Sunlight Financial, whose stock price has plummeted amid accumulating more than $500 million in underwater loans, has been acquired by a consortium led by Greenbacker Capital Management, Sunstone Credit, IGS Ventures.

Sunlight Financial has filed for Chapter 11 bankruptcy and subsequently sold its residential loan business due to escalating financial stress. The consortium acquiring the business includes Greenbacker Capital Management, Sunstone Credit, IGS Ventures, and secured lender Cross River Bank. Collectively, they operate as ED Umbrella Holdings, LLC and have entered into a Restructuring Support Agreement.

To expedite its bankruptcy proceedings, Sunlight Financial sought a fast-tracked Chapter 11 process. A company press release assures trade creditors, suppliers, contractors, and employees that they can expect full payment without delays.

The consortium plans to inject substantial new capital into Sunlight Financial and continue originating residential loans. The objective of the investment is to “re-establish the Company’s position as the pre-eminent platform for residential solar and home improvement finance solutions.”

Details surrounding the bankruptcy were made public on the morning of October 31, 2023, and are accessible via the Sunlight Financial investor relations webpage.

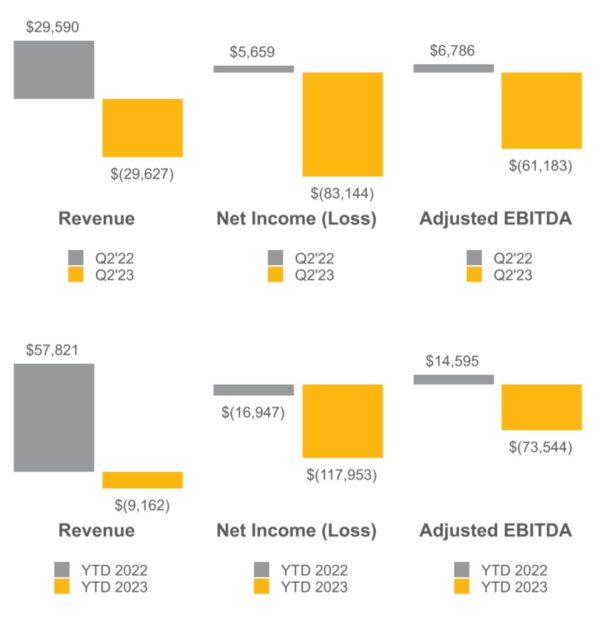

Financial troubles for the company first emerged in August with the filing of 10-Q financial documents. These records highlighted Sunlight Financial’s struggle to maintain operations, casting doubt on its viability as a “going concern,” primarily due to challenges in obtaining new loan funding.

The crux of the problem lies in the company’s delayed response to rising interest rates, which the Federal Reserve increased to over 5% from near zero. This adversely affected the company’s core business of developing residential solar loans and selling them to investors, making such transactions financially unviable and causing a sharp decline in revenue and income.

Weeks later, as the stock price continued to fall, the company implemented a 10-to-1 reverse stock split to maintain a share price above $1 and ensure continued listing on the New York Stock Exchange.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.