses.

The twins valued privacy, in every sense of the word. They were rarely photographed, refused to talk to the press and eschewed the London social circuit for a reclusive life on Brecqhou, a tiny island in the Channel upon which they built a £60mn mock castle. They took non-domiciled tax status, exempting them from UK tax on income and capital gains generated overseas, and set up a web of offshore trusts to hold both their business interests and their personal wealth.

In 2004 they acquired the Telegraph, the newspaper closest to and most unstinting in its support of the Conservative party, from Canadian media group Hollinger. People close to the family say the £665mn acquisition, sealed after a fierce fight against German media group Axel Springer and others, was never just about financial returns. “It was their icon; they loved owning the Telegraph,” says one former business and social acquaintance.

The loan HBOS provided for the Telegraph acquisition was described by those familiar with its terms as “a classic Cummings handshake loan”, referring to Peter Cummings, the disgraced former head of HBOS’s commercial banking unit.

HBOS was notorious for lending large amounts with few safeguards to high-profile investors. Its approach was excoriated by regulators and Cummings was eventually banned from the financial services industry for life.

When Lloyds took over HBOS, executives were dismayed to find there were few covenants that would easily give the bank the ability to enforce its rights on the Telegraph if the loan terms were breached or repayments ceased.

The Ritz Hotel

Bought: 1995, for £75mn

The brothers spent heavily restoring the hotel to its former grandeur, but sold it for less than initially expected at the start of the coronavirus pandemic

Sold: 2020, for around £750mn

“[The HBOS loan] was done with very little ability for the bank to enforce. This is the reason why it took a long time to get to the position management is in today,” says one person close to the bank.

Cummings’ largesse helped make the Barclay family the largest single-client exposure among the roughly £200bn of problematic HBOS loans absorbed by Lloyds. Even as Lloyds worked to resolve the bad lending, bringing the total amount owed to below £10bn within three years, the Barclay debt remained on the books.

The workout

Between 2011 and 2021, there was slow progress. The debt was restructured and partly paid down, eventually to around £800mn, according to two people familiar with the figures. However, this then swelled back to above £1bn due to unpaid interest.

The process was overseen by Stephen Shelley, then Lloyds commercial division’s chief risk officer, who was also head of the business support unit charged with untangling the toxic HBOS debts, people familiar with the process say.

He was supported by Juan Colombás, a close confidant of Horta-Osório — at the time group chief risk officer — and Antonio Lorenzo, who was responsible for running down the so-called “non-core” assets.

Horta-Osório and this team would usually meet the Barclay brothers a few times a year, most crucially after their financial accounts were finalised, according to three people close to the situation. Aidan would do most of the talking while Howard would say relatively little, the people add. One of the people says the meetings could be “pretty brutal”.

The Very Group

Bought: Littlewoods in 2002 for £750mn; GUS in 2003 for £590mn

Littlewoods and Great Universal Stores were combined under the Shop Direct banner, then rebranded as The Very Group in 2020

Estimated worth: Talk of £3bn-£4bn IPO in 2021; almost certainly less now

As the relationship soured in the latter years of Horta-Osório’s tenure, Aidan visited frequently. One person remembers how often his Rolls-Royce was parked outside the lender’s head office in the City of London. “It tells you something when you are the one coming to the bank’s manager’s office, not him coming to you,” the person says.

In 2020 came a breakthrough: the Barclays sold the Ritz to Abdulhadi Mana al-Hajri, a Qatari businessman, for about £750mn. However, those close to the situation say neither the family nor Lloyds received much of the money from the Ritz disposal because other creditors’ claims ranked higher — leaving the bank with still-heavy exposure and the family with little cash left to settle liabilities in other parts of their empire.

“In the Ritz situation, Citi[group] was in the front seat,” says the person. “It’s not that Lloyds didn’t benefit, but they didn’t get very much at all.”

Another person with knowledge of the Ritz sale says it “was asked for not only by Lloyds but also by other lenders, and it was those lenders who received the lion’s share of the benefit of that asset sale because their covenants and positions were significantly stronger than [those of] Lloyds”.

In a reflection of how poorly the former HBOS loans were structured, and the faint prospects of recovery, Lloyds wrote the Barclays’ debt down on its balance sheet.

Another person says a complication for Lloyds was that the loans sat a “long way” from the actual newspaper, in a network of offshore holding companies.

The HBOS loan was secured against Penultimate Investment Holdings, an entity in the PIHL Group, the overarching parent that indirectly owned Press Acquisitions, which in turn was the holding company for Telegraph Media Group.

Yodel

Founded: 2008

Formed by combining the delivery networks of Littlewoods and GUS, it was demerged in 2008 and adopted the name Yodel in 2010

Estimated worth: debt totals £180mn, analysts say equity is worth little

People close to both the bank and the newspaper group say that Lloyds management was keen to give the family time and space to work out a solution, mindful of the furore likely to be caused by seizing a national newspaper that sits at the heart of Conservative Britain.

