Is the FTSE 100 a great place to buy shares for passive income? I think so, although the uncertain economic environment means investors need to be more careful than usual when choosing dividend stocks to buy.

Legal & General (LSE:LGEN) is a UK blue-chip share I’m backing to continue paying massive dividends. Sure, it may have trouble growing profits if consumer spending remains weak. Yet a cash-rich balance sheet suggests the financial services giant will remain one of the Footsie’s biggest dividend payers.

Let’s say I’m targeting a £100 monthly passive income. At Legal & General’s current share price of 239.5p, I’d need to acquire 5,611 shares in the business.

Giant yields

This would come at a cost of just over £13,438. I think that’s a pretty attractive proposition for a monthly income of £100 (and a yearly one of £1,200).

These figures are based on a dividend yield of 8.93% for 2024.

But I’m not just interested in big dividends this year. I’m looking for a large and growing payout over time.

Pleasingly, City analysts expect Legal & General’s dividends to keep climbing in 2025, too. This in turn pushes the dividend yield to a stunning 9.43%.

To put that in perspective, that’s almost two-and-a-half times the FTSE 100 average forward yield.

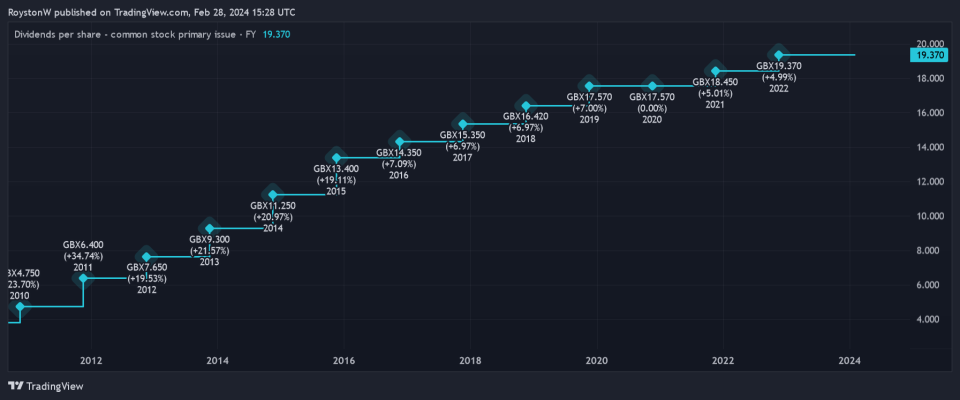

Legal & General has a long history of dividend growth

Chart by TradingView

Balance sheet strength

Of course dividends are never, ever guaranteed. And in the case of Legal & General, investors need to be aware that dividend cover for the next two years isn’t especially strong.

City brokers are tipping annual profits to grow in both 2024 and 2025. However, predicted dividends are covered just 1.2 times by expected earnings through this period. That is well below the safety benchmark of two times.

But as I’ve said, the company’s impressive balance sheet gives current dividend forecasts significant strength. As of last June, its Solvency II capital ratio clocked in at a brilliant 230%.

Its most recent financials in August also showed that capital generation continues to comfortably surpass dividends. The firm said then that it remains on course to achieve capital generation of £8bn to £9bn, and to pay dividends of £5.6bn to £5.9bn, during the five years to 2024.

I’m expecting full-year results on 6 March to once again underline Legal & General’s financial robustness.

Too cheap to miss?

All things considered, I think Legal & General is one of the best Footsie stocks that money can buy. As well as having that gigantic dividend yield, the company also trades on a rock-bottom earnings multiple.

For 2024, its price-to-earnings (P/E) ratio sits at nine times, below the FTSE 100 average of 10.5 times.

I believe this reading fails to reflect the firm’s massive long-term growth potential. Populations across each of its territories are rapidly ageing. And so demand for its retirement and wealth products looks set for steady growth, which in turn should push profits and earnings consistently higher.

I plan to hold the Legal & General shares that sit in my ISA for decades, if not indefinitely. And I’ll be looking to add to my holdings when I next have cash to invest.

The post How many cheap Legal & General shares must I buy for a £100 monthly passive income? appeared first on The Motley Fool UK.

More reading

Royston Wild has positions in Legal & General Group Plc. The Motley Fool UK has no position in any of the shares mentioned. Views expressed on the companies mentioned in this article are those of the writer and therefore may differ from the official recommendations we make in our subscription services such as Share Advisor, Hidden Winners and Pro. Here at The Motley Fool we believe that considering a diverse range of insights makes us better investors.

Motley Fool UK 2024