The United States stock market has shown robust performance recently, with a 1.0% increase over the past week and a significant 27% rise over the last year. In this thriving economic environment, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In The United States

|

Name |

Insider Ownership |

Earnings Growth |

|

GigaCloud Technology (NasdaqGM:GCT) |

27.5% |

20.9% |

|

PDD Holdings (NasdaqGS:PDD) |

32.1% |

23% |

|

Atour Lifestyle Holdings (NasdaqGS:ATAT) |

26% |

28.2% |

|

Li Auto (NasdaqGS:LI) |

29.3% |

21.8% |

|

Super Micro Computer (NasdaqGS:SMCI) |

14.3% |

40.2% |

|

Bridge Investment Group Holdings (NYSE:BRDG) |

11.8% |

90% |

|

EHang Holdings (NasdaqGM:EH) |

33% |

97.1% |

|

Carlyle Group (NasdaqGS:CG) |

29.2% |

23.6% |

|

ZKH Group (NYSE:ZKH) |

17.7% |

91.8% |

|

BBB Foods (NYSE:TBBB) |

23.6% |

75.4% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hims & Hers Health, Inc. is a telehealth company providing connections to licensed healthcare professionals across the U.S., the U.K., and other global markets, with a market capitalization of approximately $2.77 billion.

Operations: The company generates its revenue primarily through online retailing, amounting to $959.40 million.

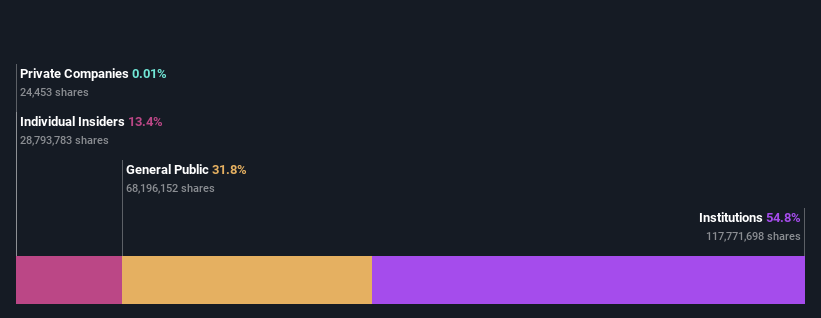

Insider Ownership: 13.4%

Earnings Growth Forecast: 39.9% p.a.

Hims & Hers Health, a company with significant insider ownership, has demonstrated robust growth, reporting a substantial increase in sales from US$190.77 million to US$278.17 million year-over-year for Q1 2024 and turning a previous net loss into a profit of US$11.13 million. The firm is optimistic about its future, projecting revenues between US$1.20 billion and US$1.23 billion for the full year 2024. Despite this positive outlook and recent executive enhancements like appointing Christopher Payne to the board, concerns remain due to share price volatility and recent shareholder dilution.

Simply Wall St Growth Rating: ★★★★☆☆

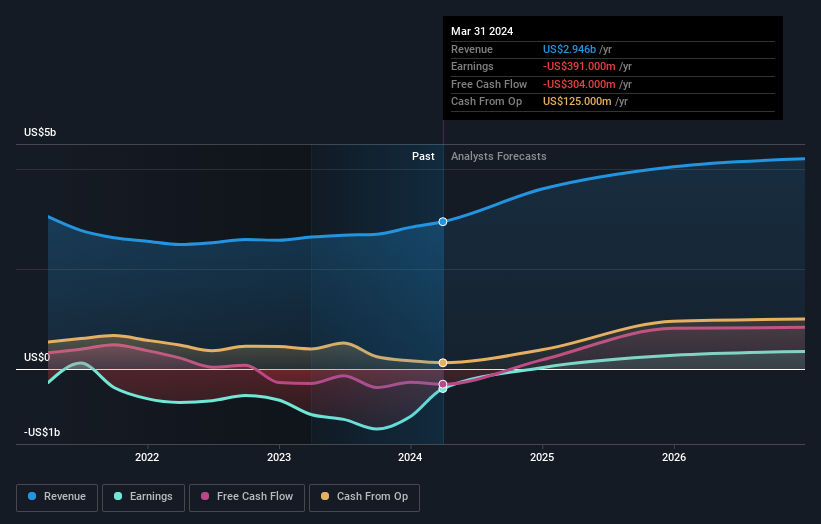

Overview: Transocean Ltd. offers offshore contract drilling services for oil and gas wells globally, with a market capitalization of approximately $4.76 billion.

Operations: The company generates $2.95 billion in revenue primarily from the provision of contract drilling services.

Insider Ownership: 11.9%

Earnings Growth Forecast: 114.8% p.a.

Transocean, a company engaged in offshore drilling services, has recently shown signs of operational recovery with a switch from a net loss of US$465 million to a net income of US$98 million in Q1 2024. Despite this positive shift and an expected annual profit growth above market trends, challenges persist due to its low forecasted return on equity (2.4%) and ongoing debt refinancing efforts, including a significant consent solicitation for amending terms related to its senior secured notes. The firm’s strategic financial maneuvers aim to stabilize its long-term obligations amidst modest revenue growth projections.

Simply Wall St Growth Rating: ★★★★☆☆

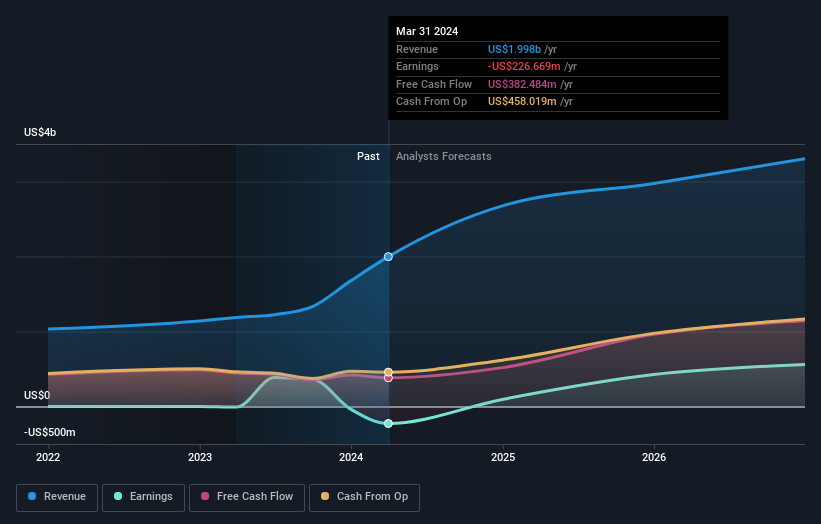

Overview: TKO Group Holdings, Inc. is a sports and entertainment company with a market capitalization of approximately $16.93 billion.

Operations: The company generates its revenue primarily through its UFC segment, which brought in $1.30 billion.

Insider Ownership: 10.3%

Earnings Growth Forecast: 72.5% p.a.

TKO Group Holdings, Inc. has demonstrated a robust first quarter with sales doubling to US$629.7 million from the previous year, despite shifting from a net profit to a net loss of US$103.8 million. The company is actively pursuing mergers and acquisitions to bolster growth and has raised its revenue forecast for 2024 to between US$2.610 billion and US$2.685 billion. Insider activities have been mixed with significant share repurchases indicating confidence by management, alongside substantial insider selling over the past three months, suggesting varied internal perspectives on the company’s valuation and future prospects.

Make It Happen

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NYSE:HIMS NYSE:RIG and NYSE:TKO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]