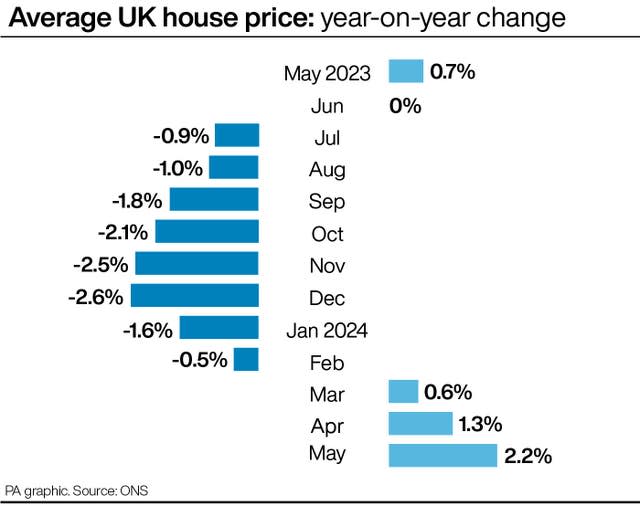

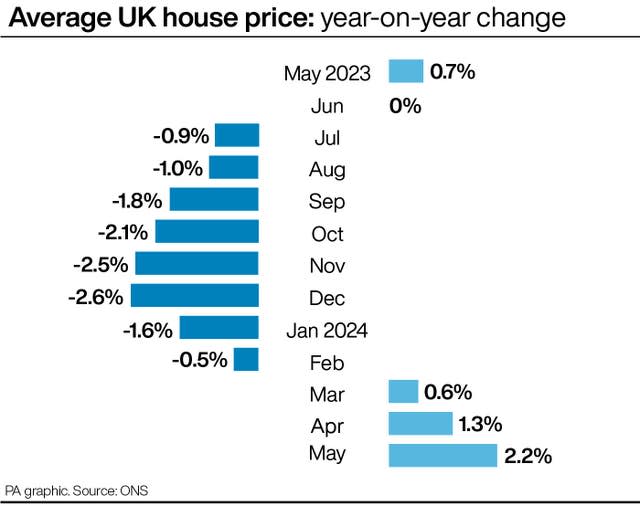

House prices increased year-on-year for the third month in a row in May, according to official figures.

Average UK house prices increased by 2.2% in the 12 months to May, up from 1.3% annual growth in April, the Office for National Statistics (ONS) said.

It marked the third month in a row with an annual increase in prices, following eight months of annual falls in prices.

The average UK house price in May was £285,000.

The typical property value in England was £302,000 in May, up by 2.2% (£6,000) from a year earlier.

Yorkshire and the Humber was the English region with the highest house price inflation in the 12 months to May, at 3.9%.

Annual house price inflation was lowest in London, an increase of 0.2%.

The average house price for Wales was £216,000, up 2.4% (£5,000) annually.

In Scotland, the average property value was £191,000 in May, up 2.5% (£4,000) from a year earlier.

The average house price for Northern Ireland was £178,000, up 4.0% (£4,000) annually.

Meanwhile, rental prices slowed. Average private rents across the UK increased by 8.6% in the 12 months to June, edging down from 8.7% in the 12 months to May.

In June, the average private rent in Britain was £1,271 per month. This was £101 higher than 12 months earlier.

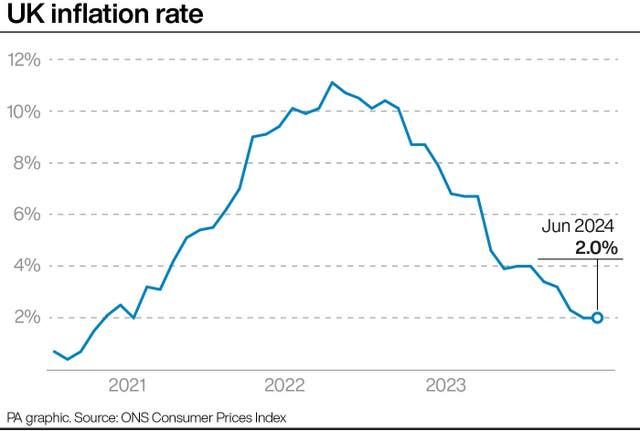

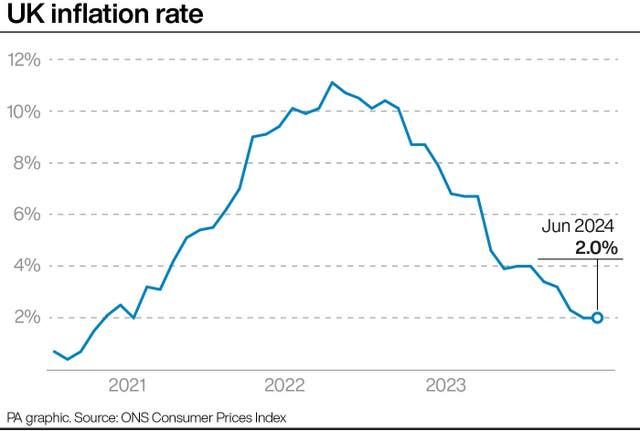

ONS figures also indicated on Wednesday that UK inflation held steady in June. The rate of Consumer Prices Index (CPI) inflation remained unchanged at 2%.

This means that prices are still rising but at a rate that the Bank of England is comfortable with, after nearly three years of above-target inflation.

Richard Harrison, head of mortgages at Atom bank said: “The fact that the ONS has now reported three months of straight house price increases is a good indication of the growing confidence in the market.”

He added: “Eyes will now turn to the Bank of England, and when it will look to start reducing bank base rate, as reduced rates will also serve to boost buyer confidence. With inflation continuing to move in the right direction, it’s simply a question of when, not if.”

David Hollingworth, associate director at broker L&C Mortgages, said: “The rate of inflation held steady at the Bank of England’s target rate of 2% in June.

“That is positive news and another month’s reading at the Bank’s target rate will buoy the hopes of those wanting a base rate cut sooner rather than later.

“However, many anticipated a further, even if slight, decline in inflation this month and the likelihood of (a Bank of England Monetary Policy Committee) decision to cut in August will remain in the balance.

“Although borrowers can still expect to see base rate fall this year, they should also be prepared for rates to be held a little longer.

“On the upside, mortgage rates have been improving in recent weeks.

“A flurry of price changes is gradually helping to drag fixed rates down, albeit slowly. As long as today’s figures don’t disappoint markets, we should see that trend continue.

“Competition is fierce in the market which has seen lenders regularly edging rates back down, unwinding increases in recent months.

“Lenders often have little margin to play with, so any move in market rates can have an impact on fixed rate pricing in either direction.

“Today’s figures are not likely to add any additional boost to the recent cuts in mortgage rates but nor should they disturb the current level.”