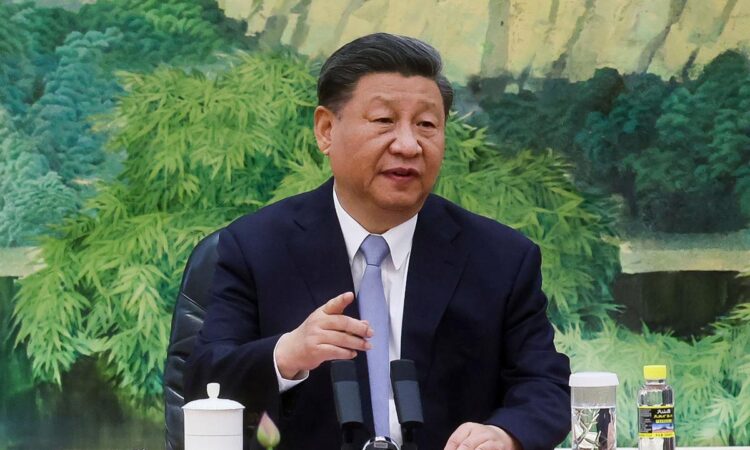

The FTSE 100 (^FTSE) continued its positive run on Wednesday, outperforming against its peers, as traders offloaded shares in China’s blue-chip firms at record pace amid growing concerns about the world’s second largest economy.

London’s benchmark index rose 0.7% by noon trade, helped by a weaker pound and a rise in mining stocks on the back of gains in metal and gold prices.

Meanwhile the CAC (^FCHI) lost 0.2% in Paris, and the Frankfurt DAX (^GDAXI) was trading flat after new data revealed that Germany suffered the steepest drop in business activity since May 2020.

It came as overseas funds fled the Chinese market, offloading the equivalent of £7.3bn ($9.29bn) in a 12-day run of withdrawals to Tuesday, the longest since Bloomberg began tracking the data in 2016.

According to the latest data on individual stocks available, foreign investors sold 6.2bn yuan (£676m) of Kweichow Moutai (600519.SS) from 7 to 18 August, making China’s largest spirits maker the most heavily sold stock via trading links with Hong Kong.

It was followed by 4.7bn yuan of selling each for leading renewables stock LONGi Green Energy Technology (601012.SS) and major lender China Merchants Bank (600036.SS).

“The FTSE 100 managed to finally break its worst run of losses since 2019 yesterday, posting its first daily gain since 10 August. The gains were hard-won however with the index trying retreating from its daily highs and failing for the second day in a row to consolidate a move above 7,300,” Michael Hewson, chief market analyst at CMC Markets, said.

“The rest of Europe managed to do slightly better, outperforming and closing higher for the second day in a row, although still closing well off the highs of the day.”

Read more: Commodities round-up: Oil prices lower as gold maintains its allure

Elsewhere, the UK’s private sector output suffered its steepest decline in activity in more than two and a half years thanks to a severe downturn in manufacturing and spending on services.

The headline seasonally adjusted S&P Global/CIPS Flash UK Composite Output Index came in at 47.9 in August, down from 50.8 in July. This was below the neutral 50.0 threshold for the first time since January.

The eurozone also saw weaker-than-expected economic data with its PMI figure falling to a 33-month low of 47.0 in August, down from 48.6 the previous month.

Watch: How does inflation affect interest rates?

Download the Yahoo Finance app, available for Apple and Android.