Amidst a backdrop of rising stock prices and solid job growth in the United States, investors are closely monitoring market dynamics and company fundamentals. In this environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

|

Name |

Insider Ownership |

Earnings Growth |

|

GigaCloud Technology (NasdaqGM:GCT) |

25.9% |

21.3% |

|

PDD Holdings (NasdaqGS:PDD) |

32.1% |

23.1% |

|

Atour Lifestyle Holdings (NasdaqGS:ATAT) |

26% |

21.7% |

|

Super Micro Computer (NasdaqGS:SMCI) |

14.3% |

40.2% |

|

Bridge Investment Group Holdings (NYSE:BRDG) |

11.6% |

98.2% |

|

Celsius Holdings (NasdaqCM:CELH) |

10.4% |

21.8% |

|

Credo Technology Group Holding (NasdaqGS:CRDO) |

15.2% |

84.1% |

|

BBB Foods (NYSE:TBBB) |

18.1% |

99.4% |

|

EHang Holdings (NasdaqGM:EH) |

33% |

101.9% |

|

Carlyle Group (NasdaqGS:CG) |

29.2% |

23.6% |

Let’s review some notable picks from our screened stocks.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Amazon.com, Inc. operates as a global online retailer and provides advertising and subscription services, with both online and physical store presences, boasting a market capitalization of approximately $1.93 trillion.

Operations: The company generates revenue through three primary segments: North America at $362.29 billion, International markets contributing $134.01 billion, and Amazon Web Services (AWS) at $94.44 billion.

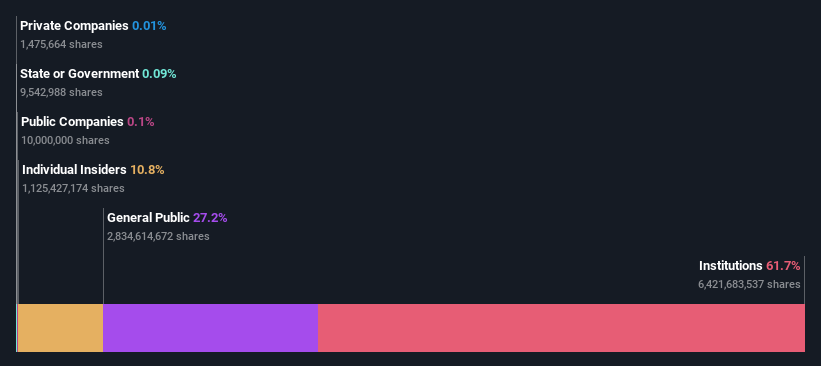

Insider Ownership: 10.8%

Earnings Growth Forecast: 21.4% p.a.

Amazon, a giant in e-commerce and cloud computing, is diversifying its portfolio through strategic alliances and potential acquisitions, such as the resumed talks to acquire MX Player. Recent collaborations with Revolution Beauty and Duke Energy underscore its commitment to expanding consumer choices and supporting sustainable energy initiatives. However, Amazon’s insider ownership is relatively low compared to other growth companies with high insider stakes, which might raise concerns about alignment between management and shareholder interests. Despite this, Amazon continues to innovate and expand aggressively as demonstrated by its ventures into new markets and technologies.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palantir Technologies Inc. specializes in developing software platforms for the intelligence community, aiding in counterterrorism efforts across the U.S., the U.K., and globally, with a market capitalization of approximately $51.13 billion.

Operations: The company generates revenue through two primary segments: Commercial, which brought in $1.07 billion, and Government, contributing $1.27 billion.

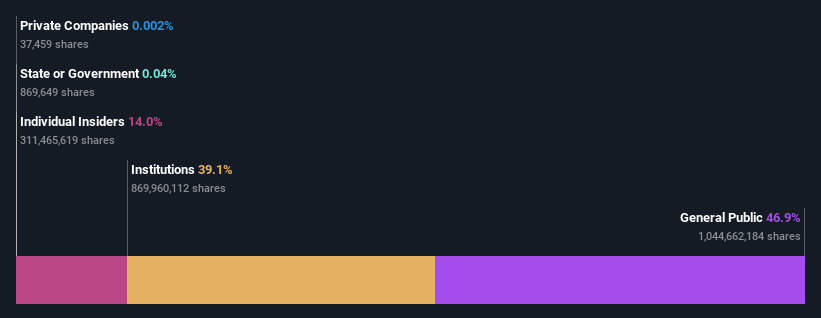

Insider Ownership: 13.4%

Earnings Growth Forecast: 24.4% p.a.

Palantir Technologies, recently profitable, is poised for substantial growth with earnings forecasted to increase by 24.4% annually, outpacing the US market’s 14.7%. However, shareholder dilution occurred over the past year and its return on equity is expected to remain low at 17%. Recent strategic partnerships in healthcare and AI platforms with Tampa General Hospital and Eaton highlight its expanding influence in data integration for operational efficiency. These collaborations are set to enhance real-time decision-making across various sectors.

Simply Wall St Growth Rating: ★★★★★☆

Overview: Toast, Inc. provides a cloud-based digital technology platform specifically designed for the restaurant sector in the United States, Ireland, and India, with a market capitalization of approximately $12.49 billion.

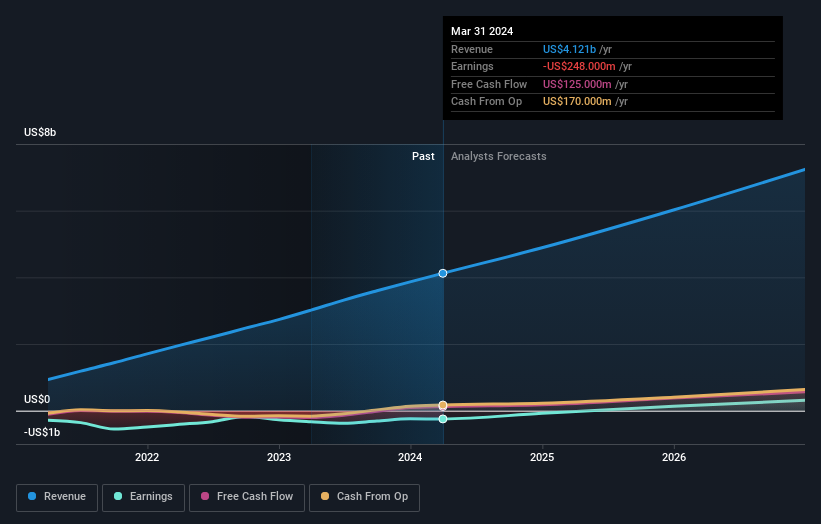

Operations: The company generates revenue primarily through its Data Processing segment, which amounted to $4.12 billion.

Insider Ownership: 21.7%

Earnings Growth Forecast: 63.1% p.a.

Toast is expected to grow its revenue by 16.9% annually, outpacing the US market average of 8.4%. The company aims to become profitable within three years, with earnings growth projected at a robust rate. However, shareholder dilution has occurred over the past year. Recent strategic moves include seeking acquisitions and investments to bolster long-term growth, alongside a focus on increasing profit and free cash flow through organic investments and potential M&A activities.

Make It Happen

Interested In Other Possibilities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGS:AMZN NYSE:PLTR and NYSE:TOST.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]