As the FTSE 100 continues its record-breaking performance, investor interest in stable income streams through dividend stocks remains high. In light of the current market dynamics and economic updates, a good dividend stock typically offers not only a reliable payout but also stands resilient during various market conditions, making it an appealing option for those looking to enhance their investment portfolios in May 2024.

Top 10 Dividend Stocks In The United Kingdom

|

Name |

Dividend Yield |

Dividend Rating |

|

Record (LSE:REC) |

8.12% |

★★★★★★ |

|

Dunelm Group (LSE:DNLM) |

7.69% |

★★★★★☆ |

|

DCC (LSE:DCC) |

3.29% |

★★★★★☆ |

|

Plus500 (LSE:PLUS) |

5.97% |

★★★★★☆ |

|

Grafton Group (LSE:GFTU) |

3.69% |

★★★★★☆ |

|

Rio Tinto Group (LSE:RIO) |

6.02% |

★★★★★☆ |

|

NWF Group (AIM:NWF) |

3.58% |

★★★★★☆ |

|

James Latham (AIM:LTHM) |

3.01% |

★★★★★☆ |

|

Hargreaves Services (AIM:HSP) |

6.41% |

★★★★★☆ |

|

Big Yellow Group (LSE:BYG) |

3.84% |

★★★★★☆ |

Click here to see the full list of 55 stocks from our Top Dividend Stocks screener.

We’ll examine a selection from our screener results.

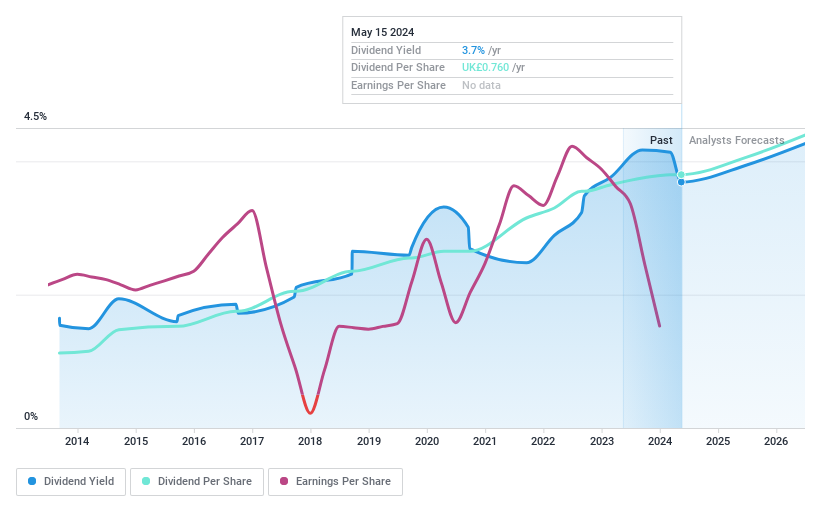

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees across the UK, Isle of Man, and Channel Islands, with a market capitalization of approximately £328.37 million.

Operations: Brooks Macdonald Group generates international revenue of £19.62 million and has a segment adjustment totaling £113.99 million.

Dividend Yield: 3.7%

Brooks Macdonald recently appointed Alex Charalambous as head of wealth, a move signaling a strategic focus on high-net-worth clients. Despite this positive development, the firm faces challenges with a recent net loss of £3.38 million and a strategic review of its underperforming international business. While the dividend increased slightly to 29 pence per share, it’s not well-covered by earnings or free cash flow, indicating potential sustainability issues despite stable historical payouts.

