The Federal Reserve officials’ cautious stance on inflation has not only delayed potential interest rate cuts but also affected market confidence and cast a pall on the Zacks Oil and Gas – Exploration and Production – United States industry. OPEC’s substantial spare capacity and Russia’s increasing oil exports to China, which rose 30% year on year in April, have added to supply concerns. The lowered oil demand projections for 2024 have further weighed on the space. Although macro challenges create uncertainties, there’s resilience in the sector, especially for operators prioritizing growth and operational efficiency. Diamondback Energy FANG, APA Corporation APA, Matador Resources MTDR and SM Energy SM emerge as stocks to watch, offering potential amid the prevailing economic headwinds.

About the Industry

The Zacks Oil and Gas – US E&P industry consists of companies primarily based in the domestic market, focused on the exploration and production (E&P) of oil and natural gas. These firms find hydrocarbon reservoirs, drill oil and gas wells, and produce and sell these materials to be refined later into products such as gasoline, fuel oil, distillate, etc. The economics of oil and gas supply and demand are the fundamental drivers of this industry. In particular, a producer’s cash flow is primarily determined by the realized commodity prices. In fact, all E&P companies’ results are vulnerable to historically volatile prices in the energy markets. A change in realizations affects their returns and causes them to alter their production growth rates. The E&P operators are also exposed to exploration risks where drilling results are comparatively uncertain.

3 Key Trends to Watch in the Oil and Gas – US E&P Industry

Downward Pressure on Oil Prices: Recent dips in oil prices, with WTI crude futures falling below $80 per barrel, can be attributed to multiple factors. The U.S. Federal Reserve’s cautious stance on inflation, requiring more signs of decline before cutting interest rates, has impacted market sentiment. The sudden death of Iran’s president created uncertainty, while the substantial spare capacity existing in OPEC countries remains a concern. Russia’s increased oil exports to China, rising 30% year over year, have shifted global supply patterns. Moreover, the International Energy Agency (IEA) has revised its 2024 oil demand growth forecast downward by 140,000 barrels per day, highlighting weaker consumption in developed economies.

Inflationary Environment: Most energy companies (including upstream operators) have been experiencing rising costs in the form of increased expenses related to maintenance and inventory. Despite moderating from record levels, inflation in Europe and the United States remains above threshold levels. This, together with supply-chain tightness, is not only pushing costs higher but also affecting capital programs. Apart from being hard to ignore, escalation in expenses is also drowning out the benefits of any commodity price increase. In our view, the inflation-associated headwinds will continue to challenge growth and margin numbers, with little chance of a quick resolution. This may lead to a rough road for oil/gas equities engaged in energy exploration and production.

Substantial Shareholder Returns: Despite gyrations in the energy market, upstream operators continue to give back cash to stakeholders. In particular, cash from operations is on a sustainable path, with revenues stabilizing and companies slashing capital expenditures from the pre-pandemic levels amid commodity realizations at a healthy enough level for market participants. To put it simply, efficiency improvements over the past few years helped the E&P firms generate significant “excess cash,” which they intend to use to boost investor returns. In fact, more and more energy companies are allocating their increasing cash pile by way of dividends and buybacks to pacify the long-suffering shareholders.

Zacks Industry Rank Indicates Bearish Outlook

The Zacks Oil and Gas – US E&P industry is a 36-stock group within the broader Zacks Oil – Energy sector. The industry currently carries a Zacks Industry Rank #162, which places it in the bottom 35% of nearly 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates challenging near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s position in the bottom 50% of the Zacks-ranked industries is a result of a negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are becoming pessimistic about this group’s earnings growth potential. As a matter of fact, the industry’s earnings estimates for 2024 have gone down 29.9% in the past year.

Despite the dim near-term prospects of the industry, we will present a few stocks that you may want to consider for your portfolio. But it’s worth taking a look at the industry’s shareholder returns and current valuation first.

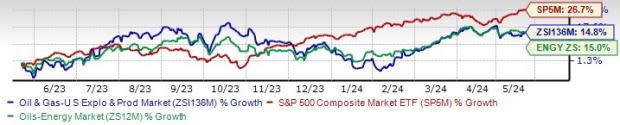

Industry Underperforms S&P 500 & Sector

The Zacks Oil and Gas – US E&P industry has fared worse than the Zacks S&P 500 composite as well as the broader Zacks Oil – Energy sector over the past year.

The industry has moved up 14.8% over this period compared with the broader sector’s increase of 15%. Meanwhile, the S&P 500 has gained 26.7%.

One-Year Price Performance

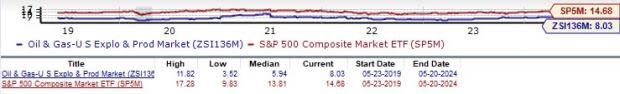

Industry’s Current Valuation

Since oil and gas companies are debt-laden, it makes sense to value them based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity but also the level of debt. For capital-intensive companies, EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the effect of noncash expenses.

