Iberdrola-Masdar alliance ABU DHABI’S Masdar bought a 46 per cent stake in Iberdrola’s East Anglia 3 offshore windfarm, the largest in the UK.

Masdar, controlled by the Gulf state and chaired by Dr Sultan al-Jaber, president of the UN Climate Change Conference (COP28) held in Dubai, announced the €15 billion deal during the climate talks.

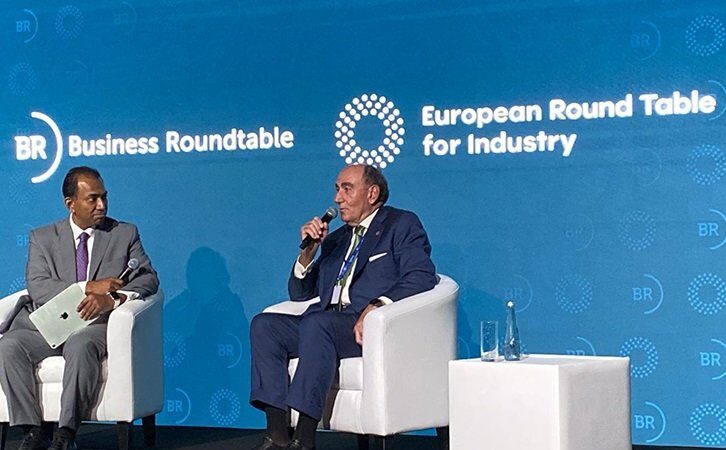

“By combining our renewables experience and financial strength we can deliver secure, competitive and clean energy more quickly,” said Ignacio Galan, Iberdrola’s executive chairman on December 5.

It was the UAE’s second agreement of this kind following Masdar’s acquisition on December 1 of 49 per cent of German-owned RWE’s £11 billion (€12.8 billion) Dogger Bank South project in the North Sea.

Treading water THAMES WATER, burdened with £14 billion (€16.3 billion) debts, is to face a parliamentary committee yet again.

The Environment Food and Rural Affairs committee will recall the company’s chief executive Cathryn Ross amid auditors’ warnings that parent company Kemble Water Holdings could be short of cash by April.

When the company was questioned last summer, MPs learnt that the situation would be alleviated by a £500 million (€583.2 million) injection from shareholders.

Instead, the Financial Times reported on December 2 that Thames Water received a £515 million (€600.6 million) convertible loan charging 8 per cent interest to be paid each March, according to Kemble Water Holdings’ accounts.

“This leads us to question the accuracy of evidence provided by Thames Water in July,” said the cross-party committee’s chairman Sir Robert Goodwill.

Qatar’s slow exit QATAR INVESTMENT AUTHORITY (QIA), Barclays second-largest shareholder, intends to sell approximately 362 million of its shares.

The £510 million (€594.8 million) transaction with QIA shedding roughly 45 per cent of its shares will reduce QIA’s 5 per cent stake to around 2.4 per cent.

In 2008 Qatar helped Barclays to avoid a state rescue with a £4 billion (€4.67 billion) bailout and originally held one billion Barclays’ shares, whose price in the meantime has dropped by half.

The sale comes at a bad time for Barclays chief executive CS Venkatakrishnan (Venkat) who is trying to boost the bank’s performance.

Dia sells Clarel SUPERMARKET chain Dia is selling its perfume and cosmetic stores, Clarel, to Colombian investment company Grupo Trinity.

According to a statement from Dia, Trinity is paying up to €42.2 million for Clarel’s 1,000 shops in Spain and three distribution centres. Nevertheless, this would have a negative impact of €9.4 million on its account its next financial year, Dia added.

The Trinity sale follows a cancelled deal last December, when private equity group, C2 Capital Partners, an affiliate of Gaw Capital Partners operating in Portugal, offered €60 million for Clarel. The transaction was cancelled last August when C2 Capital Partners failed to meet the agreed conditions.

Taking a toll SPANISH infrastructure multinational Abertis is buying the Autovia del Camino from Swiss investment bank UBS.

The Camino motorway, which links Pamplona and Logroño, has a toll concession ending in December 2030.

Announcing the sale, while omitting mention of the sums involved, Abertis said the operation consolidated the company’s new growth phase that commenced with the acquisition of new toll roads in the US and Puerto Rico.

In 2022 the Autovia del Camino enjoyed a “solid traffic performance” Abertis added, with a 4.2 per cent increase at year-end, as well as €49.5 million in revenues and an EBITDA of €45 million.

Back to the office NATIONWIDE told its 13,000 employees that they must work at least twice a week from the office.

From next April, the “work anywhere” policy introduced by its former chief executive during the pandemic will no longer be acceptable, said Nationwide’s current boss, Debbie Crosbie.

The building society has followed the lead of companies like HSBC, BT and BlackRock which announced to staff this year that they were phasing out work-from-home. Employees would now be expected to return to the office for several days each week to increase productivity, they learnt.

Renewables move ENDESA is progressing with its plans to sell up to 49 per cent of its renewables portfolio consisting principally of solar power plants.

According to the financial daily Cinco Dias, the energy company is currently considering four separate offers in the region of €1 billion as it seeks to strengthen its position in sustainable energy.

Cinco Dias also revealed that Endesa has engaged both Banco Santander and Intesa Sanpaolo to sound out potential partners although when approached by the media, the company declined to comment.

Thank you for taking the time to read this article. Do remember to come back and check The Euro Weekly News website for all your up-to-date local and international news stories and remember, you can also follow us on Facebook and Instagram.