(Bloomberg) — The euro-area economy is entering 2024 on a weaker footing than previously expected, according to new European Union forecasts that anticipate another year of subdued growth.

Most Read from Bloomberg

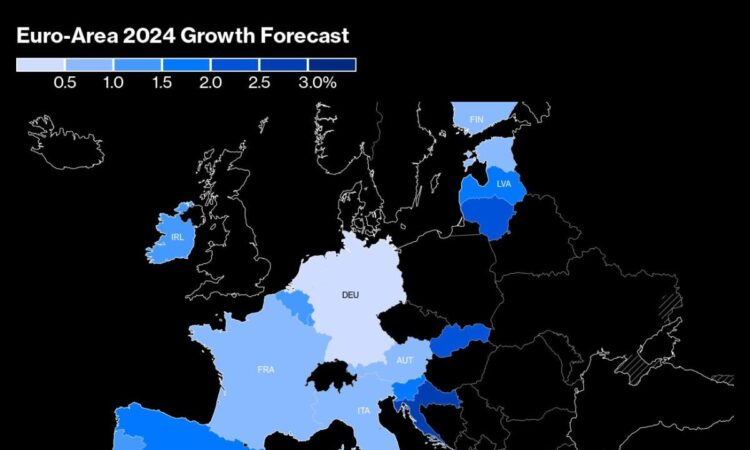

Gross domestic product in the currency bloc will accelerate only slightly to 0.8% this year after 0.5% in 2023, the European Commission said in a report Thursday. In November, it had predicted a more marked improvement to 1.2%. It also cut its 2025 forecast to 1.5%, from 1.6%

“The rebound expected in 2024 is set to be more modest than projected three months ago, but to gradually pick up pace on the back of slower price rises, growing real wages and a remarkably strong labor market,” Economy Commissioner Paolo Gentiloni said in a statement.

While 2025 should see firmer growth and inflation will likely “decline to close to the ECB’s 2% target,” he warned that “geopolitical tensions, an ever more unstable climate and a number of crucial elections around the world this year are all factors increasing the uncertainty around this outlook.”

The updated assessment adds to signs that the euro area risks slumping into a an extended period of weakness, even as prospects for the rest of the world improve.

In recent weeks, both the International Monetary Fund and the Organization for Economic Cooperation and Development cut their GDP forecasts for European countries in 2024, while revising up global expectations.

While the latest data for the end of 2023 showed the region narrowly avoided a recession over the winter, there is little sign of a quick turnaround.

“The EU economy has entered 2024 on a weaker footing than expected,” the commission said. “Prospects for the EU economy in the first quarter of 2024 remain weak.”

So far, the deterioration in the euro-area outlook has not caused the European Central Bank to reconsider its record-high 4% interest rate, though policymakers acknowledge that borrowing costs will be reduced this year.

The commission said strong monetary tightening was one reason for the weak performance of the economy in 2023, alongside inflation hurting consumers and governments starting to withdraw fiscal support.

ECB President Christine Lagarde — speaking the EU lawmakers on Thursday — cautioned again rushing into rate cuts as rising salaries becoming an ever-more significant driver of inflation.

The ECB already lowered its 2024 growth outlook in December and the commission is now in line with central bank’s 2.7% prediction for inflation. For 2025, officials in Frankfurt see inflation at 2.1%, while their colleagues in Brussels predict 2.2%.

Eight of the euro area’s 20 members contracted last year. While none are predicted to suffer that fate again in 2024, growth rates still are muted — particularly in the bloc’s three biggest economies. Germany is set to expand just 0.3% — down from 0.8% predicted in November — and the commission also cut its forecasts for France and Italy.

“Incoming data continue to signal subdued activity in the near term,” Lagarde said. “However, some forward-looking survey indicators point to a pick-up in the year ahead.”

–With assistance from Jorge Valero, Andrew Langley and Andrea Dudik.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.