The European Union (EU) and the European Bank for Reconstruction and Development (EBRD) are helping improve access to finance for Armenian micro, small and medium-sized sized enterprises (MSMEs) through Acba Bank. This collaboration sees the EBRD extending a loan equivalent to US$ 15 million in Armenian drams to help Acba Bank reach more businesses, especially those located in rural areas.The funding will also address the growing demand for longer-term local currency financing.

Supported by the EU, the project operates within the framework of the European Fund for Sustainable Development Plus (EFSD+) guarantee programme. This initiative introduces an innovative first loss risk cover, currently available in the Southern and Eastern Mediterranean region(Egypt, Jordan, Morocco, Tunisia, Lebanon and the West Bank and Gaza) and Eastern Europe and the Caucasus (Armenia, Azerbaijan, Georgia, Moldova and Ukraine). The EFSD+ financial inclusion programme is designed to empower MSMEs, fostering their competitiveness and growth. By offering effective financial tools and expertise, the programme aims to drive development and create jobs.

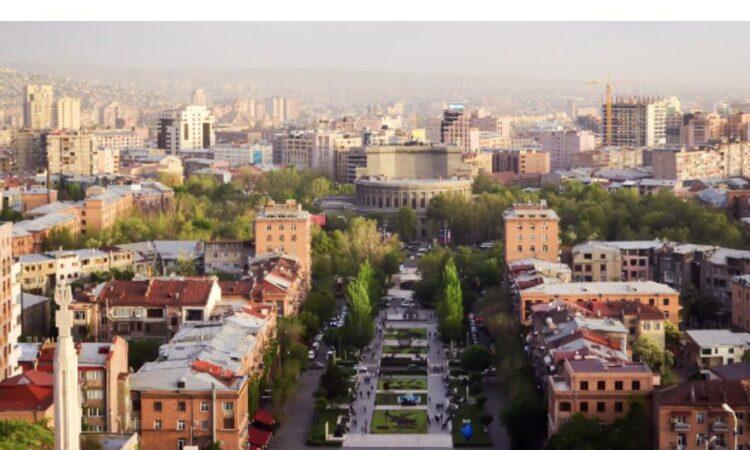

The official signing of the loan agreement took place in Yerevan with Acba CEO Hakob Andreasyan and the EBRD’s First Vice President Jürgen Rigterinkformalising the commitment.

Mr Rigterink said: “We are pleased to step up our support for MSMEs in Armenia together with ourfinancial and institutional partners. A strong private sector is among the EBRD’s priorities in the country and the funding will support more private businesses in rural areas. Making the funding available in drams will protect borrowers from foreign currency-related risks.”

Lawrence Meredith, Neighbourhood East and Institution Building Director at the European Commission, commented: “We welcome this EU-backed loan agreement between the EBRD and AcbaBank, which will provide new opportunities to MSMEsacross the country, especially in rural areas. Supporting a sustainable, innovative and competitive economy is among the five flagship initiatives of the EU’s Economic and Investment Plan in Armenia. As we address the pressing need for extended local currency funding, we pave the way for a more resilient and innovative future for Armenia’s business ecosystem.”

Hakob Andreasyan, CEO of Acba Bank, added: “AcbaBank and the EBRD have a rich history of partnershipgoing back to 2003. Our partnership has continuously expanded over the years through different programmes directed at supporting the Armenian economy, particularly during economic shocks or downturns. The EBRD has been always innovative in its programmes. We are delighted to join our forces once again with our partners, the EBRD and the EU, to continue to support local MSMEs in terms of their current liquidity needs and long-term investments, especially in rural Armenia.’’

This project also contributes to the implementation of the EU’s Economic and Investment Plan (EIP) in the Eastern Partnership countries. One of the key flagship priorities of the EIP for Armenia is to promote a sustainable, innovative and competitive economy by directly supporting up to 30,000 small and medium-sized enterprises (SMEs) in the country.

Acba Bank, a long-standing partner of the EBRD since 2003, is one of the leading banks in Armenia, with a strong position in lending to agriculture and MSMEs, especially in rural areas. With its network of 64 branches in all regions of Armenia, it can reach out to numerous clients in diversified sectors.

The EBRD is a leading institutional investor in Armenia. The Bank has invested close to €2 billion across 206 projects in the country to date, where it is supporting private sector development and the transition to a sustainable, green economy.