(Bloomberg) — Arm Ltd. has decided against selling shares on the London Stock Exchange for now, dealing a blow to UK politicians who were lobbying the home-grown technology giant ahead of its initial public offering.

Most Read from Bloomberg

The SoftBank Group Corp.-owned company will instead focus on a sole listing in New York for Arm later this year, people familiar with the matter said, asking not to be identified because the information isn’t public. The company is keeping its headquarters in Cambridge, England, for the time being and hasn’t ruled out the potential for a secondary listing in London down the road — but one is not likely, the people said.

SoftBank declined to comment. The company was aiming last year for a valuation of at least $60 billion for Arm, people familiar with the matter said at the time.

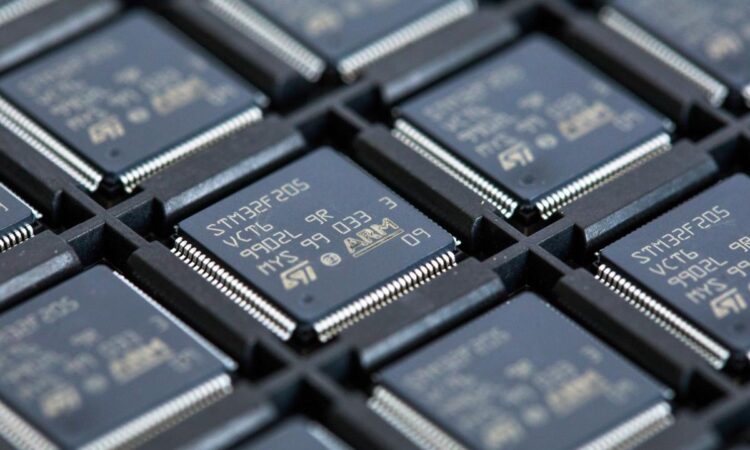

Arm is a jewel of the UK tech industry. Its technology is found in most of the world’s smart phones and is pervasive across the electronics industry. Tokyo-based SoftBank’s $32 billion deal to buy the business in 2016 came with promises that it would create more UK jobs and leave the headquarters where it was. UK Prime Minister Rishi Sunak has been courting the company and its backer for a listing on the London Stock Exchange.

Sunak’s office didn’t immediately respond to a request for comment.

SoftBank founder Masayoshi Son has repeatedly said his primary focus is to take Arm public in the US because of its deep investor base and attractive valuations. He had considered a secondary listing in London after political appeals. Still, turmoil in the UK government, which went through three prime ministers last year, obstructed talks.

Julia Hoggett, Chief Executive Officer of the London Stock Exchange Group, said in July that she was lobbying hard for an Arm listing.

“We’ve been working very hard. I describe the energy that I have to winning anything as being that we have to be young, scrappy and hungry,” she said in the interview on Bloomberg Television. “We should absolutely fight for anything that we think we have a compelling strategy to propose.”

The LSE didn’t immediate respond to a request for comment.

–With assistance from William Shaw, Emily Ashton and Giles Turner.

(Updates with requests for comment in the fifth and last paragraphs)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.