A couple of days after having dinner with friends last summer, Jazzmin Golden was surprised to find a payment request pop up on her Venmo app.

The ask: $5 to help cover a bottle of wine.

“I was thinking, this is so petty,” said Golden, 34 of Los Angeles, who noted that she’s been getting more trivial payment requests during the past two years. “It’s important to be sensitive to your loved ones’ financial situation, but I don’t know. I find it really odd to nickel and dime your close friends and family.”

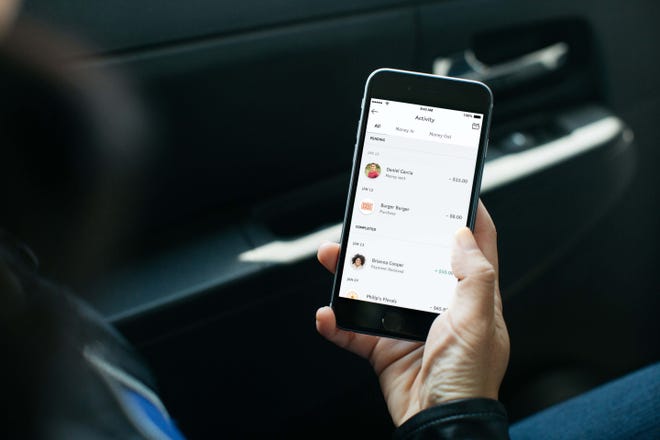

A recent study from Forbes Advisor found people are changing the way they use peer-to-peer payment apps like Venmo, Zelle and Cash App as high inflation dampens consumers’ spending power.

Consumer prices in December were up 6.5% from the year prior, according to the Labor Department.

Survey: Inflation is making more people lean on payment apps

More people are splitting costs with payment apps: About half (47%) of users say they’re using payment apps to split costs in ways they normally wouldn’t due to inflation, according to an online survey conducted on 1,000 U.S. adults in November by Forbes Advisor and OnePoll.

- Six in 10 of the surveyed 18- to 25-year-olds said they were turning to payment apps to split bills at least once a week, while the same held true for 58% of those in the 26- to 41-year-old group.

- Half of 26- to 41-year-olds and 53% of 18- to 25-year-olds say they rely on payment apps more often due to inflation. The majority of respondents in older age groups said they were not using payment apps more frequently due to higher prices.

What purchases users are splitting: Restaurant tabs, groceries and rent are the leading purchases split on payment apps for young adults.

- For users 18 to 25, 64% use payment apps to split restaurant bills and groceries, and 47% use the apps to split rent. Just 25% of users use the apps to split bar tabs.

- For users 26 to 41, 58% use the apps to split restaurant bills, 51% use them to split grocery costs and 37% use them to split payments for gas.

The prevalence of “petty” requests: Most users (86%) say anything under $5 isn’t worth requesting.

Nevertheless, about two out of five young adult users said they have received requests for a “petty amount.” A quarter of all users say they’ve had someone repeatedly request small payments.

Venmo tax reporting:IRS delays $600 1099-K tax reporting for Venmo, PayPal, CashApp and more

Payment app usage is up

What Venmo is saying: Paypal CEO Dan Schulman in November saidVenmo hit 57 million monthly active users, an 85% uptick over the past two years.

“With recent inflation levels, Venmo enables friends and family to easily support one another and share payments – whether it’s to chip in for gas or groceries, split the check for dinner, or shout a friend a coffee from afar,” reads a statement from a Paypal spokesperson Tom Hunter.

What Zelle says: Zelle is seeing customers use its payment app more often for “critical moments” like splitting bills and paying rent, “especially as people adjust to high inflation by living with family and friends,” according to Melissa Lowry, chief marketing officer of Early Warning Services, which owns and operates Zelle.

Zelle is also seeing more usage in areas like the gig economy and other necessities like splitting groceries.

What about Cash App: Cash App generated $774 million of gross profit in the third quarter, up 51% from the previous year, according to Amrita Ahuja, CFO of its parent company Block. Inflows (the money people put in their accounts, which includes peer-to-peer payments) grew 19% year-over-year to $52 billion, a new quarterly record.

Payment apps:Venmo, Cash and PayPal are free, but here’s who they are telling your business

Venmo scams:How to use a payment app without getting ripped off

You can follow USA TODAY reporter Bailey Schulz on Twitter @bailey_schulz and subscribe to our free Daily Money newsletter here for personal finance tips and business news every Monday through Friday.