- This weekly round-up brings you the latest developments in the global energy sector.

- Top energy news: EU renewable energy deal delayed on role of nuclear in transition; G7 and EU to ban restart of Russian gas pipelines; Battery maker to go ahead with Germany factory after Berlin matches US subsidies.

- For more on the World Economic Forum’s work in the energy space, visit the Centre for Energy and Materials.

1. EU renewable energy deal delayed on role of nuclear in transition

European Union countries were set to finalize a new target to get 42.5% of the bloc’s energy from renewable sources by 2030, up from a previous goal of 32%. But the deal has been delayed after France indicated it would not support the plan as low-carbon hydrogen generated with electricity from nuclear power would not qualify as renewable under the targets, The Financial Times reports.

France derives about 70% of its electricity from nuclear energy and plans to build six new reactors, according to the World Nuclear Association.

Six other pro-nuclear EU countries also withheld support for the directive. But anti-nuclear governments including Germany and Austria are against classifying nuclear as clean energy.

The EU is working to decarbonize its economies to tackle climate change and build a renewable energy industry that will limit the bloc’s dependence on energy from any one country.

France is not the only country to have pushed for last-minute changes to proposed legislation. Germany pulled out of supporting a 2035 ban on combustion engines, pending exemptions that it achieved after negotiations with the European Commission.

The role of nuclear power in the global energy transition is still unclear, but nuclear power generation is free from CO2 emissions, and advanced nuclear technologies are safer and less exposed to dangers like earthquakes and meltdowns than traditional large-scale reactors.

Nuclear fission power plants produce around 10% of the world’s electricity from approximately 440 reactors.

