(Bloomberg) — European Union lawmakers warned the European Central Bank that its credibility is at stake over its ability to get inflation back under control.

Most Read from Bloomberg

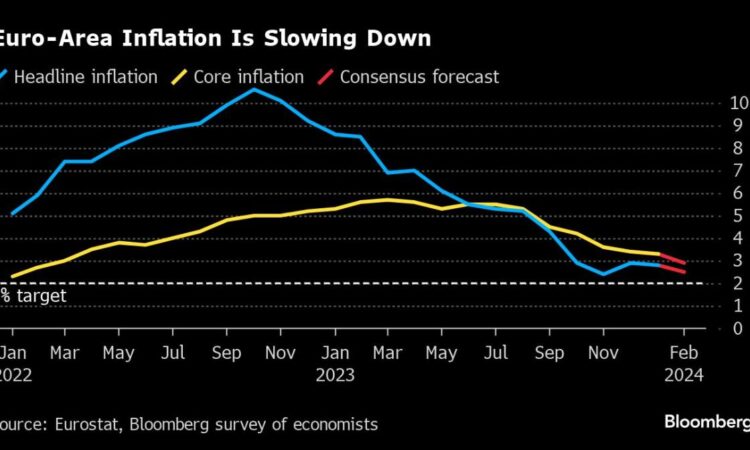

In a resolution marking the annual report that President Christine Lagarde presented to parliament this week, members voted overwhelmingly for a resolution stating their worry that consumer prices remain untamed.

“If the ECB fails to bring inflation to the target level in a timely manner, while increasing the financing costs in the euro area, particularly for citizens and companies, the ECB risks losing its credibility,” they said.

Parliament “is deeply worried about persistently high inflation rates, especially core inflation rates, and their detrimental impact on competitiveness, investments, job creation and consumers’ purchasing power, affecting those who have fixed or limited incomes in particular,” they added, calling “on the ECB to take all necessary measures to reduce the inflation rate in accordance with its mandate.”

They also highlighted that

-

“that such a situation causes economic uncertainty and increases the cost of living for citizens” and

-

“that this can lead to increasing inflation expectations, which sustain a cycle of price hikes and undermine economic stability; notes that quantitative inflation targets are to be met over a medium-term horizon”

-

inviting “the ECB to provide more information on the monitoring and setting of the neutral interest rate.”

Lawmakers also asked the ECB to “fundamentally review and improve its models and their role in its policymaking in light of the subpar performance of the models in recent years.”

The report comes just days before the ECB’s March 7 monetary policy meeting, where rates will almost certainly be left unchanged before a cut later this year. Officials seem to be converging around a June move, though some have been pushing for earlier action.

–With assistance from Lyubov Pronina.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.