Some fintechs are rolling out more insurance on their deposit accounts to offer added peace of mind to individuals and businesses in the wake of the recent banking turmoil.

This month, SoFi Technologies, Inc. (SOFI), Mercury, and Crescent launched deposit products that cover more than the standard $250,000 insurance guaranteed by the Federal Deposit Insurance Corp. (FDIC).

SoFi is providing $2 million in insurance, while Mercury is offering up to $5 million in FDIC insurance for its customers through its Mercury Vault. And taking it to an entirely different stratosphere, Crescent also debuted a similar product, Crescent Cash, to offer customers access to over $75 million in FDIC protection.

The launches come as several reports show folks are taking their deposits to larger banks that they believe are safer after the collapse of Silicon Valley Bank (SVB) and Signature Bank, providing an opening for these offerings — which are not new — to attract customers.

“It is clear that some companies can push these products — even though in some cases they were offered before the SVB crisis unfolded — to capitalize on the uncertainty created by this crisis, and attract business away from potential competitors,” John Sedunov, a finance professor at Villanova University, told Yahoo Finance.

What’s insured by FDIC

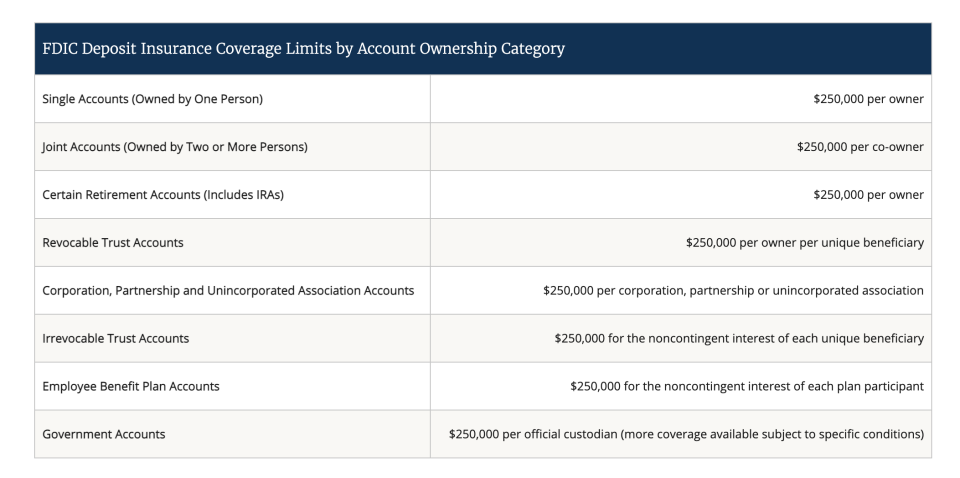

The Federal Deposit Insurance Corp.’s standard insurance covers up to $250,000 per depositor, per bank, for every account ownership category for deposit accounts like savings, checking, and certificates of deposit (CDs).

Anything above that is uninsured, which kicked off a bank run at Silicon Valley Bank when its customers — specifically small start-ups — lost confidence in the institution and wanted to withdraw those deposits.

That’s where these new offerings come in, aimed in large measure at start-ups and small business operators that need to stash away more than the $250,000 limit.

Let’s start with SoFi Bank’s new cash management product. It’s marketed as FDIC-insurance for account holders that amounts to eight times larger than the $250,000 amount of FDIC insurance offered for deposit accounts under federal law.

The souped-up coverage is possible because it spreads your deposit via the SoFi FDIC Insurance Network and skirts the FDIC protected coverage limit per depositor by divvying up a customer’s deposits across a number of banks, each protected under the $250,000 umbrella. Customers, however, access their cash deposits directly from Sofi, so it’s a single banking relationship.

There are no account fees for SoFi checking and savings accounts, and no fees to increase FDIC insurance coverage, according to the bank’s website.

Customers at San Francisco-based Mercury with $5 million or more in their accounts can ramp up FDIC insurance protection on their cash deposits by opting into the firm’s sweep network of FDIC-insured banks, including Goldman Sachs, Capital One Bank (USA), Bank of Houston, and Bank of New England.

By doing so, their deposits are then spread across bank accounts in the myriad partner banks, none exceeding $250,000.

Customers can also select to shift cash funds to short-term Mercury Treasury accounts which, in turn, invests their money into a Vanguard money market fund, which is predominantly composed of U.S. government-backed treasury products. U.S. Treasury bills, bonds, and notes also aren’t covered by FDIC insurance, but they are backed by the full faith and credit of the federal government.

“We aren’t releasing exact figures about our customer increase at this time, but I can confirm we saw over $2 billion in deposits and thousands of new customers in the wake of the SVB situation,” Celeste Carswell, a Mercury communications team member, told Yahoo Finance.

Finally, Crescent Cash, touts access to over $75 million in FDIC insurance protection for its depositors, and 3.75% annual percentage yield (APY) on savings account holdings. Its muscled-up cash sweep network consists of over 300 FDIC-insured banks without requiring you to individually open and manage separate accounts.

Crescent, headquartered in Lincoln Nebraska, also gives depositors the option to purchase short-term Treasury bills.

These higher insured deposits programs are the latest iteration of existing products designed to help customers manage large cash balances through a single banking relationship.

“It’s more of what has already been around,” Greg McBride, chief financial analyst at Bankrate.com, told Yahoo Finance. “The CDARS program available through IntraFi has been around for 20 years. And since this can be a competitive tool in appealing to high net worth clientele, we’ll continue to see these offerings.”

For years, many small business owners and individuals with higher cash balances have opened accounts covered under the IntraFi Network Deposits program, where you are eligible for FDIC insurance on millions of dollars through a network of financial institutions without having to open accounts at multiple banks. Instead, you can keep all your money at one bank as long as that bank is part of the network.

A cash management account (CMA) that usually comes with check writing, a debit card, and earns interest that’s opened at a brokerage is another way to hold deposits with higher levels of insurance for small business operators. A nonbank financial service provider offers CMAs and can often insure more than $250,000 by dividing the fund into smaller amounts and placing them in deposit accounts at other IntraFi Network Deposits banks members.

A MaxSafe account maximizes FDIC insurance coverage by offering protection for balances of $250,000, up to $3.75 million total per person. Wintrust, the company that offers MaxSafe accounts, provides this level of protection by distributing deposits across more than a dozen community bank charters, similar to how the IntraFi Network works. MaxSafe accounts include CDs, money market accounts, and IRAs.

“Banks that participate in a network that moves money among other member banks in the network can give high net worth bank customers the convenience of dealing with one bank but having their entire balance fully protected by federal deposit insurance,” McBride said.

One caveat to this: If you already have an account with a balance at a particular bank that’s in one of these networks, the funds deposited under your name through the network will be combined with your existing ones at that bank and will count toward the FDIC’s $250,000 insurance coverage threshold.

McBride is quick to point out that most individuals don’t need these fancy deposit arrangements. This is largely for small businesses.

“There is no reason to move your money out of safety concerns. And if your balances exceed deposit insurance limits, take steps to rectify this,” he said. “Accounts in different ownership categories – such as individual, joint, trust, and retirement – can enable you to increase your deposit insurance coverage while staying with your bank.”

Kerry is a Senior Reporter and Columnist at Yahoo Finance. Follow her on Twitter @kerryhannon.

Read the latest financial and business news from Yahoo Finance.