Rocket Lab USA, Inc. (NASDAQ:RKLB) Q4 2022 Earnings Call Transcript February 28, 2023

Operator: Good afternoon, and thank you for attending today’s Rocket Lab Fourth Quarter 2022 Financial Results Update and Conference Call. My name is Daniel, and I will be the moderator for today’s call. All lines will be muted during the presentation portion of the call, with an opportunity for questions and answers at the end. It is now my pleasure to hand the conference over to our host, Colin Canfield and Head of Investor Relations. Colin, please proceed.

Colin Canfield: Hello, everyone. We’re glad to have you join us for today’s conference call to discuss Rocket Labs Fourth Quarter and Full Year 2022 Financial Results. Before we begin the call, I’d like to remind you that our remarks may contain forward-looking statements that relate to the future performance of the company, and these statements are intended to qualify for the Safe Harbor protection from liability established by the Private Securities Litigation Reform Act. Any such statements are not guarantees of future performance and factors that could influence our results are highlighted in today’s press release and others are contained in our filings with the Securities and Exchange Commission. Such statements are based upon information available to the company, as of the date hereof and are subject to change for future developments.

Except as required by law, the company does not undertake any obligation to update these statements. Our remarks and press release today may also contain non-GAAP financial measures within the meaning of Regulation G enacted by the SEC. Included in such release is a reconciliation of these non-GAAP financial measures to the comparable financial measures calculated in accordance with GAAP. This call is also being webcast with a supported presentation. A replay and copy of the presentation will be available on our website. Our presenters today are Rocket Lab’s Founder and Chief Executive Officer, Peter Beck, and Chief Financial Officer, Adam Spice. After our prepared comments, we will take questions. And now, let me turn the call over to Mr. Beck.

Peter Beck: Thanks very much, Colin. So welcome everybody and thank you for joining us today. Today’s presentation will go over our key business accomplishments for the year of 2022, as well as specific highlights from the fourth quarter. We’ll also discuss further achievements we’ve made since the end of the quarter. Adam will then talk you through our financial results for the fourth quarter and full year and also cover the financial outlook for 2023. After that we’ll take questions and finish today’s call with the upcoming conference we’ll be in attending. All right. On to what the company achieved in 2022. Starting with a quick recap of our launch activity for 2022. It was our busiest year of launches yet. We retained our position as the leading small launch vehicle globally.

And once again Electron held the title of second most frequently launched US Rocket annually. Across nine electron launches, we deployed more than 40 satellites to precise orbits for our customers, including commercial constellation, operators NASA and the Electron . Across these launches, we had 100% mission success rate for the year, providing our customers with a reliable path to orbit. 2022 was also the year we successfully delivered the CAPSTONE mission to the moon for NASA with a launch plus spacecraft solution using Electron and Photon. We completed two successful ocean recoveries of Electron’s first stage as part of our rocket reusability program. We conducted five successful missions for constellation operators. We put all three Electron pads to use including our first launch out of LC-2 in Virginia in Q4 which was statistically launched in Q1 2021.

And we also caught Electron with a helicopter for the first time. More on each of these achievements later in the presentation. As mentioned in 2022, we reached our highest annual launch cadence with nine missions, assuring that Electron remains the global market leader in small launch. With 100% mission success in 2022, Electron is the most reliable dedicated small launch vehicle globally. As of 31st December 2022, we’ve completed 32 electron missions and deployed 152 satellites. I’m pleased to say that, both those numbers have already increased thanks to another successful mission in Q1 2023. 2022 was also the year that Electron mission beyond Earth orbit and for the first time successfully deploying the CAPSTONE mission to the moon for NASA.

This mission was far from just the standard electron launch. It was a highly complex mission that showcased our strength as an end-to-end space company, not just a launch provider. In addition to providing the launch for Electron, on Electron our team developed and built and operated the Luna Photon a highly capable interplanetary spacecraft that set CAPSTONE on a course to the moon. And the team developed a highly efficient lunar trajectory to enable such a small rocket to transport a payload into orbit. Rocket Lab is the only small provider to have designed, built, launched and operated its own satellites in orbit further expanding our total addressable market. The CAPSTONE mission is the first to launch NASA’s atoms program to return humans to the moon and we’re immensely proud to have enabled this crucial first step.

