The introduction of transferable solar tax credits under the Inflation Reduction Act (IRA) is revolutionizing the solar finance landscape, with online transfers occurring, and nuanced techniques to maximize value developing.

The Inflation Reduction Act (IRA), a key initiative of President Biden’s administration, has introduced a transformative feature for the solar industry: The ability to transfer solar project tax credits from the project owner to other commercial entities with tax liabilities. Previously, tax equity models required the future owner of the tax credits to share in the project’s risk, a complex arrangement that has facilitated over a hundred billion dollars in U.S. solar projects.

This new transferability option simplifies the process significantly. It eliminates the need for the tax credit’s new owner to be a partner in the solar project; they only need to be able to utilize the tax credit. Theoretically, for smaller projects, the documentation should be simple. Larger, more financially intensive projects still require substantial legal expertise.

Some industry groups have found that for projects exceeding a certain size, traditional tax equity models may remain advantageous due to the opportunity to sell the project’s depreciation.

In October, Evergrow, a specialty finance company, announced their first IRA tax credit transfer. The transaction involved connecting high net worth individuals with Connecticut-based solar developer Davis Hill Development.

Larger deals in the solar tax credit transfer space are happening as well, as demonstrated by Blackstone and Bank of America’s agreement to transfer $580 million worth of tax credits, funding $1.5 billion in solar and wind projects.

For insights into this evolving market, pv magazine USA consulted Adam Shor, a boutique finance consultant who works on smaller projects, and tax attorney David Burton of Norton Rose Fulbright.

Adam Shor noted a growing demand for tax credits, influencing the tax equity market.

Some deals that I previously would have seen as a “tax equity” deal are now “tax credit transfer” deals. This is due to the perceived simplicity of a transfer deal, but more practically speaking, it’s easier to attract a transfer credit buyer than a tax equity investor.

Shor highlighted that tax credit transfer deals, often simpler purchase and sale agreements, are becoming more popular due to their straightforward nature compared to tax equity partnerships. These partnerships require deeper involvement and understanding of the long-term risks in solar projects. In contrast, transfer deals cut down on complexity and documentation, with term sheets typically a third of the length of those in tax equity deals. This efficiency makes these transfers appealing to investors seeking the financial benefits of tax credits without deep operational involvement.

David Burton noted that certain large-scale deals, particularly in areas with high solar radiation and lower labor costs, are opting for the performance tax credit (PTC) over the standard investment tax credit (ITC). This choice is seen in projects where the PTC, applied over the first ten years of a project’s life, offers greater benefits.

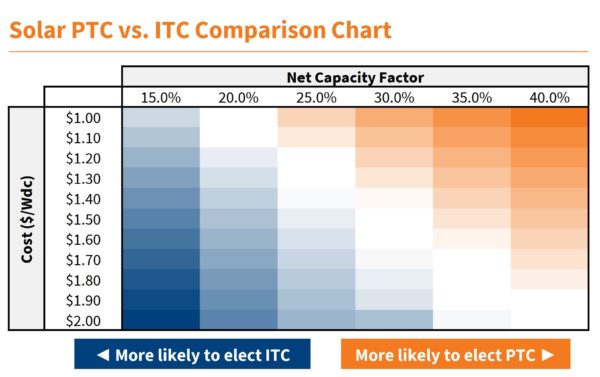

An analysis by the CRC-IB team [pv-magazine-usa.com] indicated that projects with higher capacity factors and lower cost might benefit more from the PTC. Conversely, smaller projects in lower capacity markets would likely gain more from the ITC.

Shor has observed tax credit prices for smaller projects (under $15 million) hovering in the 85 to 90 cents on the dollar range. In contrast, Burton’s team at Norton Rose Fulbright sees similar pricing for newer technologies like renewable natural gas and CO2 capture. For larger, standard solar and wind projects with strong indemnity and solid balance sheets, the prices are slightly higher, often in the mid to low 90 cents per dollar range.

Both experts agree on the increasing necessity of insurance in these transactions. However, the insurance focus isn’t on the project’s completion but on ensuring the project’s eligibility for tax credits. Burton noted:

The insurer is covering risks like how much of the project’s basis is ITC-eligible, whether the project began construction before January 29, 2023 to be grandfathered from compliance with the prevailing wage and apprentice rules, or whether the project satisfied the “80/20” repowering test in order to qualify for tax credits, despite the predecessor project having qualified for tax credits.

The team at Norton Rose Fulbright has extensively covered this topic in a detailed article.

An essential aspect of tax transfer finance is that developers and project owners must fully fund their projects initially. Credit buyers typically prefer to finance projects as late in the year as possible, with December 15th being a common deadline. Bridge loan financing is becoming available for the tax credit transfer amounts to approved customers.

To conclude, Shor emphasized a critical strategy for solar developers aiming to maximize their commissions: understanding and leveraging the “step up” in tax credit transfer deals. Unlike traditional tax equity deals, transfer deals typically do not accommodate a “step up” due to legal penalties for claiming excessive credits. The “step up” refers to the difference between the cost basis and the fair market value basis of an asset, which can significantly impact a developer’s financial return.

Many developers are adopting what’s informally known as a “t-flip” (tax equity flip) strategy. This involves initially selling the project into a traditional tax equity partnership to benefit from some level of a step up and monetize the available depreciation. Subsequently, the credits are transferred from the tax equity partnership to a third-party buyer solely interested in the tax credit aspect. This method allows developers to distribute risk, reduce the initial tax equity investor’s investment, and maximize benefits from the sale of the project’s tax advantages.

This approach underscores the nuanced strategies solar developers can employ to optimize their returns in the evolving landscape of solar tax credit finance.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: [email protected].