We feel now is a pretty good time to analyse Americas Gold and Silver Corporation’s (TSE:USA) business as it appears the company may be on the cusp of a considerable accomplishment. Americas Gold and Silver Corporation, together with its subsidiaries, engages in the exploration, development, and production of mineral properties in North America. On 31 December 2022, the CA$144m market-cap company posted a loss of US$43m for its most recent financial year. The most pressing concern for investors is Americas Gold and Silver’s path to profitability – when will it breakeven? We’ve put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

See our latest analysis for Americas Gold and Silver

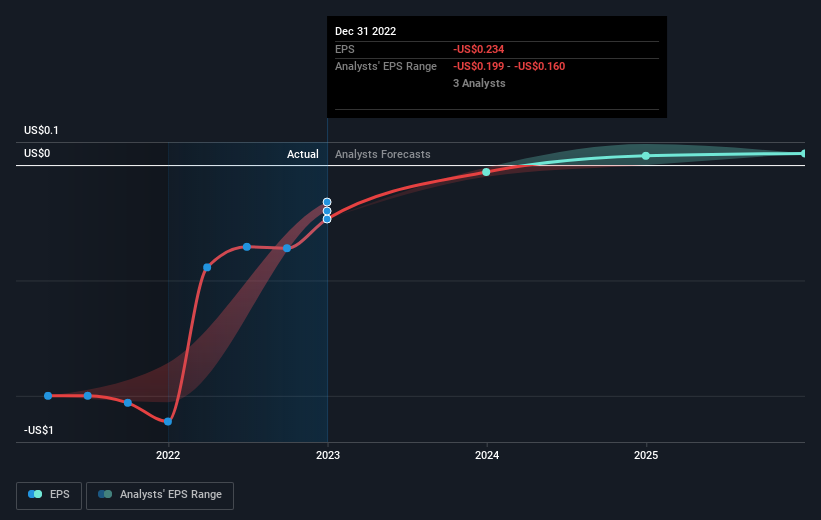

Consensus from 4 of the Canadian Metals and Mining analysts is that Americas Gold and Silver is on the verge of breakeven. They expect the company to post a final loss in 2023, before turning a profit of US$8.5m in 2024. Therefore, the company is expected to breakeven just over a year from today. How fast will the company have to grow each year in order to reach the breakeven point by 2024? Working backwards from analyst estimates, it turns out that they expect the company to grow 113% year-on-year, on average, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

We’re not going to go through company-specific developments for Americas Gold and Silver given that this is a high-level summary, but, keep in mind that generally a metal and mining business has lumpy cash flows which are contingent on the natural resource mined and stage at which the company is operating. So, a high growth rate is not out of the ordinary, particularly when a company is in a period of investment.

One thing we’d like to point out is that The company has managed its capital judiciously, with debt making up 13% of equity. This means that it has predominantly funded its operations from equity capital, and its low debt obligation reduces the risk around investing in the loss-making company.

Next Steps:

There are too many aspects of Americas Gold and Silver to cover in one brief article, but the key fundamentals for the company can all be found in one place – Americas Gold and Silver’s company page on Simply Wall St. We’ve also compiled a list of essential factors you should further research:

-

Valuation: What is Americas Gold and Silver worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Americas Gold and Silver is currently mispriced by the market.

-

Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Americas Gold and Silver’s board and the CEO’s background.

-

Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here