Amidst a backdrop of global market fluctuations and specific challenges within the UK economy, investors are keenly watching the FTSE 100’s movements and broader economic indicators. In such a climate, identifying undervalued stocks becomes crucial as they may present opportunities for value in an otherwise uncertain environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

|

Name |

Current Price |

Fair Value (Est) |

Discount (Est) |

|

Kier Group (LSE:KIE) |

£1.362 |

£2.71 |

49.7% |

|

Morgan Advanced Materials (LSE:MGAM) |

£3.09 |

£6.08 |

49.2% |

|

Mercia Asset Management (AIM:MERC) |

£0.295 |

£0.58 |

49.1% |

|

LSL Property Services (LSE:LSL) |

£3.17 |

£6.00 |

47.2% |

|

CMC Markets (LSE:CMCX) |

£2.575 |

£5.15 |

50% |

|

Elementis (LSE:ELM) |

£1.41 |

£2.78 |

49.3% |

|

Loungers (AIM:LGRS) |

£2.83 |

£5.35 |

47.1% |

|

Nexxen International (AIM:NEXN) |

£2.465 |

£4.90 |

49.7% |

|

Aston Martin Lagonda Global Holdings (LSE:AML) |

£1.465 |

£2.82 |

48% |

|

eEnergy Group (AIM:EAAS) |

£0.0575 |

£0.11 |

48.1% |

Here’s a peek at a few of the choices from the screener

Overview: Keywords Studios plc offers creative and technical services to the global video game industry, with a market capitalization of approximately £1.81 billion.

Operations: The company generates revenue from three primary segments: Create (€336.07 million), Engage (€164.89 million), and Globalize (€279.49 million).

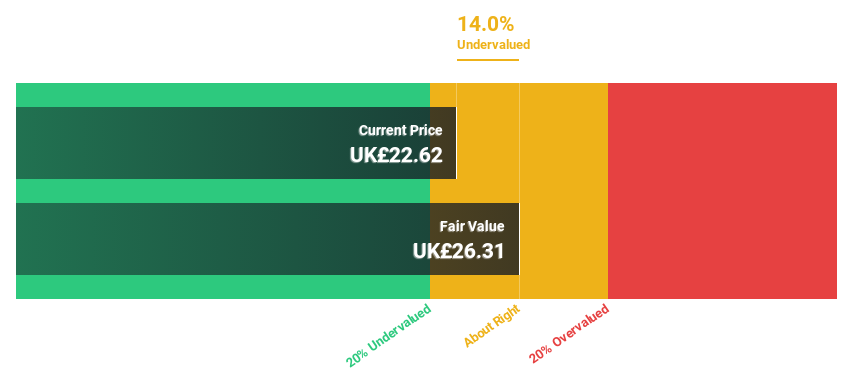

Estimated Discount To Fair Value: 14.0%

Keywords Studios, valued at £22.62, trades below its fair value of £26.31, suggesting undervaluation based on discounted cash flow analysis. Despite a volatile share price and lower profit margins year-over-year (2.6% from 6.9%), the company’s earnings are expected to grow significantly by 31.93% annually over the next three years, outpacing the UK market growth forecast (13.1%). Additionally, revenue is projected to increase by 9.6% annually, faster than the UK market’s 3.7%. Recent M&A discussions with EQT highlight potential valuation adjustments and strategic interest in Keywords’ future growth trajectory within the gaming industry.

Overview: Ibstock plc is a manufacturer and seller of clay and concrete building products, primarily serving the residential construction sector in the United Kingdom, with a market capitalization of approximately £620.69 million.

Operations: The company generates its revenue from two main segments: clay products, which brought in £292.22 million, and concrete products, contributing £113.62 million.

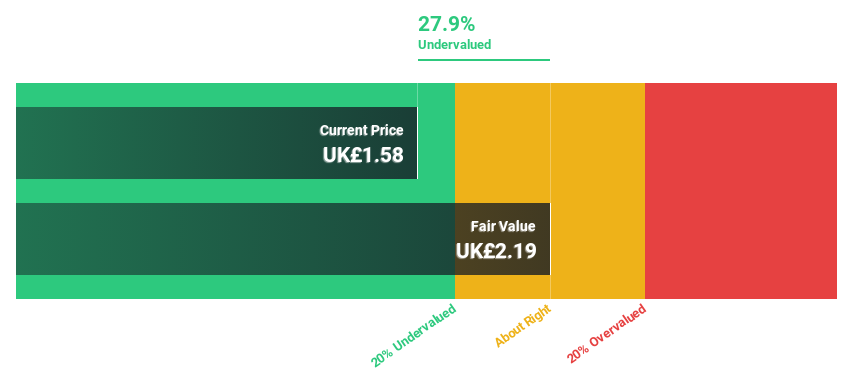

Estimated Discount To Fair Value: 27.9%

Ibstock, priced at £1.58, is valued below its calculated fair value of £2.19, indicating potential undervaluation based on cash flow analyses. Although its dividend coverage by earnings and cash flows is weak, the company’s earnings are expected to grow 26.41% annually over the next three years—twice the rate of the UK market average (13.1%). However, recent events include a dividend cut to 3.6 pence per share as approved in their last AGM on May 16, 2024.

Overview: The Sage Group plc, a company specializing in technology solutions and services for small and medium businesses across the U.S., the U.K., France, and globally, has a market capitalization of approximately £10.55 billion.

Operations: Sage Group’s revenue is primarily generated from North America (£1.01 billion), Europe (£0.60 billion), and the United Kingdom & Ireland (£0.49 billion).

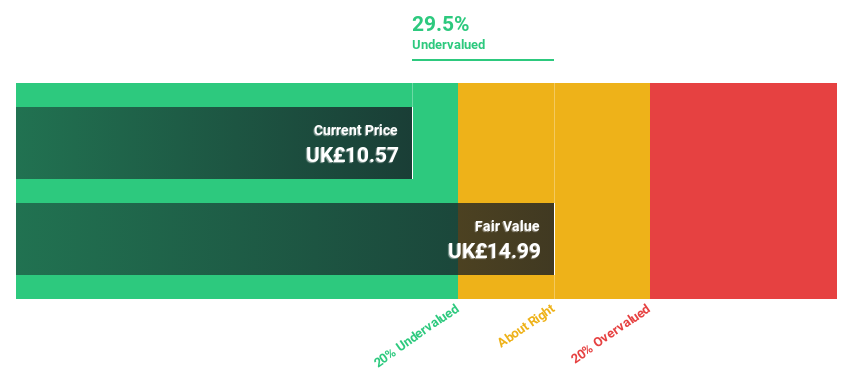

Estimated Discount To Fair Value: 29.5%

Sage Group, priced at £10.57, trades below its estimated fair value of £14.99, highlighting potential undervaluation based on discounted cash flows. Its earnings have expanded by 28.4% over the past year and are projected to grow by 14.32% annually. Despite this growth, Sage’s revenue increase of 8.2% per year is modest compared to higher market expectations but still outpaces the UK market forecast of 3.7%. Recent product enhancements in Sage Estimating and Intacct aim to boost operational efficiencies and financial control for users, potentially strengthening future revenue streams.

Key Takeaways

Ready To Venture Into Other Investment Styles?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:KWS LSE:IBST and LSE:SGE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com