Over the past year, the United States stock market has experienced a robust growth of 25%, though it has remained flat over the last week. In this context, dividend stocks can be particularly appealing for investors looking for potential steady income streams in a market where earnings are expected to grow by 15% annually.

Top 10 Dividend Stocks In The United States

|

Name |

Dividend Yield |

Dividend Rating |

|

Columbia Banking System (NasdaqGS:COLB) |

7.67% |

★★★★★★ |

|

Resources Connection (NasdaqGS:RGP) |

5.03% |

★★★★★★ |

|

Silvercrest Asset Management Group (NasdaqGM:SAMG) |

5.07% |

★★★★★★ |

|

Regions Financial (NYSE:RF) |

5.04% |

★★★★★★ |

|

Citizens Financial Group (NYSE:CFG) |

4.85% |

★★★★★★ |

|

Ennis (NYSE:EBF) |

4.83% |

★★★★★★ |

|

CompX International (NYSEAM:CIX) |

4.78% |

★★★★★★ |

|

Carter’s (NYSE:CRI) |

4.85% |

★★★★★☆ |

|

Marine Products (NYSE:MPX) |

5.51% |

★★★★★☆ |

|

Evans Bancorp (NYSEAM:EVBN) |

5.02% |

★★★★★☆ |

Click here to see the full list of 209 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Burke & Herbert Financial Services Corp., with a market capitalization of approximately $724.28 million, serves as the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland.

Operations: Burke & Herbert Financial Services Corp. generates revenue primarily through its community banking segment, which amounted to $107.52 million.

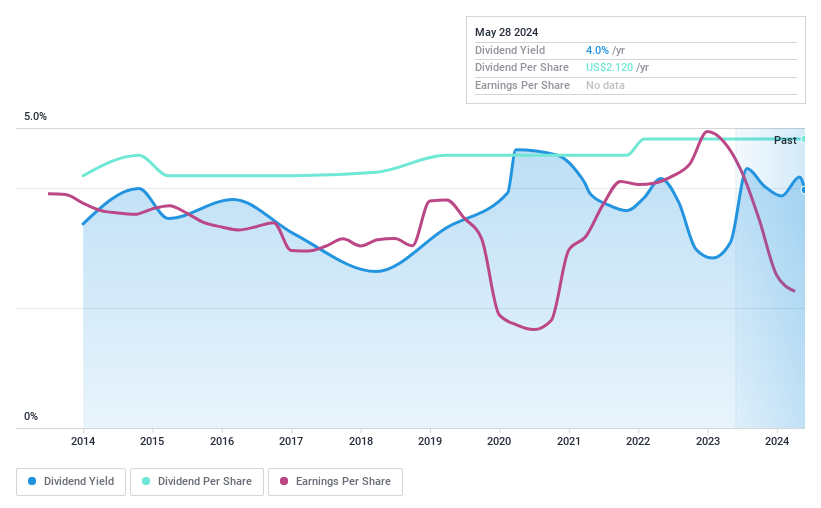

Dividend Yield: 4%

Burke & Herbert Financial Services maintains a steady dividend yield of 3.97%, though it falls below the top quartile of US dividend stocks. The company’s dividends have shown growth and reliability over the past decade, supported by a payout ratio of 77.3%. However, recent financials reveal a decline in profit margins from 33% to 19%, alongside substantial shareholder dilution over the past year. Despite trading at a significant discount to estimated fair value, concerns about future dividend coverage and profitability persist due to insufficient data on earnings and cash flow projections for dividends.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ohio Valley Banc Corp., with a market cap of $112.65 million, serves as the bank holding company for The Ohio Valley Bank Company, offering a range of commercial and consumer banking products and services.

Operations: Ohio Valley Banc Corp. does not provide detailed segmentation of its revenue in the provided text.