Just 15 days after launching CAPSTONE, our most complex mission to date the team turned around the next launch, which was a dedicated national security mission for the NRO. This rapid launch turnaround not only set a Rocket Lab record, but is by far the fastest turnaround between successful launches for any other small launch provider. Overall in 2022, we averaged a launch approximately every 40 days compared with a launch nearly every 60 days in 2021. And from April to November last year we successfully had a launch every month. So far I’ve touched on some of the key launch achievements for 2022, but it was also a significant year of growth for our space systems under the business. More than 200 spacecraft were launched in 2022, featuring Rocket Lab Space Systems products including reaction wheels, star trackers, ratios, solar power, light software, separation systems and more.

Rocket Lab technology was featured in one form or another on 30% of globally addressable launches in 2022, demonstrating the success of our strategy to extract value from the full space chain not just from our own launches. We delivered space systems products to more than 60 customers globally, spanning commercial and government sectors. In 2022, we built a new space system production lines including one to support high-volume reaction wheel production to serve mega constellation customers, and a new satellite manufacturing facility at our Long Beach headquarters. 2022 was the year that really submitted Rocket Lab’s position as a leading spacecraft manufacturer. We have more than 25 spacecraft in development for various customers, including NASA our NASA mission to Mars communications constellation for Globalstar and space manufacturing satellites and home orbits depots.

To achieve, this we’ve scaled our space systems team expanded our manufacturing and development facilities, and of course integrated, our four space system acquisitions into our spacecraft programs. And finally, before we wrap up the full year highlights and dive into the fourth quarter in more detail. In 2022, we saw backlog more than doubled from $241 million at the end of 2021 to more than $500 million at the end of Q4 2022, with growth driven by healthy mix of launch and Space Systems bookings. So with that, let’s move on to the key accomplishments of 2022’s fourth quarter in more detail. The final quarter of 2022 saw our successful launch of two Electron missions delivering satellite to orbit for the Swedish National Space Agency and General Atomics.

We were also honored to be selected by NASA to launch two dedicated Electron missions to deliver the TROPICS mission to orbit to monitor hurricanes and tropical storms. In Q4, we also received the required licenses and approvals for our first mission from Launch Complex 2 in Virginia. There was a long road to bring LC-2 into operations, but with those approvals in place at the end of the year we’re able to launch the first Electron mission from US soil early 2023. To top that off we also introduced Rocket Lab National Security, a new subsidiary to deliver reliable launch services and space systems capabilities to US government and APOLLO. We signed our largest order of satellite separation systems in the company’s history totaling $14 million in hardware to serve the Space Development Agency’s Tranche 1 Transport Layer.

It was also the quarter that CAPSTONE reached lunar orbit signaling final mission success for the NASA mission more than five months after the successful launch on Electron. We also got testing underway at the NASA Space Center for Archimedes engine hardware and completed construction of the new satellite production line and clean room at our Long Beach headquarters. Okay. Let’s start off with the key achievements in Q2 — in Q4 for Electron. We rounded out 2022 with two successful Electron launches in Q4. Both missions were from Launch Complex 1 and saw our total launch tally for the year reached nine successful missions as mentioned. This is a significant increase in launch cadence from six missions in 2021. And we look forward to continuing to increase our cadence in 2023.

Electron is already a trusted launch provider to NASA having successfully delivered missions to lower orbit and to the moon for the agency previously. So once again we’re honored where NASA entrusted Electrons to deploy the remaining spacecraft in the TROPICS constellation across two dedicated missions. This is a constellation close to our hearts because it aims to enable scientists to study hurricanes, tropical storms and ultimately leading to improved modeling and prediction to help save lives and livelihoods in the path of storms. These missions are scheduled to launch no earlier than May this year and we look forward to sharing more about them in the lead up to launch. In November, during our final mission for 2022 we conducted another successful slash down in ocean recovery of Electron’s first stage as part of our Rocket reusability program.

