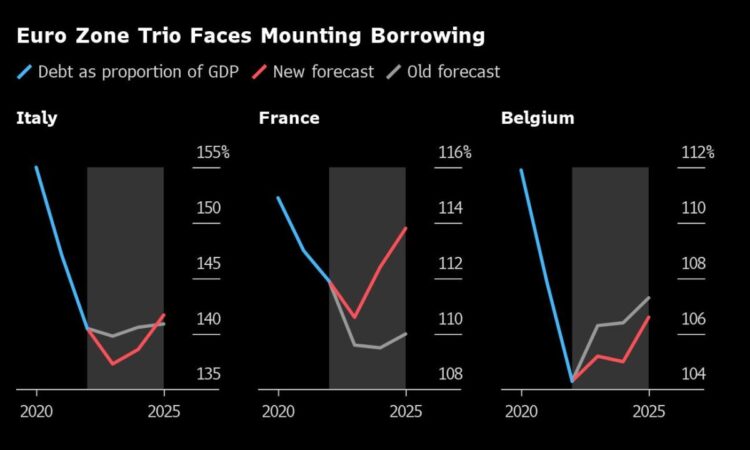

(Bloomberg) — Italy now faces a widening deficit and a jump in debt next year, according to European Union forecasts that conflict markedly with the rosier outlook of Premier Giorgia Meloni’s government.

Most Read from Bloomberg

A shortfall of 4.7% for 2025 projected by the European Commission on Wednesday would be one percentage point larger than that seen by the Treasury, which anticipated a result of narrowing.

Brussels officials predict that debt will surge by three percentage points in that time to reach a four-year high, also notably worse than the outcome foreseen in Rome.

That’s because they didn’t take into account planned asset sales on which details are lacking, EU Economy Commissioner Paolo Gentiloni told reporters. Finance Minister Giancarlo Giorgetti said separately that the EU outlook didn’t take into account the impact of recent measures.

“The deficit is expected to increase marginally to 4.7% of GDP in 2025, based on unchanged policies, on the back of a slowdown of current revenue and a further increase in interest expenditure,” the Commission said. It added that EU recovery fund cash “is set to sustain public investment.”

Both the outlooks of the Commission and the Treasury incorporate an assumption of current government policies because of the shift to a new timetable for assessment of budgets.

While that proviso gives Meloni and her coalition scope to improve things with remedial measures, the new forecasts suggest that officials in Brussels now reckon that her challenge in doing so is getting even harder.

It adds to pressure on the government to act as soon as its latest test of voter sentiment, the European Parliament elections in early June, get out the way.

One test after that ballot will come when the Commission issues recommendations later that month to countries whose deficits exceed 3% — a category that Rome itself anticipates Italy to fall within until at least 2026.

The Meloni government has tried to pursue a path of fiscal restraint accompanied by mild loosening, and acted quickly last year to limit a generous home-renovation measure that has cast a long shadow over its public finances.

The Commission attributed the jump in debt it foresees to the legacy of that policy, known as the superbonus. Italian lawmakers approved measures on Tuesday to spread out the impact of that policy over 10 years.

Giorgetti acknowledged that the superbonus is weighing on the public finances, but said that things are better than the EU outlook suggests.

“The European data on debt to GDP does not incorporate the effects of very recent measures that will have positive effects on our accounts,” he said in a statement.

The superbonus doesn’t pose the same sort of threat to the public finances that Greece faced when it succumbed to the region’s sovereign debt crisis more than a decade ago, Gentiloni told reporters after the briefing, according to Ansa.

“The measure will certainly have also had positive effects, but it got out of control and became dangerous,” he was cited as saying. “In our opinion the government is right to remedy it.”

The coalition’s approach won the confidence of investors, while ratings companies have kept outlooks stable ever since Moody’s removed the threat of a downgrade to junk.

The spread between Italy’s bonds and German equivalents, a key measure of risk in the region, narrowed earlier in 2024 to a two-year low.

The Commission did have some good news for Italy: it raised its growth forecast for this year by 0.2 percentage point to 0.9%, while trimming it only slightly to 1.1% for 2025. Consumer spending will be “subdued” but exports will contribute to expansion, officials said.

(Updates with Giorgetti in 4th paragraph, chart on growth)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.