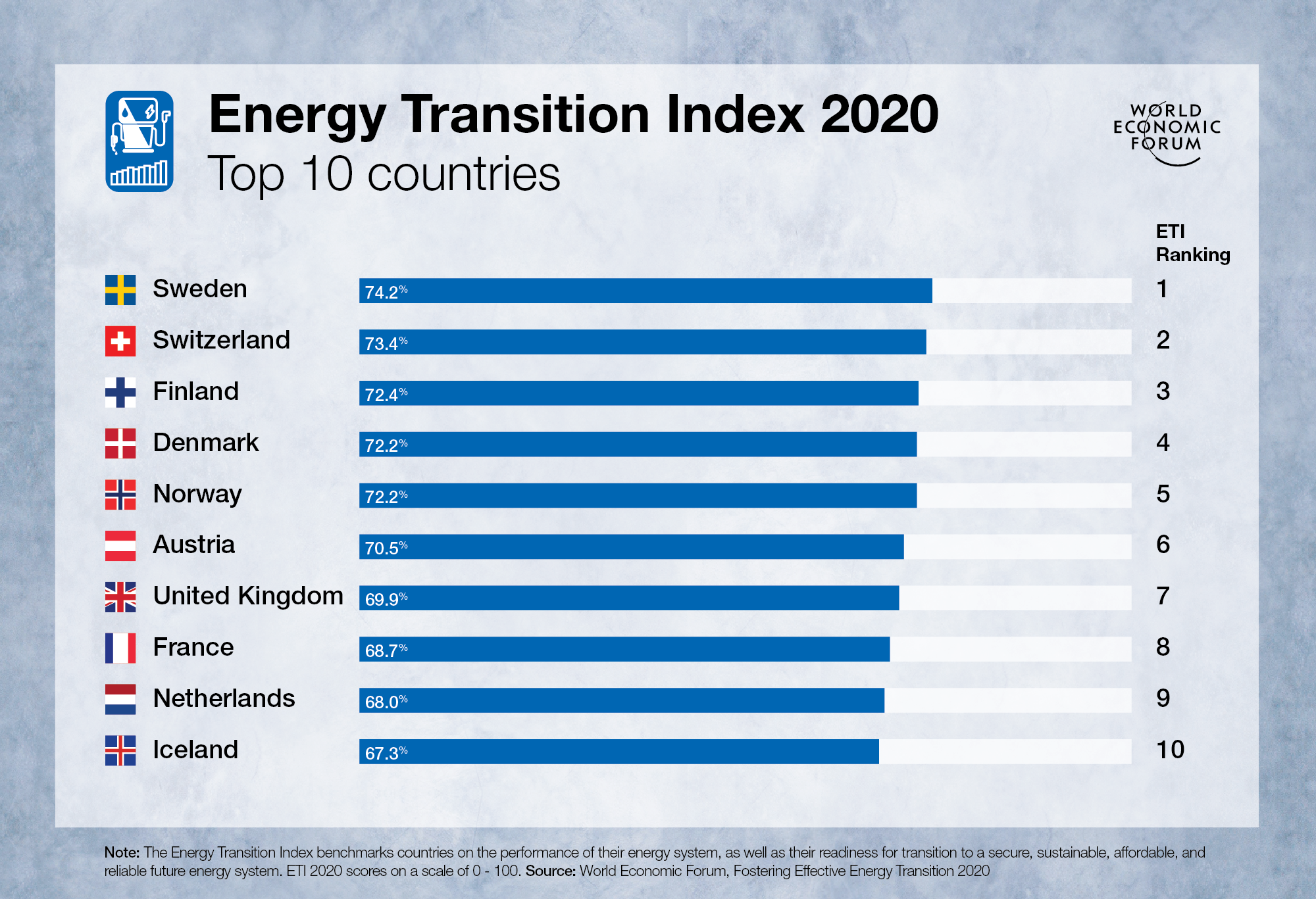

Moving to clean energy is key to combating climate change, yet in the past five years, the energy transition has stagnated.

Energy consumption and production contribute to two-thirds of global emissions, and 81% of the global energy system is still based on fossil fuels, the same percentage as 30 years ago. Plus, improvements in the energy intensity of the global economy (the amount of energy used per unit of economic activity) are slowing. In 2018 energy intensity improved by 1.2%, the slowest rate since 2010.

Effective policies, private-sector action and public-private cooperation are needed to create a more inclusive, sustainable, affordable and secure global energy system.

Benchmarking progress is essential to a successful transition. The World Economic Forum’s Energy Transition Index, which ranks 115 economies on how well they balance energy security and access with environmental sustainability and affordability, shows that the biggest challenge facing energy transition is the lack of readiness among the world’s largest emitters, including US, China, India and Russia. The 10 countries that score the highest in terms of readiness account for only 2.6% of global annual emissions.

To future-proof the global energy system, the Forum’s Shaping the Future of Energy and Materials Platform is working on initiatives including, Systemic Efficiency, Innovation and Clean Energy and the Global Battery Alliance to encourage and enable innovative energy investments, technologies and solutions.

Additionally, the Mission Possible Platform (MPP) is working to assemble public and private partners to further the industry transition to set heavy industry and mobility sectors on the pathway towards net-zero emissions. MPP is an initiative created by the World Economic Forum and the Energy Transitions Commission.

Is your organisation interested in working with the World Economic Forum? Find out more here.