We had initially planned to attempt a helicopter catch for this mission, but not all the requirements were met to ensure a successful capture due to a brief telemetry loss with Electron’s first stage during atmospheric reentry. This turned out to be quite a happy turn of events as it gave us another chance to bring back a stage that had been postponed. We never want to lose an opportunity. Our team the return stage and components through analysis and testing. And we’re starting to see a bit of a pattern here that we had initially expected. Electron survived an ocean recovery in remarkably good condition. And in a lot of cases it’s components actually pass requalification for flight. In one of our upcoming flights we’re going to attempt another ocean recovery.

This time we have a few additional waterproofing modifications to the stage to protect some of the key areas and the bits we want to keep dry. In is outcome of testing and analysis at this stage the mission may move us towards sticking to sticking with marine recovery altogether and introduce significant savings to the whole operation. In 2022 we proved that it was possible to run over with a returning stage mid-air and get it on the helicopter hook. But if we can save ourselves the extra step by just plucking out in water we will. Without the helicopter if we’re able to determine that ocean recovery is the most viable and effective path to recovery this opens up even more flexibility with our launch windows and takes us from around 30% of Electron emissions been suitable for recovery to anywhere between 60% and 70%.

We look forward to sharing the development of this following our next recovery mission in the coming months. Moving on to Neutron achievements for the fourth quarter of 2022. In Q4, we officially opened the Archimedes Test Complex at NASA Stennis Space Center in Mississippi. The site will be home to engine testing for Neutrons Archimedes engines and the team made fire at the site for the first time before the end of the year with the commencement of our figuring those hardware testing. Q4 sourced the major movements at NASA Wallops Flight Facility for Neutron, including the completion of our first Neutron development building, which will be home to some stage assembly and integration activity. The team also started moving dirt at the side of Neutron launch pad with construction moving into full swing now that we’re in the New Year.

We also started to see some really exciting hardware development in Q4 with carbon composite structures for Neutron first stage and different stages in production. As you can see here, we’re working on a much bigger scale in Electron but we’ve been able to take that deep composite experience we’ve developed with electron and use knowledge to rapidly streamline Neutrons development. We’re designing Neutron to be the world’s first carbon composite large launch vehicle with the lightest and highest-performing in history. And we say light, I mean really light. The vehicle is full tank combined, here you see an image. Two of those halves together weighs about the same as the Harley-Davidson motorbike, some 380 kgs, so incredibly high performance.

Moving on to — from launch onto space systems. In the final quarter of 2022, we had some great milestones with space systems including Rocket Lab hardware on 30% of all globally addressable launches. In the quarter alone more than 90 spacecraft launched to orbit featuring Rocket Lab’s Space Systems technology. One of the most exciting of those was the Artemis 1 launch of NASA’s SLS rocket in November. That mission featured Rocket Lab solar rays, satellite dispensers and software, helping support NASA’s goal of returning humans to the moon after the surface of the moon.

The SOCC will provide 24/7 monitoring and management of Globalstar constellation, including continuous satellite control and monitoring using Rocket Labs met ground data systems, satellite orbit determination, and maneuver planning, collision avoidance, orbit maintenance and current management. By designing and building — by designing and manufacturing Globalstar’s our spacecraft buses, delivering the flight and ground software solution in developing and supporting the spacecraft operation center, we’re once again executing on our strategy of going beyond launch to deliver complete space in mission solutions. And finally, in Q4, our solar team in Albuquerque, New Mexico delivered the final solar panels for the NASA gateway power in propulsion elements.