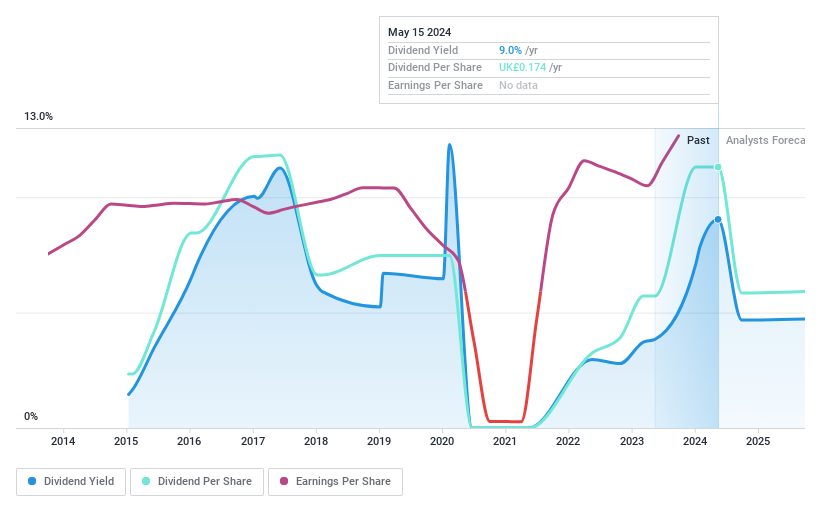

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shoe Zone plc is a UK-based footwear retailer with a market capitalization of approximately £88.99 million.

Operations: Shoe Zone plc generates its revenue primarily through its footwear retailing operations, totaling approximately £165.66 million.

Dividend Yield: 9%

Shoe Zone offers a high dividend yield at 9.04%, ranking in the top 25% of UK dividend payers. However, its dividends show signs of instability, with a history of unpredictable payments over the past nine years and only a recent initiation into consistent payouts. Despite this, both earnings and cash flows adequately cover current dividends, with payout ratios at 39.9% and 31.5% respectively. The company’s share price has been volatile recently, adding an element of risk for potential investors.

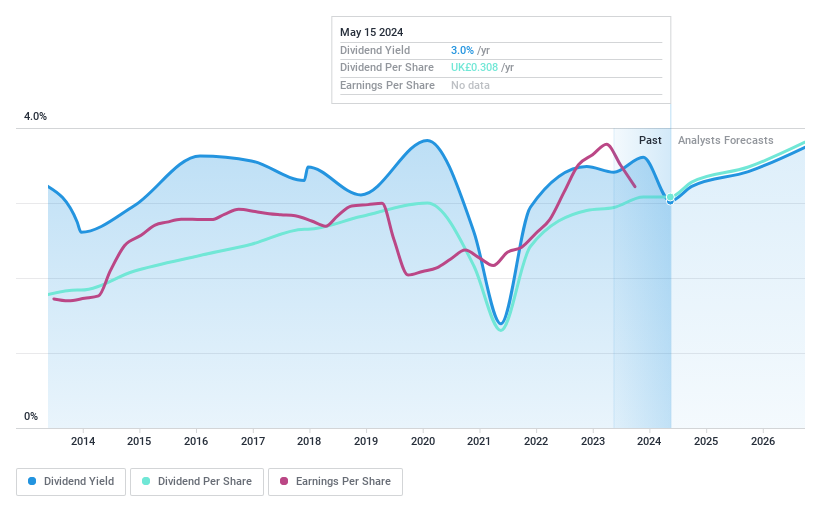

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Britvic plc operates as a manufacturer, marketer, distributor, and seller of soft drinks across the United Kingdom, Republic of Ireland, France, Brazil, and other international markets with a market capitalization of approximately £2.52 billion.

Operations: Britvic plc generates its revenue primarily from the UK with £1.19 billion, followed by France at £185 million, Ireland at £160.3 million, Brazil at £156.2 million, and other international markets contributing £59.4 million.

Dividend Yield: 3%

Britvic recently reported a rise in half-year sales to £880.3 million and net income to £59.9 million, with earnings per share increasing from the previous year. Despite a historically unstable dividend track record and low yield of 3.03% compared to top UK dividend payers, Britvic’s dividends are well-supported by earnings and cash flows, with payout ratios at 63.8% and 47.5%, respectively. However, the company carries high debt levels which could influence future dividend sustainability.

Taking Advantage

-

Get an in-depth perspective on all 55 Top Dividend Stocks by using our screener here.

-

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

-

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:BRK AIM:SHOE and LSE:BVIC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com