On the basis of the trailing 12-month enterprise value-to-EBITDA (EV/EBITDA), the industry is currently trading at 8.03X, significantly lower than the S&P 500’s 14.68X. It is, however, above the sector’s trailing 12-month EV/EBITDA of 3.07X.

Over the past five years, the industry has traded as high as 11.82X, as low as 3.52X, with a median of 5.94X.

Trailing 12-Month Enterprise Value-to EBITDA (EV/EBITDA) Ratio (Past Five Years)

4 Stocks to Watch

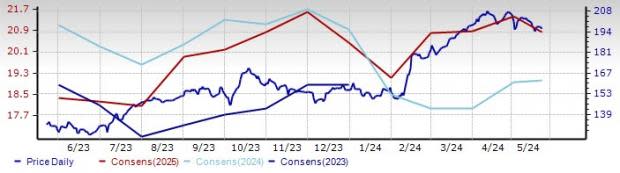

Matador Resources: The Dallas, TX-based operator has a strong presence in the oil-rich core acres of the Wolfcamp and Bone Spring plays in the Delaware Basin. In the sub-basin of the broader Permian, the company has a vast inventory of drilling areas that will back the exploration and production company’s production volumes.

Carrying a Zacks Rank #2 (Buy), the Zacks Consensus Estimate for MTDR’s 2024 earnings has moved up 13.8% over the past 60 days. Matador Resources delivered a trailing four-quarter earnings surprise of roughly 14.3% on average. The company’s shares have gained 32.2% in a year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Price and Consensus: MTDR

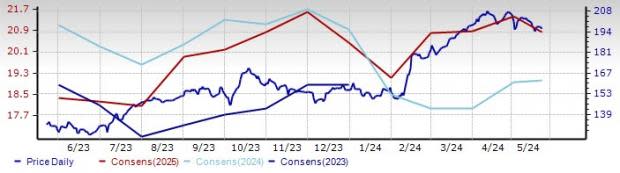

SM Energy Company: Denver, CO-based SM Energy Company, previously known as St. Mary Land & Exploration Company, is an independent oil and gas explorer in North America. The company’s operations are focused on the Permian Basin and South Texas & Gulf Coast regions.

The 2024 Zacks Consensus Estimate for SM indicates 12.1% year-over-year earnings per share growth. The Zacks Rank #2 company delivered a trailing four-quarter earnings surprise of roughly 13.8%, on average. SM Energy’s shares have surged 75.9% in a year.

Price and Consensus: SM

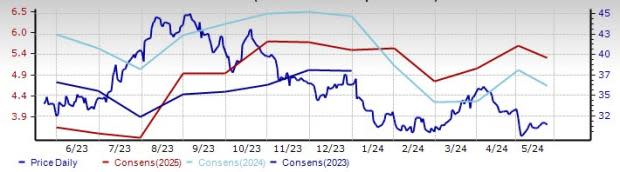

Diamondback Energy: Diamondback Energy focuses on growth through a combination of acquisitions and active drilling in the lucrative Permian Basin spread over west Texas and New Mexico. While many companies employ a similar strategy, a few have been as successful as Diamondback. The upstream company has consistently posted some of the strongest operational and financial results among the independent producers. With an attractive production profile, favorable industry trends and low breakeven economics, the margin of safety on investment is very high.

Carrying a Zacks Rank #3 (Hold), the Zacks Consensus Estimate for FANG’s 2024 earnings has moved up 6% over the past 60 days. Diamondback Energy delivered a trailing four-quarter earnings surprise of roughly 3.4% on average. The company’s shares have gained 47.9% in a year.

Price and Consensus: FANG

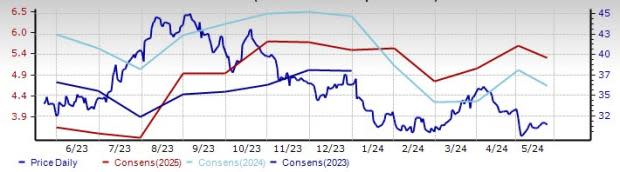

APA Corporation: APA’s large, geographically diversified reserve base and high-quality drilling inventory should guarantee multi-year production growth. The company’s increased focus on the Permian basin, known for its low cost and high internal rates of return, is another key driver. APA’s slew of discoveries in offshore Suriname, through its joint venture with TotalEnergies, is another catalyst for the company. Over time, Suriname is expected to become one of APA’s major assets with significant cash flow potential.

APA beat the Zacks Consensus Estimate for earnings in two of the last four quarters and missed in the other two. The company delivered a trailing four-quarter earnings surprise of roughly 5.5%, on average. APA currently carries a Zacks Rank of 3. The energy explorer’s shares have lost 9.4% in a year.

Price and Consensus: APA

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

APA Corporation (APA) : Free Stock Analysis Report

SM Energy Company (SM) : Free Stock Analysis Report

Matador Resources Company (MTDR) : Free Stock Analysis Report