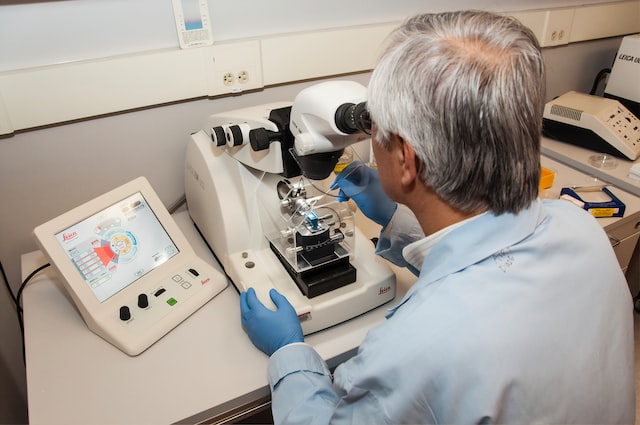

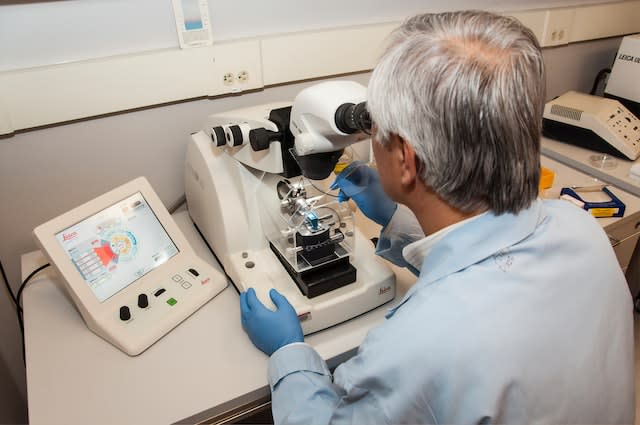

Photo by National Cancer Institute on Unsplash

These solar panels will enable NASA’s gateway lunar space station to be the most powerful electric propulsion spacecraft ever flown and they’re a critical part of returning humanity to the moon. That wraps up our Q4 2022, but we’ve been busy since then. So let’s take a quick look at some of the company’s key accomplishments so far in Q1 2023. Electron took to the Virginia skies for the very first time in January 2023, marking the beginning of Rocket Lab launches from the US. It was a successful mission that delivered three satellites for Commercial Constellation operator, HawkEye 360. This was a significant moment for us and for the small satellite industry as the new US launch pad represents even more flexibility and responsible launch capabilities for small satellite operators.

All three Rocket Lab launch pads across two hemispheres are now operational and we look forward to many launches from them all. With that, first LC-2 mission successfully launched, we’re on to the next. In fact, right now there are Rocket Lab both Launch Complex 1 and Launch Complex 2 appearing for a launch within a mere few days of each other. On Launch Complex 1 in New Zealand, we are preparing to launch two satellites for BlackSky Global and what will be our sixth mission for the constellation company. Meanwhile at Launch Complex 2 in Virginia, the team is preparing to launch a mission for Capella Space, a SAR constellation operator that we previously launched in 2020. Both missions are currently scheduled to launch and manage with launch windows to be finalized in the coming days based on final customer requirements and range status.

And while we have one rocket in the pad for Capella Space, we’ve just signed a multiple contract with them to launch another four dedicated Electron mission through 2023. These missions are on the top of our second launch for them coming up in March. So five launches to look forward to this year altogether. We’re honored that they’ve entrusted us with five missions in 2023 to help build their growing satellite constellation. The latest multi-launch deal with Capella Space further to meet our leadership position as the trusted small launch provider of choice for constellation operators. We’ve now launched and signed deals with some of the most prominent constellations and operators globally, demonstrating the value that Electron provides to these customers by offering reliable and flexible launch to tailored orbits.

Onto our Space Systems and we started the quarter strong by releasing two new space systems products, a new satellite radio and reaction wheels, specifically designed for constellation bus spacecraft. These products bolster our existing heritage and space system components and provide an entry point to new programs and mission profiles. This quarter we also formally established a new subsidiary, Rocket Lab Australia to explore opportunities to support the expansion of Australia’s national space capabilities. The Australian government has set a goal to triple the size of the Australian space sector from an estimated AUD 4 billion in 2016 to AUD 12 billion by 2030. To help facilitate this growth, the Australian government has committed more than 2 billion to the civil space sector since 2018, the program spending earth observation, satellite infrastructure, high-tech manufacturing in support of NASA’s Artemis program.

The Australian government has also committed 17 billion above and beyond the civil space investment for the development of defense-based capabilities. Rocket Lab has already played a key role in supporting Australia’s rapid growth in space through supplying launch and space system products to Australian organizations. By building on our deep expertise and proven heritage in the space sector, we’re well positioned to advance Australia’s capabilities in space. We have people in the ground already and we look forward to exploring opportunities where they make strategic sense for us as a business and where we can truly strengthen Australia’s position as a global space sector. On the Neutron front, this quarter we’ve made investments and progress into establishing manufacturing infrastructure that will support scale production of Neutron.

