(Bloomberg) — European natural gas prices extended a six-week decline as sluggish demand curbs the need for more aggressive purchases to fill inventories.

This advertisement has not loaded yet, but your article continues below.

Benchmark futures slipped below €32 on Monday, near the lowest levels since July 2021. Prices have more than halved since the start of this year amid stable supply, mild weather and stronger contributions to power generation from renewables.

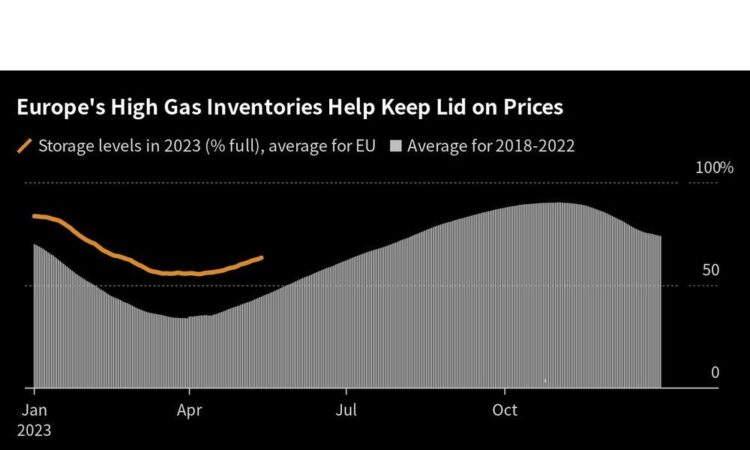

The region’s gas market is recovering after Russia cut supplies in the wake of its invasion of Ukraine last year. Inventories in the region are unusually high — 63% full — after a month of net injections and an influx of liquefied natural gas.

Industrial gas demand in Europe from January to April was 20% lower than the five-year average, according to Wood Mackenzie Ltd. research analyst Rosaline Hulse. While some countries have pared the decline in consumption, it’s not indicative of a full rebound — “more a gradual warming up of sentiment,” she said by email.

This advertisement has not loaded yet, but your article continues below.

Still, traders are eyeing the possibility of higher gas usage in the coming weeks if the weather turns hotter. That could mean higher fuel consumption to power air conditioning, as energy companies seek to replenish gas inventories ahead of winter.

Meanwhile, the Group of Seven nations and European Union are taking further steps to reduce their reliance on Russian energy. The G-7, meeting in Japan later this week, is seeking to prevent the reopening of routes where Russia cut supplies, according to a draft statement seen by Bloomberg.

The EU is discussing an 11th sanctions package, which could include a formal ban on the northern leg of the northern Druzhba oil pipeline from Russia, Bloomberg previously reported. Any EU ban would need the full backing of all member states.

Dutch front-month gas, Europe’s benchmark, traded 1.6% lower at €32.25 per megawatt-hour by 9:42 a.m. in Amsterdam. The UK equivalent contract also declined.

—With assistance from Elena Mazneva and Alberto Nardelli.