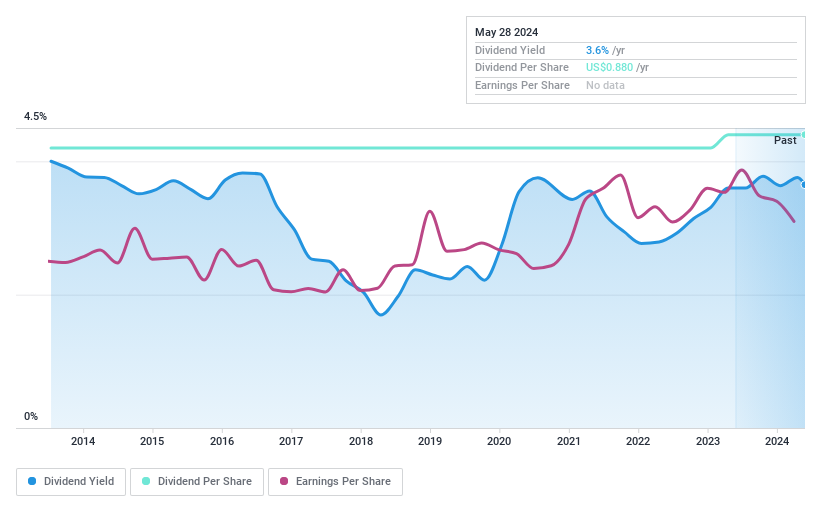

Dividend Yield: 3.6%

Ohio Valley Banc Corp. reported a decrease in net interest income and net income in Q1 2024, yet maintained its quarterly dividend at US$0.22 per share. The company’s dividend yield stands at 3.65%, below the top quartile of U.S. dividend payers but has shown stability and growth over the past decade, supported by a low payout ratio of 36.5%. Recent board changes and auditor appointments suggest ongoing governance adjustments, potentially impacting future financial management strategies.

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arrow Financial Corporation operates as a bank holding company, offering commercial and consumer banking, along with financial products and services, with a market capitalization of approximately $410.11 million.

Operations: Arrow Financial Corporation generates its revenue primarily through community banking, which accounted for $131.05 million.

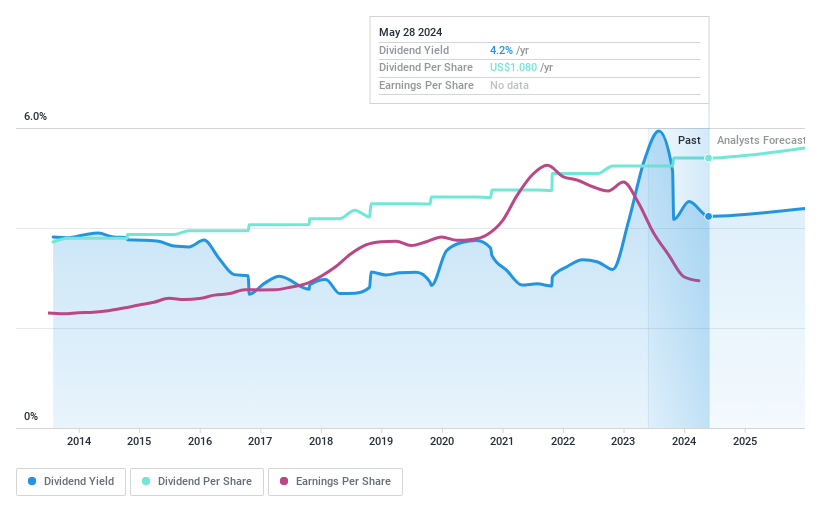

Dividend Yield: 4.2%

Arrow Financial Corporation has recently declared a stable quarterly dividend of US$0.27 per share, reflecting its consistent shareholder returns despite a slight decline in Q1 2024 net interest income and net income compared to the previous year. The company also actively engaged in share repurchases, buying back shares worth US$10 million under its latest program, demonstrating confidence in its financial health. However, it’s important to note that Arrow’s dividend yield of 4.23% is below the top quartile for U.S. dividend stocks, which may affect its attractiveness to yield-focused investors.

Turning Ideas Into Actions

Want To Explore Some Alternatives?

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:BHRB NasdaqGM:OVBC and NasdaqGS:AROW.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]