(Bloomberg) — Slovakia risks being punished in financial markets if it doesn’t take steps to roll back spending and rein in the biggest budget gap in the European Union, Prime Minister Ludovit Odor said in an interview.

Most Read from Bloomberg

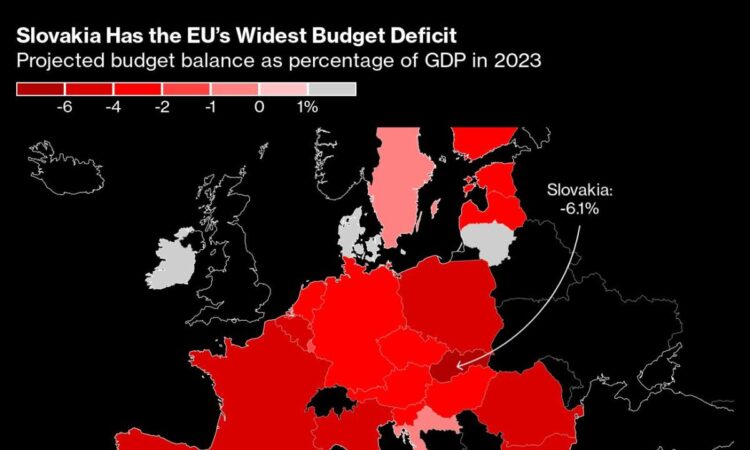

The euro member country’s deficit is projected to top 6% of gross domestic product this year, the widest in the bloc and Slovakia’s biggest shortfall in over a decade.

“If we continue like this, the financial markets could punish us in the future,” the 46-year-old former central banker told Bloomberg in Bratislava on Tuesday. “For now, they trust us because they believe that the recovery plan will come.”

Odor, who took power last month and will stay in office until a snap election on Sept. 30, said his caretaker administration will prepare a set of measures to get the country’s spending back on track, regardless of what ruling coalition emerges after elections. His administration faces an initial confidence vote as early as Wednesday.

Slovakia sold €2 billion ($2.2 billion) of 10-year bonds two weeks ago, with demand topping €7.7 billion. The yield on the notes traded around 3.8% on Wednesday, putting the nation’s cost of borrowing on par with lower-rated Greece. A little over two years ago, Slovakia was hardly paying any premium versus benchmark German bunds.

The nation’s public debt is projected to rise to 59% of gross domestic product this year from 48% in 2019 on spending related to the Covid-19 pandemic, the war in neighboring Ukraine and efforts to ease the cost-of-living crisis after inflation surged to nearly 13% last year.

“Slovakia has no choice but to consolidate,” Odor said. “Public finances are not in good shape.”

Changes being prepared include a shift to targeted state aid and social payments, he said. Other proposals include higher taxes on consumption and a removal of various tax exceptions, he added.

‘Party Over’

“Nobody takes the approved budget seriously,” Odor said. “We need to communicate that the party is over.”

The Council for Budget Responsibility, a fiscal watchdog, said this month that Slovakia needs to improve the general government balance by 6% of GDP to secure long-term sustainability of public debt.

Slovakia is rated A2 by Moody’s Investors Service and A+ at S&P Global Ratings, which earlier this month changed the outlook on the nation’s debt to stable from negative.

Still, it’s yet to be seen what impact Odor’s plans will have on the nation’s public finances, with parties that now lead opinion polls showing no desire to cut public spending.

Parties led by Robert Fico and Peter Pellegrini, respectively, have pledged to increase state spending to protect Slovak businesses and households from the consequences of Russia’s invasion of Ukraine and shocks in the global economy.

–With assistance from Zoe Schneeweiss and Krystof Chamonikolas.

(Recasts with market reaction, chart)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.