This includes composite tank molds for Stage 1 and 2 as well as the installation of large 3D printers and modeling machines to enable a record production of the Archimedes engine. Q1 2023 bought a welcome news in the form of a new acquisition strategy for the National Space Security launch. This is the Space Force’s program to launch the nation’s most critical and valuable government assets. Under NSSL Phase 3 RFP, which was released earlier this month new entrant launch vehicles qualified a bit for launches. Neutron is designed with NSSL launches in mind and we look forward to making Neutron available to meet the national security needs. This wasn’t a chance of good luck for us. We actively engaged NSSL on this to introduce this change on the back of our strong relationship with them.

The first vote of confidence in Neutron came back in September 2021, when we won a $24 million contract for the development contract the Neutron transfer stage through the Space Force’s Systems Command of Launch Enterprise, which falls under the NSSL program. The contract recognizes Neutron design to maximize NASA orbit capability or the launch session accuracy and response of dedicated launch of the US government all key requirements to the highest priority missions awarded through the NSSL. And I’m pleased to see this further strengthening of our relationship with this new path opened up. And finally before I hand over to Adam for the financial highlights, I’d like to share that David Cowan is wrapping up his time on Rocket Lab’s Board of Directors.

David is a partner at Bessemer Venture, our partner is one of our earliest investors and he joined Rocket Lab’s Board in 2014. Since then we’ve been grateful for his leadership and guidance as we grew Rocket Lab from a small start-up to a publicly listed company. It was a leading small launch provider and now global space systems firm. I’d like to personally thank David for his support and efforts at Rocket Lab over the past nine years and wish him the very best for his continued work in deep tech. And with that I’ll hand over to Adam to discuss the financial highlights.

Adam Spice: Great. Thanks Pete. I will first review our fourth quarter 2022 results and then discuss our outlook for the first quarter of 2023. Fourth quarter 2022 revenue was $51.8 million, which was within our initial guidance range of $51 million to $54 million and well above our revised guidance range of $46 million to $47 million provided in December. Fourth quarter 2022 revenue reflects growth of 88% over the year ago fourth quarter of 2021 and the result to successful launches and continued strong contribution for our Space Systems business. The overage to our revised guidance range was a result of higher than anticipated revenue recognition from a SolAero contract to a major prime contractor program. This closes out a very successful year with full year 2022 revenue of $211 million, up 239% from 2021 with launch in Space Systems finishing the year with revenue growth of 56 and 546% respectively.

Now turning to gross margins. GAAP gross margin for the fourth quarter was 3.5% below the low end of our original guidance range of 5% to 7%. Non-GAAP gross margin for the fourth quarter was 15%, which was also below our original guidance range of 16% to 18%. GAAP and non-GAAP gross margin results relative to both our revised guidance and to our Q3 2022 results reflects a combination of reduced launch cadence and related lack of fixed cost absorption below average revenue contribution from the Catch Me If You Can R&D recovery mission and unfavorable mix within our Space Systems components revenue. More specifically launch cadence was impacted by the pushout of the HawkEye 360 launch from the December quarter due to weather and other factors.

The below average revenue contribution from the successful Q4 2022 Catch Me If You Can recovery mission was a conscious decision to trade off acceleration of the Electron recovery margin improvement initiatives versus maximizing revenue from additional payloads that were taken longer to secure and integrate. Our current launch manifest and proven execution capabilities gives us confidence that we’ll see a return to growth and gross margin expansion in the launch segment of our business as we progressed through 2023. Lastly, the unfavorable mix within Space Systems was a result of the timing of revenue recognition under a legacy low-margin pre-acquisition SolAero contract with a major prime contractor. We anticipate significant top line growth to resume for our Space Systems segment in the second half of the year.

As we forecast to begin benefiting from more meaningful revenue contribution under the MDA Globalstar contract which brings with it gross margin uplift in addition to forecasting a beneficial mix and change in our Space Systems component revenues as our higher-margin component solutions contribute at a greater rate versus the lower-margin component solutions. We ended Q4 with 818 production-related headcount, up 21 from the prior quarter which positions us well to not only scale production, but also the resources to exploit margin expanding production efficiencies. Turning to operating expenses, GAAP operating expenses for the fourth quarter were $39.1 million at the low-end of our guidance range of $39 million to $41 million. Non-GAAP operating expenses for the fourth quarter were $27.3 million which was below our guidance range of $28 million to $30 million.