2. G7 and EU to ban Russian gas pipelines restart

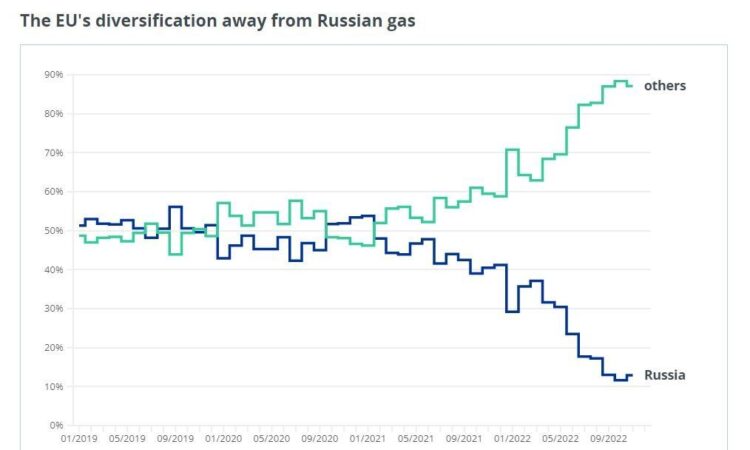

The G7 and EU plan to ban the resumption of imports of Russian gas on pipeline routes where Moscow has stopped supplies, marking the first time Western countries will have blocked such shipments since the outbreak of the war on Ukraine, according to The Financial Times.

The move will have little immediate impact on gas supplies, as Russia has already cut gas exports to the EU. But Western leaders are trying to keep limiting Russia’s energy revenues in order to apply economic pressure to resolve the conflict in Ukraine.

Moscow has acknowledged having “problems” with its energy revenues following the imposition of G7-led price caps on Russian oil and oil products. Its energy revenues more than halved in January-March.

Even with the reduction in sales to Europe, Russia exported more oil in April than in any month since its invasion of Ukraine, with nearly 80% going to China and India, according to the International Energy Agency. But its oil export revenues for the month were still down by 27% on the year, in part due to lower global energy prices.

3. News in brief: More energy stories from around the world

Europe’s biggest battery maker is going ahead with a new factory in Germany after Berlin pledged hundreds of millions of euros of state funding, says The Financial Times. Northvolt had previously indicated that it would concentrate on the US for the proposed site, unless the EU matched the subsidies that the US was offering.

Companies looking to use nuclear fusion to generate electricity expect to spend about $7 billion by the time their first plants come online, according to the Fusion Industry Association (FIA) survey. Even though fusion plants that produce more energy than they use are still 15 years or more away, supply chain companies need to make investments to scale up in time, IFA Head Andrew Holland says.

An African company that runs a pay-as-you-go-model for solar panels has raised over $250 million in one of the continent’s largest-ever tech start-up fundraisers. M-Kopa, which also runs pilot projects to finance electric motorbikes, says the money will help it expand and acquire up to 100,000 customers a month, according to The Financial Times.

A former coal-fired power plant in the UK will soon be the site of a new battery project. There is increasing interest in converting former coal plants into net-zero projects, as developers can benefit from pre-existing infrastructure and workforces, according to Energy Monitor.

At the same time, a $15 billion investment in coal gasification in Indonesia has been withdrawn, as the financial environment for coal investment deteriorates, says Energy Monitor.

US oil and gas firms are looking for state backing for Australian carbon capture and hydrogen projects, as they look to increase investments that can slash their emissions intensity. Australia plans to scale up its offshore carbon capture and storage capability, following big incentives by the US and a $24 billion commitment from Britain for such projects over the next two decades.

The UK’s National Grid is calling for sweeping changes to its electricity grid regulation, after it emerged that many renewable energy projects will have to wait over 10 years to begin power generation due to the number of applications for grid connection. The proposed plans include replacing the current first-come, first-served approach in favour of prioritizing more viable projects to try and reduce the bottleneck, writes UK newspaper The Guardian.

4. More on energy from Agenda

Global investment in energy transition technologies hit a record $1.3 trillion in 2022. Here are some initiatives countries have launched to help encourage the transition to low-carbon energy – including half-price energy bills if you live near a wind farm.

Solar energy is growing faster than any other energy technology in history. These four charts demonstrate the transformative impact of solar energy in combating climate change.

Power from nuclear fusion offers the prospect of an almost inexhaustible energy source for future generations. But what exactly is nuclear fusion? The science behind it – and the latest news on it – are explained here.

To learn more about the work of the Energy, Materials, Infrastructure Platform, contact Ella Yutong Lin: ellayutong.lin@weforum.org