Confidence in the UK’s housing market is starting to dip, despite an improving outlook in recent months, according to surveyors.

A net balance of 8% of property professionals saw home buyer demand falling rather than rising in May, marking the weakest reading since November 2023, the Royal Institution of Chartered Surveyors (Rics) found.

Buyer demand was weakest in the South East and South West of England, the report said.

Amid softening demand, the latest data suggests house prices fell slightly in May, Rics said, with a balance of 17% of professionals seeing prices fall.

Scotland and Northern Ireland bucked the trend, with house prices continuing to head upwards.

Survey participants also reported a fall in the number of sales agreed during May, although sales volumes are expected to rise modestly over the next three months, the report said.

The outlook 12 months ahead remains relatively upbeat, with 43% of survey participants anticipating an uplift in sales activity, rising from 33% in April.

Meanwhile, a mismatch in the private rented sector remains, with demand continuing to significantly outstrip supply, leaving renters tackling rising living costs and falling affordability levels, Rics added.

A net balance of 35% of professionals saw tenant demand rise rather than fall.

Rics chief executive Justin Young said: “Despite an improving overall outlook, today’s data reveals that confidence in the housing market is beginning to dip – just as parties launch their manifestos.

“Greater attention must be paid to improving conditions for ‘generation rent’, who are faced with rising rents and a lack of suitable options.

“This particular demographic – typically made up of people aged between 18 and 40 – has doubled in the last two decades, so politicians need to focus on them, as well as homeowners, as a means of gaining the support of a growing portion of the electorate.

“The housing market needs policies that think longer term, not short, and awareness that the different tenures are interlinked, so there is no one solution that will fix the situation.

“With the market under strain, the supply and demand gap in both lettings and buy side continues to create issues.”

Tarrant Parsons, Rics senior economist, said: “The recent recovery across the UK housing market appears to have slipped into reverse of late, with buyer demand losing momentum slightly on the back of the upward moves seen in mortgage rates over the past couple of months.

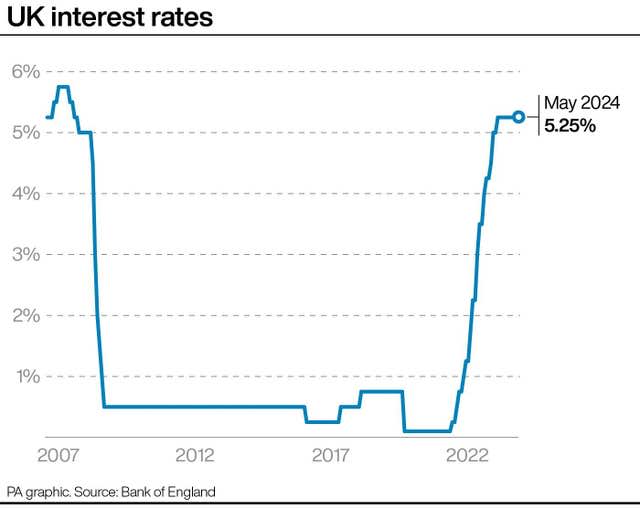

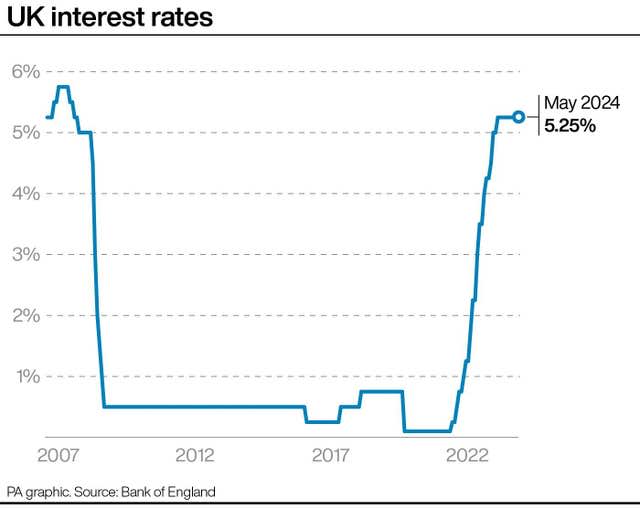

“Nevertheless, expectations point to this delaying, rather than derailing, a modest improvement going forward. Indeed, respondents continue to envisage a more positive trend in sales activity coming through over the year ahead, although this is likely predicated on the Bank of England being able to start lowering interest rates in the coming months.”

Figures published on the Financial Conduct Authority’s website this week indicate that a minimum of around 1.1 million mortgages benefited from one or more of the options set out in a mortgage charter, which many lenders have signed up to in order to support struggling borrowers.

The charter was introduced in June 2023 and lenders representing around 90% of the mortgage market have signed up.

The charter sets out various potential options available to borrowers, including allowing customers who are up to date with their payments to switch to interest-only payments for six months, or to extend their mortgage term with the option to revert to their original term within six months.