Is a new European energy crisis brewing? Some observers in financial publications we follow have speculated recent natural gas spikes may lead to higher energy bills (or worse) for the Continent this winter.[i] But in our view, short-term volatility notwithstanding, natural gas prices don’t seem set to soar from here, which likely renders this another brick in the young bull market’s (a long period of generally rising equity prices) proverbial wall of worry.

European natural gas prices have risen since early August, including some big daily jumps like the 28% spike from €28.38 per megawatt hour (Mwh) to €36.26 Mwh from 8 – 9 August.[ii] We have seen some observers pin rising prices on potential labour actions at a couple of Australia’s liquefied natural gas (LNG) facilities, suggesting this could take some Aussie LNG production offline (about 10% of global supply).[iii] The Land Down Under is one of the world’s biggest LNG exporters, accounting for about 20% of the global market—with most of its shipments going to Asia.[iv] Some outlets we follow posit the potential industrial action in Australia could send Asian buyers elsewhere, increasing competition for limited global supply, allegedly pushing energy prices up for the foreseeable future—and potentially keeping European energy bills high this winter.

We think strike chatter perhaps did hurt sentiment, contributing to European natural gas prices’ recent rise. But we find commodity markets, like the stock market, can be volatile in the short term—according to our research, prices may rise or fall for any (or no) reason on a daily basis. Also, labour strikes aren’t a given: Negotiations remain ongoing, so the widely discussed negative outcome may not even manifest.[v]

To us, this seems like a rehash of 2022’s European energy crisis forecasts, which dotted publications we follow last year. After Russia’s invasion of Ukraine last year, many forecasters we follow argued retaliatory Western sanctions would lead to severe energy shortages on the Continent. But that didn’t happen. The EU found alternative LNG supply sources, particularly from the US and Qatar.[vi] Prices fell below pre-invasion levels, rationing never happened and European economies by and large got on with life.[vii]

But recycling fears is a bull market hallmark, according to our studies of market history, so it doesn’t surprise us that some economic analysts we follow now say 2023 will be the real test for Europe despite all of its progress. The EU just hit its target of filling gas storage facilities to 90%, almost three months ahead of its 1 November deadline.[viii] However, storage facilities at capacity would cover only 25% – 30% of projected wintertime EU gas consumption, so we have read a few observers argue wobbling LNG supply abroad leaves Europe’s energy situation fragile and uncertain.[ix] We don’t dismiss the possibility production disruptions and/or severely cold weather lead to much-higher gas prices. But we think it is equally possible prices don’t soar thanks to another mild winter, better conservation than expected and/or higher production. For example, some small-scale floating LNG projects in the US and Africa could boost gas supply this year, helping offset potential headwinds elsewhere.[x]

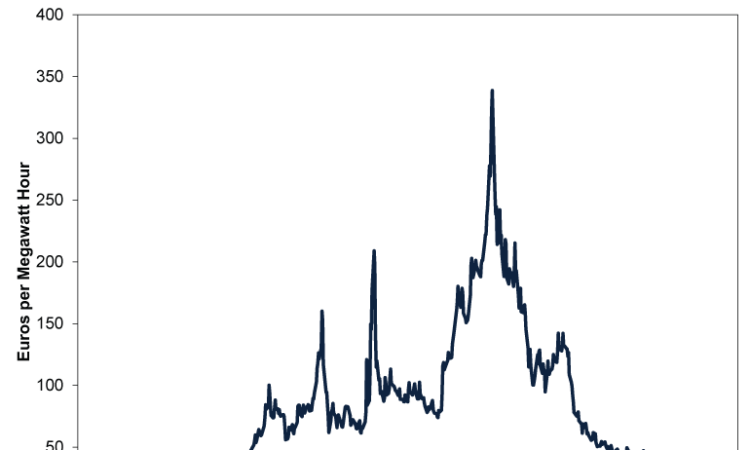

Note, too, today’s prices are a far cry from last year’s all-time high levels even with the recent rise. (Exhibit 1) If gas prices nearly 10 times today’s didn’t drive the eurozone’s economy into a deep ditch, we doubt recent wiggles will do much.[xi] Europe got through that tough period without resorting to rationing or blackouts. History won’t necessarily repeat (indeed we find it never does, exactly), but we don’t think it beneficial if investors underestimate Europe’s ability to adapt again if necessary.

Exhibit 1: European Natural Gas Prices

Source: FactSet, as of 18/8/2023. Dutch TTF natural gas price in euros, 31/12/2020 – 17/8/2023.

[i] Source: FactSet, as of 18/8/2023. Dutch TTF natural gas prices, 31/7/2023 – 18/8/2023.

[ii] Ibid. Dutch TTF natural gas prices, 1/8/2023 – 9/8/2023.

[iii] “Explainer: How Would a Strike at Australian LNG Facilities Affect Gas Markets?” Marwa Rashad, Reuters, 10/8/2023. Accessed via MSN.

[v] “Woodside Says ‘Constructively Addressed’ Worker Concerns as It Seeks to Avert Strike,” Praveen Menon and Renju Jose, Reuters, 21/8/2023. Accessed via Yahoo! Finance.

[vi] “Explainer: Europe’s Energy Security Better Than Feared After a Year of War in Ukraine,” Kate Abnett, Reuters, 24/2/2023. Accessed via Yahoo! Finance.

[vii] Source: FactSet and Eurostat, as of 22/8/2023. Dutch TTF natural gas prices, 30/6/2021 – 30/6/2023 and eurozone gross domestic product (GDP) growth rate, quarter-over-quarter change, Q3 2022 – Q2 2023. Gross domestic product is a government-produced measure of economic output.

[viii] “EU Reaches 90% Gas Storage Target Ahead of Winter,” Directorate-General for Energy, European Commission, 18/8/2023.

[x] “Baseline European Union Gas Demand and Supply in 2023,” IEA, December 2022.