The decline in both GAAP and non-GAAP total operating expenses versus the third quarter, was primarily driven by an R&D grant benefit and lower stock-based compensation partially offset by increases in headcount and prototyping expenses supporting Neutron and Space Systems. In R&D specifically, GAAP expenses decreased by $2.5 million or 14% in the fourth quarter, driven by again R&D grant benefits and lower stock-based compensation. Non-GAAP R&D expenses were down $1.6 million or 13% quarter-on-quarter. We anticipate a return to sequential growth in R&D, as we ramp investment in our Neutron launch vehicle. Quarter ending R&D headcount was 348, representing an increase of 18 heads from September 30th 2022. In SG&A, GAAP expenses increased $1.1 million quarter-on-quarter or 5%, driven primarily by outside services, primarily owing to the first year SOX compliance related expenses.

Non-GAAP SG&A, expenses increased by $1.6 million or 10% quarter-on-quarter mostly driven by outside services as previously mentioned. Quarter ending SG&A head count was 197 represent an increase of one head from September 30 2022. On a year-on-year basis, GAAP operating expenses for the fourth quarter of $39.1 million were up $8 million or 26% year-on-year, while non-GAAP operating expenses of $27.4 million were up $7 million or 34% year-on-year. The growth in both GAAP and non-GAAP operating expenses were primarily driven by the acquisitions of ASI, PSC and SolAero which occurred in Q4 2021 and Q1 of 2022 as well as increase in staffing costs related to Neutron vehicle development, the Electron booster recovery initiatives and Photon development projects.

In R&D specifically, GAAP expenses decreased by $3.1 million or 25% in the fourth quarter, while non-GAAP expenses were up $2.6 million or 33% year-on-year. In SG&A, GAAP expenses increased $5 million or 26% year-on-year. Cash consumed from operations was $19 million in the fourth quarter, compared to $23 million in the third quarter. The sequential improvement of $4 million was driven primarily by improved cash collections during Q4. Purchases of property, equipment and capitalized software licenses increased from $8 million in Q3 to $15 million in Q4. These investments are primarily aimed at new equipment facilities underpinning our Neutron development initiative and expansion of our Photon production capabilities. Overall, non-GAAP free cash flow consumption in the fourth quarter was $33.9 million compared to $31.3 million in the third quarter.

The ending balance of cash, cash equivalents, restricted cash and marketable securities was $484.3 million at the end of the fourth quarter. With that, let’s turn to our guidance for the first quarter of 2023. We expect revenue in the first quarter to range between $51 million and $54 million, which reflects $32 million to $35 million of contribution from Space Systems and $19 million of contribution from Launch Services, which assumes three launches or two remaining launches in the quarter. One of the three launches forecasted in Q1 was a successful January HawkEye 360 mission out of LC-2 in Virginia, which was a partially filled rideshare mission, where similar to an R&D mission we made a conscious choice to focus on expediting our first-ever LC-2 launch versus maximizing revenue by filling the rest of the mass capacity on the launch vehicle.

Based on our manifested launch backlog, we expect our average selling price to increase back to our standard pricing as we progress through the remainder of 2023. We expect first quarter GAAP gross margins to range between negative 5% and negative 3% and non-GAAP gross margins to range between positive 7% and 9%. These forecasted GAAP and non-GAAP gross margins reflect greater contribution from our Launch Services segment, as well as lower margin product mix within our Space Systems segment. We expect first quarter GAAP operating expenses to range between $44 million and $46 million and non-GAAP operating expenses to range between $33 million and $35 million. This quarter-on-quarter increase was driven primarily by increased R&D staff costs and prototype expenses related to accelerated investments in the Neutron launch vehicle development and scaling up our Photon product family.

We expect first quarter GAAP and non-GAAP net interest expense to be $1 million. We expect first quarter adjusted EBITDA loss to range between $28 million and $30 million and basic shares outstanding to be approximately 476 million shares. And with that, I’ll turn it back to the operator for questions.

See also 13 High Growth Consumer Stocks to Buy and 12 Most Profitable Mid-Cap Stocks Now.

To continue reading the Q&A session, please click here.