A senior banker at Lloyds says the family “continued to make proposals around [debt] reduction — refinancing, injection of equity, sale of part of the businesses; all of those things have been regular and active discussions over the years”.

Another senior Lloyds banker says the other Barclay businesses backed by the debt also faced issues: “Life changes — financial crisis, pandemic — and assumptions about business trading don’t come through. You’re in a position you’re not comfortable with so you start exploring options. We were clear from day one that we weren’t going to lend more money and we wanted clear repayment plans to reduce the borrowing . . . in line with asset sales opportunities.”

But there appeared little sign to the bank that the Barclays would be able to get to grips with the large debts that lay behind their business empire.

The end game

There was no specific trigger event that led Lloyds to move on the Telegraph, two people with knowledge of the discussions tell the FT. In the 18 months before it seized the company, the family made multiple restructuring proposals, the people add. One included an asset swap that involved US private equity firm Carlyle, which would have resulted in Lloyds taking steep losses on the nominal value of its loans.

Lloyds rejected all the schemes, with its executives concluding that no deal would represent better value than repossessing the profitable newspaper group and selling it themselves. The bank hired AlixPartners and Lazard over a year ago to help draw up potential strategies to recover the money.

Brecqhou

Bought: 1993. The asking price was £3.5mn

The brothers spent millions building ‘Fort Brecqhou’ on the 32-hectare islet next to Sark, between Jersey and Guernsey in the Channel Islands

Estimated worth: around £65mn, according to court documents

Once it had signalled its intent to act, Lloyds moved quickly to roll up the offshore-based holding companies and remove the Barclay family from the boards managing the group. Those ejected included Aidan and Howard.

Even as this was happening, the family made an eleventh-hour attempt to rescue the newspaper, but their proposal was dismissed as the “same deal in different wrapping”, a person briefed on the decision says.

Nunn, the Lloyds chief executive, said in July that it had been “the right time” to move and that “from our perspective the Telegraph and the Spectator are well-performing businesses [so] there’s no need to have a rushed sales process”.

Potential buyers include DMGT, which owns the Daily Mail, and National World, which is headed by former Mirror chief David Montgomery. Hedge fund investor Sir Paul Marshall, Czech billionaire Daniel Křetínský and former Telegraph editor Sir Will Lewis are also interested in backing bids, while News UK owner Rupert Murdoch has registered interest, according to people close to the situation. Many potential buyers have sounded out investors in the Middle East and the US for extra financial firepower.

The Barclay family has made repeated offers to take back control of the Telegraph by offering to buy back some of the debt, with financial support potentially from Abu Dhabi. But the bank has stuck to its plans for a sale.

Lenders are now shifting their focus to the rest of the Barclays’ empire. Yodel, the delivery company, has been put up for sale by the family and the FT has learnt that Lloyds is now also in talks with the Barclay family and Carlyle over the future of The Very Group, an online retailer that provides high-cost credit to many of its customers. It is linked to the Telegraph debt through a loan guarantee.

The Very Group boomed during the pandemic but is also heavily indebted, with Carlyle the most senior creditor after the family brokered a 2021 refinancing to replace funding previously provided by alternative lender Greensill. Ambitions to raise cash by floating the company on the stock market were derailed by deteriorating market conditions.

As creditors pressured for restructuring and repayment, relations between family members became increasingly strained and from 2020 onwards the details of their internal ructions spilled into the public domain via two high-profile court cases.

In 2020, Sir Frederick and his daughter Amanda brought an extraordinary lawsuit against three of Sir David’s sons — Aidan, Howard and Alistair — along with Aidan’s son Andrew and another man, alleging they were parties to the clandestine recording of private conversations over several months. The dispute was settled the following year.

The death of Sir David in early 2021 did not ease the tension. Earlier this year, a court deliberating in a case over Sir Frederick’s failure to pay £100mn to his ex-wife heard that he had been in effect cut off from the family wealth by his nephews following a 2014 reorganisation of the business empire.

His stake in the mock castle on Brecqhou — often nicknamed Xanadu in the British press after the hubristic mega-mansion in Citizen Kane — had become one of his only identifiable assets, the court was told. It has been valued at about £32.5mn.

The “web of highly complex overseas trust arrangements” cited by the court make it difficult to know how wealthy the rest of the family now are, although Aidan Barclay admitted to “severe pressures in the business in the last couple of years” as part of his uncle’s divorce case.

Those close to the family see the irony in how its fiercely-protected private affairs — there was even a bust-up over a gravestone commemorating the twins’ father — could now be written about in the very newspaper over which they once had tight control.

Another longtime associate says the Telegraph acquisition was the brothers’ “obituary move”, an attempt to create a legacy for two lads from a working-class background who had risen to control the newspaper with the deepest links to the country’s ruling political party.

“However,” he adds, reflecting on the crumbling business empire and the bitter family disputes, “it’s not quite worked out that way.”