The transition to sustainability will enable social, economic and financial prosperity and stability in the European Union (EU). The EU’s climate targets set out in the European Green Deal demonstrate its commitment to achieving a fair and prosperous future for all citizens. Achieving those goals requires mobilising significant private finance towards the sustainability objectives. Public finance also needs to work harder and smarter to shift the system and bring in more private finance. Policy choices will have to be made against a backdrop of challenging geopolitical, economic and social dynamics.

The EU has pledged to make Europe the first climate-neutral continent by 2050 under the European Green Deal. Moreover, it is committed to achieving a sustainable, fair and prosperous future for all Europeans. Those aims go hand-in-hand; the intensity of climate impacts is already showing us the costs of inaction – in both economic and human terms.

According to the European Commission’s own estimates, an additional €620bn per year in investments is needed to achieve these goals. That is double current projections, but the task is far from insurmountable. Much can be achieved by making sure more existing finance – both private and public – ends up in the right place.

A sustainable finance regulatory framework to mobilise more investment in the transition

The EU has shown excellent leadership in promoting ambitious sustainable finance legislation for the private sector. However, too much money is still paying for activity that runs counter to the goals of the transition. The existing regulatory framework is a good basis to work from, but needs to provide stronger incentives for investors to put their money towards sustainability objectives.

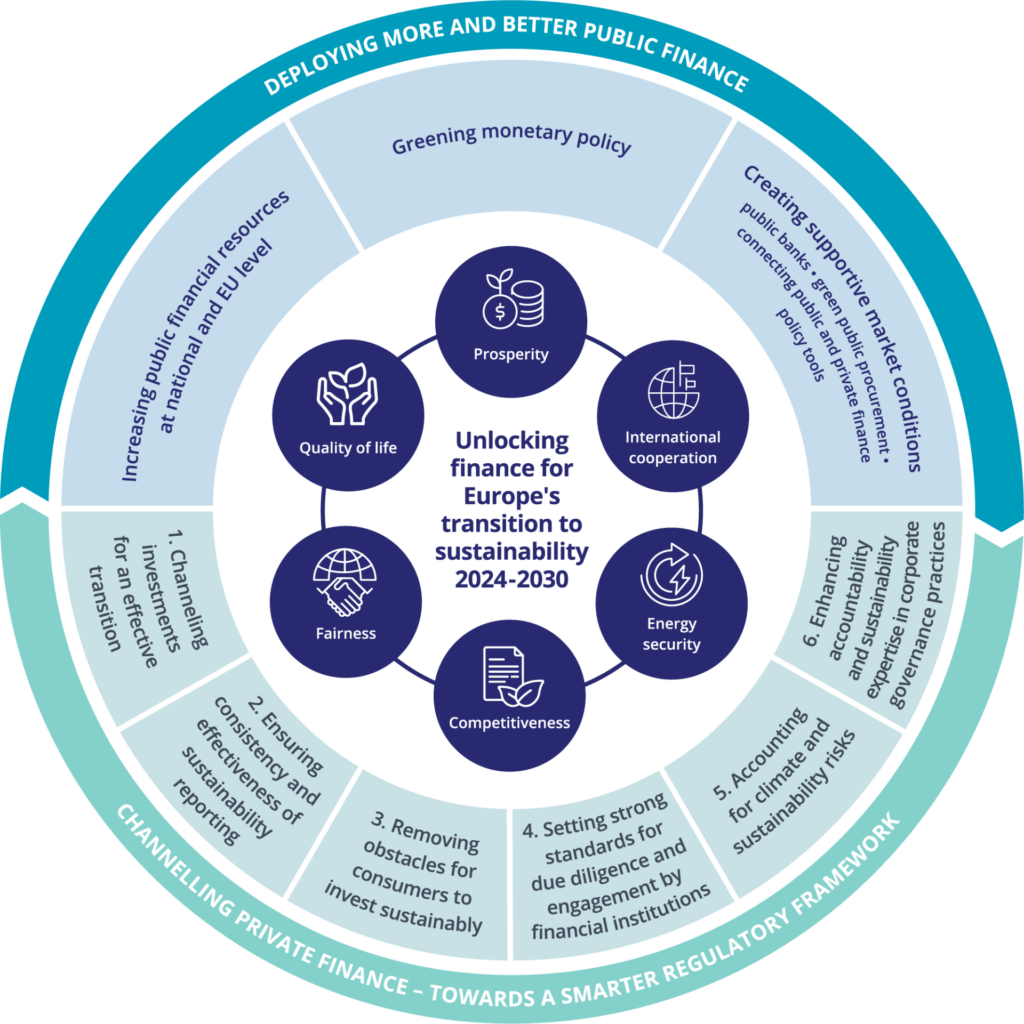

Our report provides detailed recommendations in support of six key objectives to make the system more coherent, predictable, and applicable to all potential users:

- Channelling investment for an effective transition.

- Ensuring consistency and effectiveness of sustainability reporting.

- Removing obstacles for consumers to invest sustainably.

- Setting strong standards for due diligence and engagement by financial institutions.

- Accounting for climate and sustainability risks.

- Enhancing accountability and sustainability expertise in corporate governance.

Putting public finance to work in support of the transition

Public finance needs to work in concert with private finance. It can help leverage private investment in the right areas, and is necessary to support the implementation of regulations that affect consumers and businesses. There are also areas – such as public services – that rely on public investment.

Our report links the opportunities for public finance to the private needs, and discusses:

- Why public finance is necessary, and how more can be made available for the transition at national and EU level.

- How monetary policy, including dual interest rates, can adapt to incentivise more investment in sustainable projects.

- How public funding can be deployed effectively, including through public banks, green public procurement, and applying private finance regulatory tools to public funding.

Sabrina Pignedoli MEP said on the launch of the report:

“I believe it is necessary to stimulate the financial sector with proactive policies to foster the green transition. In this regard, I consider the conclusions of the report ‘Investing in Europe’s Prosperity: A Vision for Financing the Transition to Sustainability to 2030’ especially significant.”

Read the report: Investing in Europe’s prosperity.

This report is a joint publication from E3G, ShareAction and WWF Europe Policy Office. Our organisations have drawn on our respective areas of expertise to address the opportunities and challenges of the transition in this holistic way. The three organisations jointly developed the content and recommendations in the Introduction and Chapter 1 on private finance. Chapter 2 on public finance was led by E3G and reflects its views alone.

Authors collaborating with E3G on this report are Emily Ahmed and Marika Carlucci (ShareAction); Sebastien Godinot and Uku Lillevali (WWF).